Credit card debt costs the average Canadian household $4,154 annually in interest payments. Using a personal loan for credit card payoff can cut these costs significantly.

We at Financial Canadian see this strategy work when borrowers secure rates below their current credit card APRs. Personal loans offer fixed payments and clear payoff timelines that credit cards lack.

How Personal Loans Replace Credit Card Debt

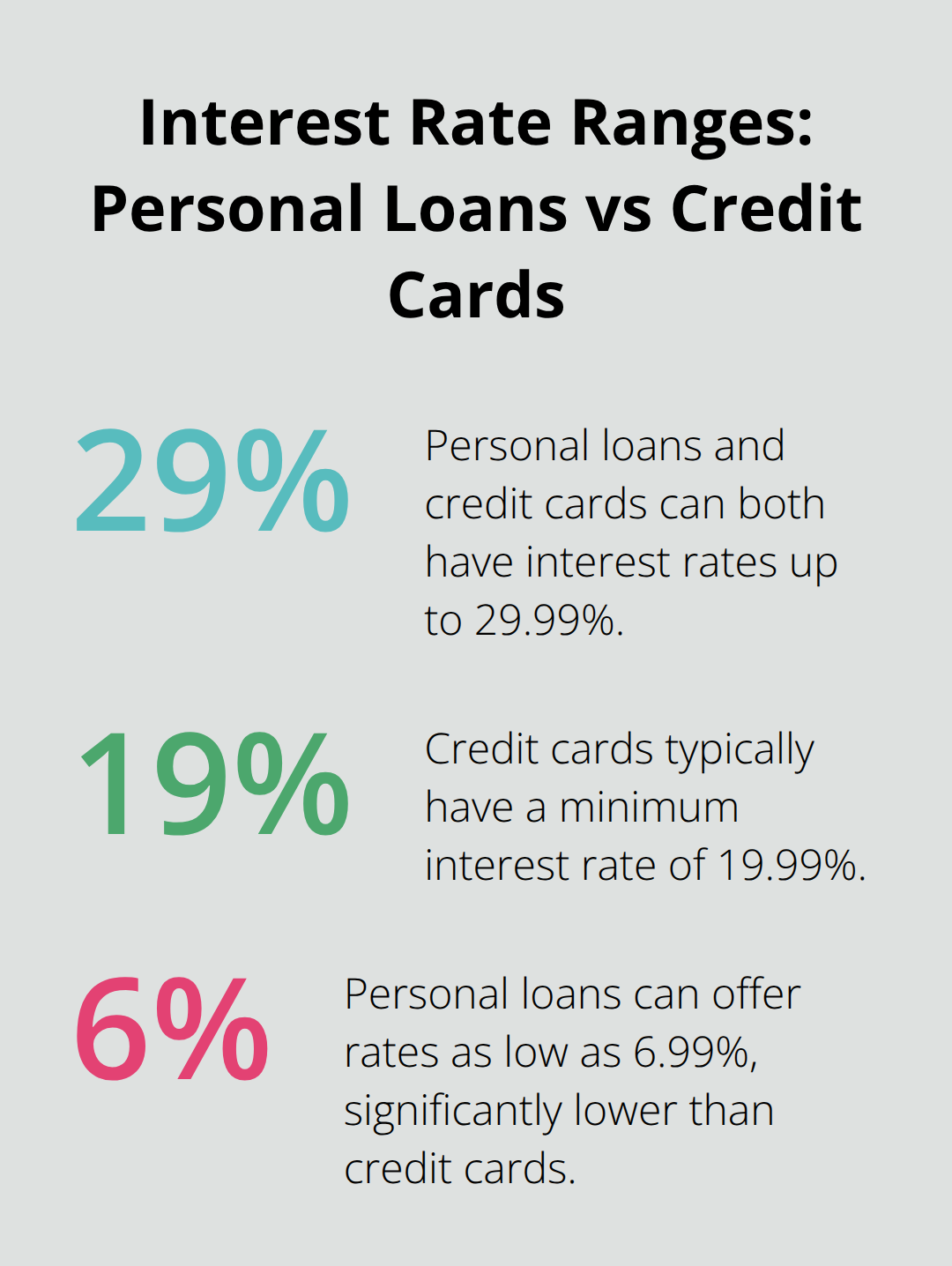

Personal loans provide a lump sum payment that eliminates your credit card balances immediately. Major Canadian banks like TD and RBC offer personal loans with rates between 6.99% and 29.99%, while credit cards typically charge 19.99% to 29.99% annually. This rate difference creates immediate savings for most borrowers.

