Getting a secured credit card without credit check opens doors for Canadians with poor or no credit history. These cards require a security deposit but skip the traditional credit screening process.

We at Financial Canadian have researched the top no-credit-check options available in Canada. This guide walks you through the best cards, application steps, and strategies to rebuild your credit score effectively.

How Do Secured Cards Work Without Credit Checks

The Security Deposit Replaces Credit Screening

Secured credit cards without credit checks operate through a straightforward trade-off mechanism. Card issuers require a cash deposit instead of evaluating your credit history. This deposit typically ranges from $49 to $500 and serves as your credit limit while acting as collateral for the card issuer. The OpenSky Plus Secured Visa demonstrates this approach with a minimum $200 deposit requirement and 28.99% APR. Your deposit eliminates the lender’s risk and makes traditional credit screening unnecessary. Most Canadian secured cards follow this model, where your deposit amount directly determines your spending power.

Why Lenders Skip Traditional Screening

Card issuers skip credit checks because the security deposit covers potential losses from missed payments. This approach benefits both parties: you gain access to credit building tools regardless of past financial mistakes, while lenders reduce their risk exposure. The Secured Chime Credit Builder Visa takes this further with 0% APR, since the deposit protects against defaults. Lenders still verify your identity and income capacity, but they don’t examine payment histories or credit utilization patterns. This streamlined approval process typically takes 24-48 hours (compared to traditional cards that require 7-14 days for credit evaluation).

Deposit Requirements Drive Credit Building Success

Your security deposit becomes the foundation for rebuilding credit scores. Cards like the First Progress Platinum Prestige require deposits between $200-$2,000, with higher amounts providing better credit utilization ratios. You should maintain utilization below 30% of your deposit amount to maximize score improvements. Most secured cards report to all three major bureaus-Equifax, Experian, and TransUnion-which makes responsible usage visible across your entire credit profile. The deposit refund process varies by issuer, with some cards transitioning to unsecured status after 6-12 months of consistent payments.

Now that you understand how these cards function without traditional credit checks, let’s examine the best secured credit card options available to Canadian consumers.