Interest Rate Differences Create Real Savings

Credit card companies profit from minimum payments that keep balances high for years. Personal loans force complete payoff within 2 to 7 years maximum. A $15,000 credit card balance at 22.99% APR costs $3,448 annually in interest with minimum payments. The same debt through a personal loan at 12.99% APR costs $1,948 annually (a savings of $1,500 per year). Personal loan rates vary based on creditworthiness and lender policies, while credit card rates remain consistently higher.

Fixed Payments Eliminate Payment Confusion

Personal loans eliminate payment confusion through fixed monthly amounts that never change. Credit card minimum payments fluctuate based on balance and trap borrowers in endless cycles. A $20,000 personal loan at 10% APR requires exactly $396 monthly for 5 years, then the debt disappears completely. Credit cards with similar balances often require 15+ years through minimum payments, which costs thousands more in total interest.

The Debt Payoff Timeline Advantage

Personal loans create definite end dates for debt freedom (typically 2-7 years), while credit cards can stretch payments indefinitely. This structured approach forces discipline and prevents the temptation to make only minimum payments. The next step involves calculating your exact debt totals and comparison shopping for the best loan terms available.

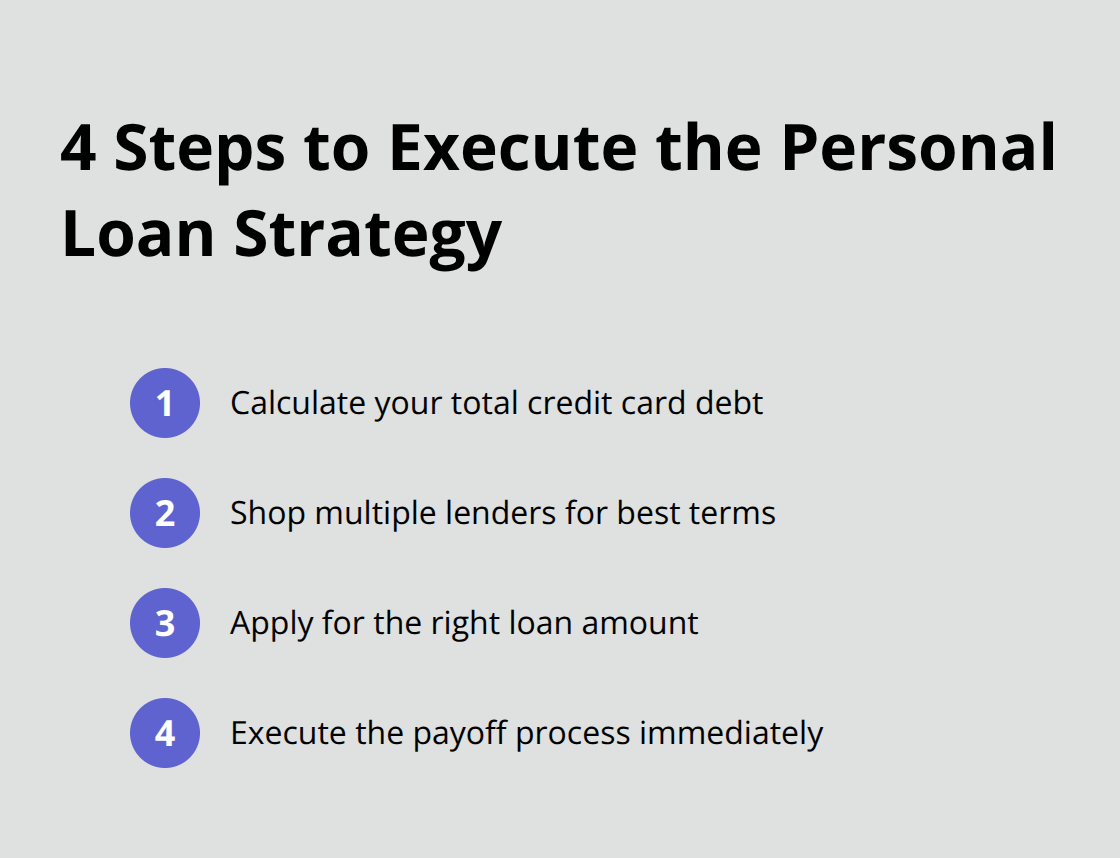

How to Execute the Personal Loan Strategy

Start with a complete debt inventory across all credit cards. Include balances, minimum payments, and interest rates. Add origination fees, annual fees, and any outstanding promotional balances. Most Canadians underestimate their total debt by 15-20% when they skip this detailed calculation step. Write down exact numbers from recent statements rather than estimates.

Calculate Your Total Credit Card Debt

List every credit card with current balances, interest rates, and minimum monthly payments. Include store cards, gas cards, and any promotional balance transfers. Add up annual fees across all cards (typically $0-$700 per card). Factor in any pending purchases or automatic payments that will post before loan funding. This complete picture prevents borrowers from taking insufficient loan amounts that leave partial balances.

Shop Multiple Lenders for Best Terms

Credit unions and alternative lenders may offer competitive personal loan rates compared to major banks for the same borrower profile. Check at least 5 lenders that include your current bank, local credit unions, and online platforms like Paymi or Lending Loop. Request prequalification quotes that show exact rates without hard credit pulls. Focus on total costs that include origination fees (ranging from 0% to 8% of loan amount). A $20,000 loan with 3% origination fee costs $600 upfront, which makes a slightly higher rate with no fees potentially cheaper overall.

Apply for the Right Loan Amount

Submit applications for loan amounts that cover total credit card debt plus any fees. Most lenders fund personal loans within 3-7 business days through direct deposit. Apply to your top 2-3 lenders within a 14-day window to minimize credit score impact from multiple inquiries. Provide accurate income documentation and debt information to avoid delays or rejections.

Execute the Payoff Process Immediately

Pay off credit card balances immediately upon loan funding to stop daily interest accumulation. Contact each credit card company to confirm zero balances and request written confirmation. Close cards with annual fees but keep your oldest no-fee cards open to maintain credit history length. Set up automatic payments for your new personal loan to avoid late fees and maintain the lower fixed rate throughout the term.

The success of this strategy depends heavily on your ability to resist new credit card debt while repaying the personal loan, which brings us to the important advantages and potential pitfalls you need to consider.

What Are the Real Benefits and Risks?