Which Secured Cards Skip Credit Checks in Canada

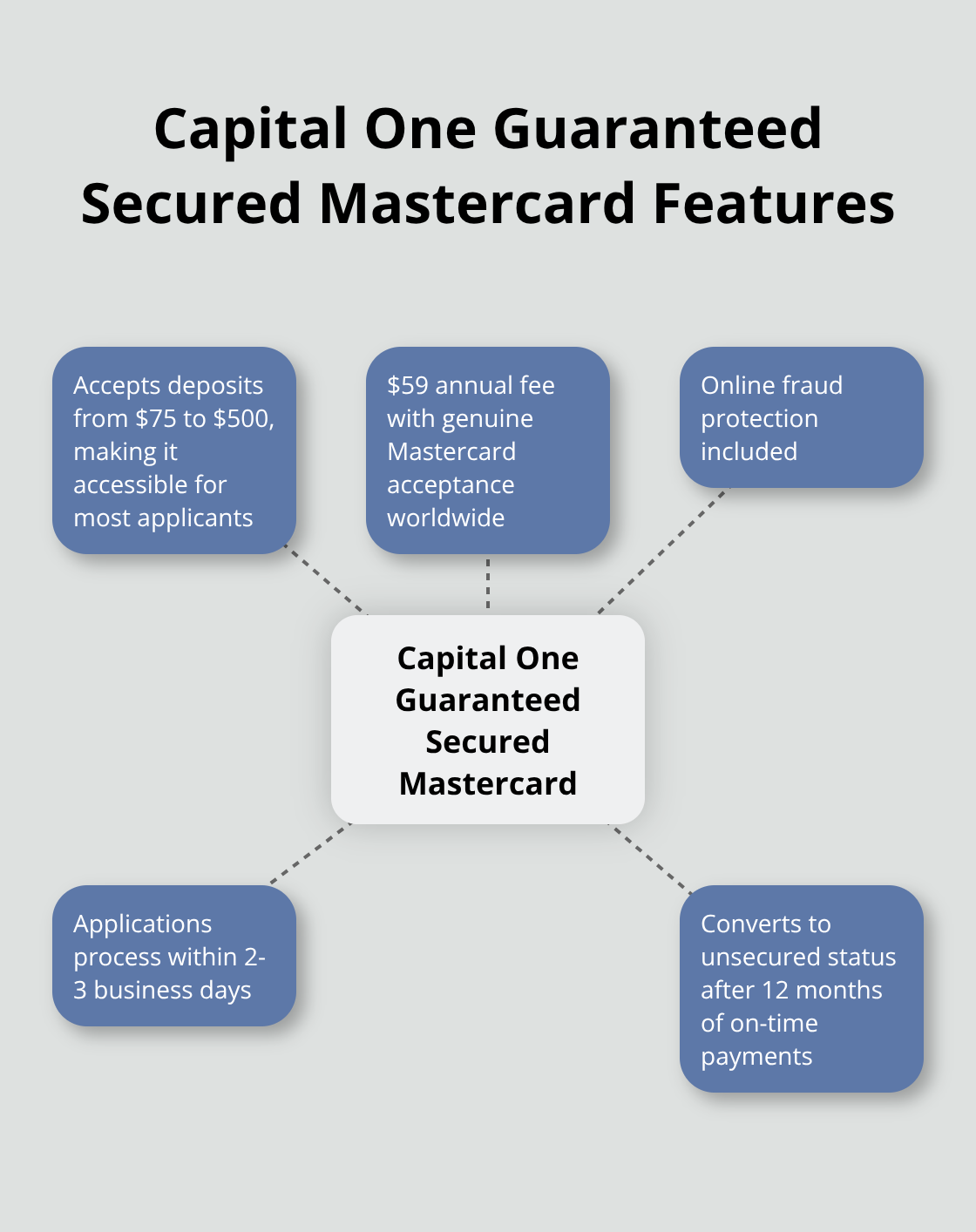

Capital One Guaranteed Secured Mastercard Features

Capital One Guaranteed Secured Mastercard leads the Canadian market for no-credit-check secured cards. This card accepts deposits from $75 to $500, which makes it accessible for most applicants. Capital One offers secured credit cards that require a refundable security deposit to open the account, which accelerates credit score improvements compared to single-bureau cards.

The card charges a $59 annual fee but provides genuine Mastercard acceptance worldwide and online fraud protection that many competitors omit. Applications process within 2-3 business days, and Capital One converts the card to unsecured status after 12 months of on-time payments.

Home Trust Secured Visa Card Benefits

Home Trust Secured Visa Card offers superior terms with its $500 minimum deposit requirement and 19.99% APR that beats most secured card rates. The application process requires proof of Canadian residency, employment verification, and six months of bank history.

Home Trust requires applicants to be permanent Canadian residents, reach the age of majority in their province, and not currently be in bankruptcy. This requirement adds complexity but strengthens your overall relationship with the institution (which can benefit future credit applications).

Alternative Credit Options

Koodo Mobile Tab operates differently from traditional secured cards by extending credit for device purchases without credit checks. The Tab reports to credit bureaus but limits your spending to mobile devices and accessories only.

This restriction makes it unsuitable as a primary credit tool compared to traditional secured cards. The Tab functions more like installment financing than a versatile credit card that helps build comprehensive credit history.

Now that you know which cards skip credit checks, let’s walk through the exact steps to apply for these no-credit-check secured cards.

How to Apply for No Credit Check Secured Cards

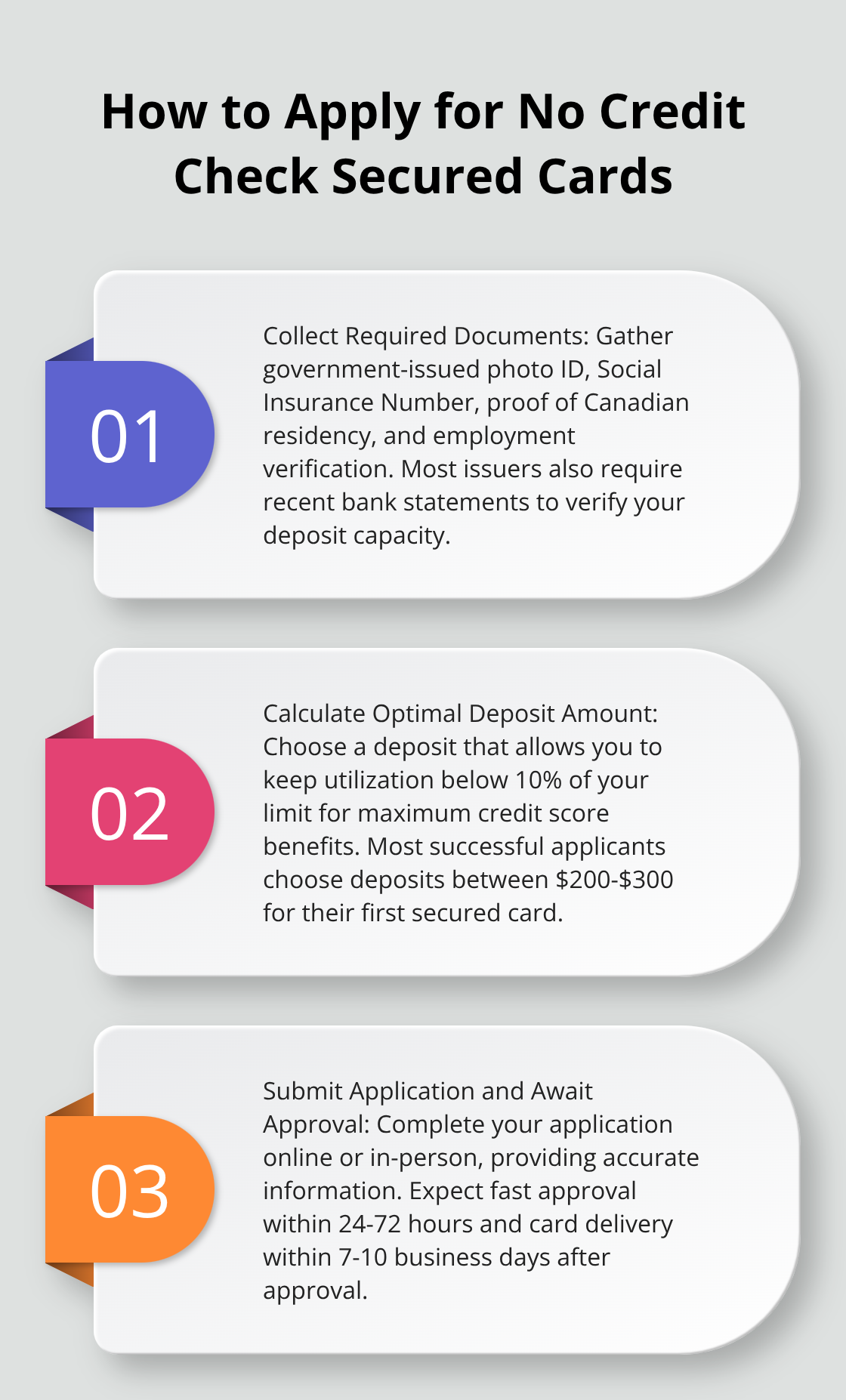

Collect Your Required Documents First

You need these essential documents for your application: government-issued photo ID, Social Insurance Number, proof of Canadian residency, and employment verification. Most issuers require bank statements from the past three months to verify your deposit capacity. Capital One Guaranteed Secured Mastercard accepts pay stubs or employment letters as income proof, while Home Trust demands six months of bank history. You must reach the age of majority in your province and hold permanent resident status. Applications fail when applicants lack proper residency documentation or sufficient income to cover monthly payments plus the security deposit.

Calculate Your Optimal Deposit Amount

Your security deposit determines your credit limit and impacts your credit utilization ratio. Start with the minimum deposit to test the card, then increase it after three months if needed. Capital One accepts deposits from $75 to $500, while Home Trust requires $500 minimum. Try to choose a deposit that allows you to keep utilization below 10% of your limit for maximum credit score benefits. Higher deposits provide better utilization ratios but tie up more cash (most successful applicants choose deposits between $200-$300 for their first secured card).

Submit Your Application Online or In-Person

Complete your application through the issuer’s website or visit a branch location for in-person assistance. Online applications take 10-15 minutes and process faster than paper submissions. You must provide accurate income information and employment details during this step. Double-check all personal information before submission to avoid delays or rejections.

Expect Fast Approval and Card Delivery

No-credit-check secured cards process applications within 24-72 hours after deposit verification. Capital One typically approves applications within two business days, while Home Trust takes up to five days for document review. Your card arrives 7-10 business days after approval via standard mail. Activation happens immediately through phone or online once you receive the physical card (some issuers allow you to add the card to digital wallets before the physical card arrives).

Final Thoughts

Capital One Guaranteed Secured Mastercard and Home Trust Secured Visa Card stand out as the top secured credit card without credit check options for Canadian consumers. Capital One’s lower deposit requirements make it accessible for most applicants, while Home Trust offers better interest rates for qualified candidates. Both cards report to major credit bureaus and create pathways to unsecured credit products.

You must make consistent on-time payments and maintain utilization below 30% of your credit limit to build credit effectively. Pay your full balance monthly to avoid interest charges and set up automatic payments to prevent missed due dates. Monitor your credit score quarterly through free services (many banks offer this feature) to track your progress toward better financial health.

Contact your issuer about upgrades to unsecured cards or credit limit increases after six months of responsible usage. Many cardholders transition to premium credit products within 12-18 months of positive payment history. We at Financial Canadian provide comprehensive web design services to help businesses establish strong digital presence and drive growth.

Leave a comment