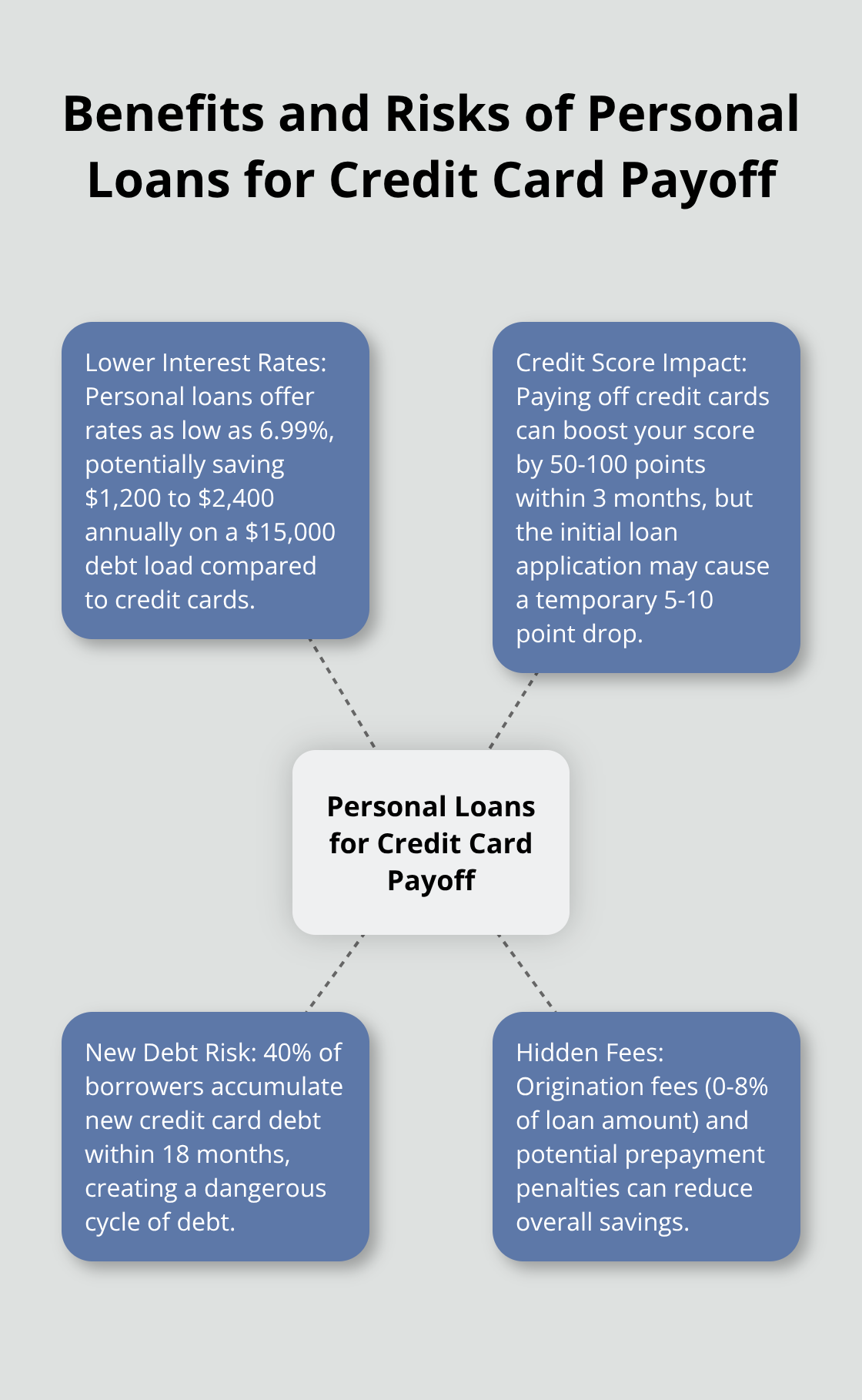

Lower Interest Rates Drive Immediate Savings

Personal loans offer competitive rates for borrowers with good credit scores. Canadians with credit scores above 650 typically qualify for personal loan rates between 6.99% and 15.99%, while their credit cards charge 19.99% to 29.99% annually. This rate difference saves $1,200 to $2,400 annually on a $15,000 debt load.

The fixed payment structure eliminates minimum payment traps that keep credit card balances high for decades. Your monthly payment stays the same throughout the loan term, which makes budgets predictable and forces complete debt elimination within 2 to 7 years maximum.

Credit Score Changes Work Both Ways

Personal loans can boost your credit score through improved credit utilization ratios. Paid-off credit cards drop your utilization from potentially 80-90% down to 0%, which increases scores by 50-100 points within 3 months according to credit agencies.

However, the initial loan application creates a temporary 5-10 point drop from the hard credit inquiry. Keep your paid-off credit cards open to maintain credit history length (which accounts for 15% of your credit score calculation).

New Debt Accumulation Remains the Biggest Risk

Statistics from debt counselors show that 40% of borrowers who use personal loans for credit card payoff accumulate new credit card debt within 18 months. This creates a dangerous cycle where borrowers end up with both personal loan payments and new credit card balances.

The solution requires immediate action after payoff. Close cards with annual fees right away and keep only 1-2 no-fee cards for emergencies. Set up automatic personal loan payments to maintain discipline and avoid the temptation to skip payments when money gets tight.

Hidden Fees Can Reduce Your Savings

Origination fees range from 0% to 8% of the loan amount and reduce your actual savings significantly. A $20,000 loan with a 3% origination fee costs $600 upfront, which makes a slightly higher rate with no fees potentially cheaper overall.

Some lenders also charge prepayment penalties that prevent early payoff without additional costs. Read all loan terms carefully and calculate total costs including fees before you commit to any personal loan offer.

Final Thoughts

Personal loan for credit card payoff works best when you secure rates at least 5 percentage points below your current credit card APRs and commit to new debt avoidance. Borrowers with credit scores above 650 and stable income see the most dramatic savings through this strategy. Balance transfer cards offer another path with 0% promotional rates for 12-21 months, though these revert to standard rates afterward.

Debt avalanche methods target highest-rate cards first without new debt, while debt snowball approaches focus on smallest balances for psychological wins. The debt consolidation loan approach requires discipline to succeed long-term. Close high-fee cards immediately after payoff and automate your loan payments to maintain momentum (track your progress monthly and resist the temptation to use available credit limits).

We at Financial Canadian help businesses establish strong digital presence through comprehensive web design services that drive growth and visibility. Your next step involves the debt strategy that matches your financial discipline level and credit profile. Execute it consistently until you achieve complete debt freedom.

Leave a comment