Getting approved for credit cards becomes nearly impossible when your credit score hits rock bottom. Traditional lenders slam the door shut on applications from people with terrible credit histories.

A secured credit card for terrible credit offers a lifeline. We at Financial Canadian have researched the best options available to Canadians facing credit challenges, helping you rebuild your financial standing step by step.

How Do Secured Credit Cards Actually Work

Secured credit cards serve as training wheels for your credit journey and require a cash deposit that becomes your credit limit. The bank holds your $500 deposit and gives you a $500 credit limit, which creates a zero-risk situation for lenders. This deposit stays locked in a separate account while you use the card for purchases, and you still receive monthly bills that must be paid on time.

The Real Difference from Regular Credit Cards

Regular credit cards rely entirely on your creditworthiness and promise to pay. Banks extend unsecured credit based on your income, credit score, and financial history. Secured cards flip this model completely – your own money backs every purchase and eliminates the bank’s risk of losing money if you default. The monthly payments you make don’t touch your deposit. They go toward your purchase balance just like any credit card.

Why Banks Say Yes to Terrible Credit

Banks approve secured credit card applications with credit scores as low as 300 because your deposit eliminates their financial risk. Even if you stop payments entirely, they keep your deposit to cover the outstanding balance. This protection allows them to report your payment history to Equifax and TransUnion without worry about losses. The bank actually profits from annual fees, interest charges on carried balances, and the float on your deposit money while it helps you rebuild credit.

Security Deposits Create Win-Win Protection

Most Canadian secured cards require minimum deposits between $200 and $500, though some accept as little as $75. Your deposit earns minimal interest (typically under 1% annually) while the bank uses it as collateral. After consistent payment history, many issuers automatically review your account for graduation to an unsecured card and return your deposit.

What Happens After You Apply

The application process moves quickly once you submit your information and deposit. Most banks process secured card applications within 24 to 48 hours since the deposit removes their risk assessment concerns. You’ll need to provide basic personal information, income details, and your security deposit to complete the application. The specific requirements and documents needed vary by lender, which makes it important to understand each bank’s individual process before you apply.

Which Secured Cards Work Best for Terrible Credit

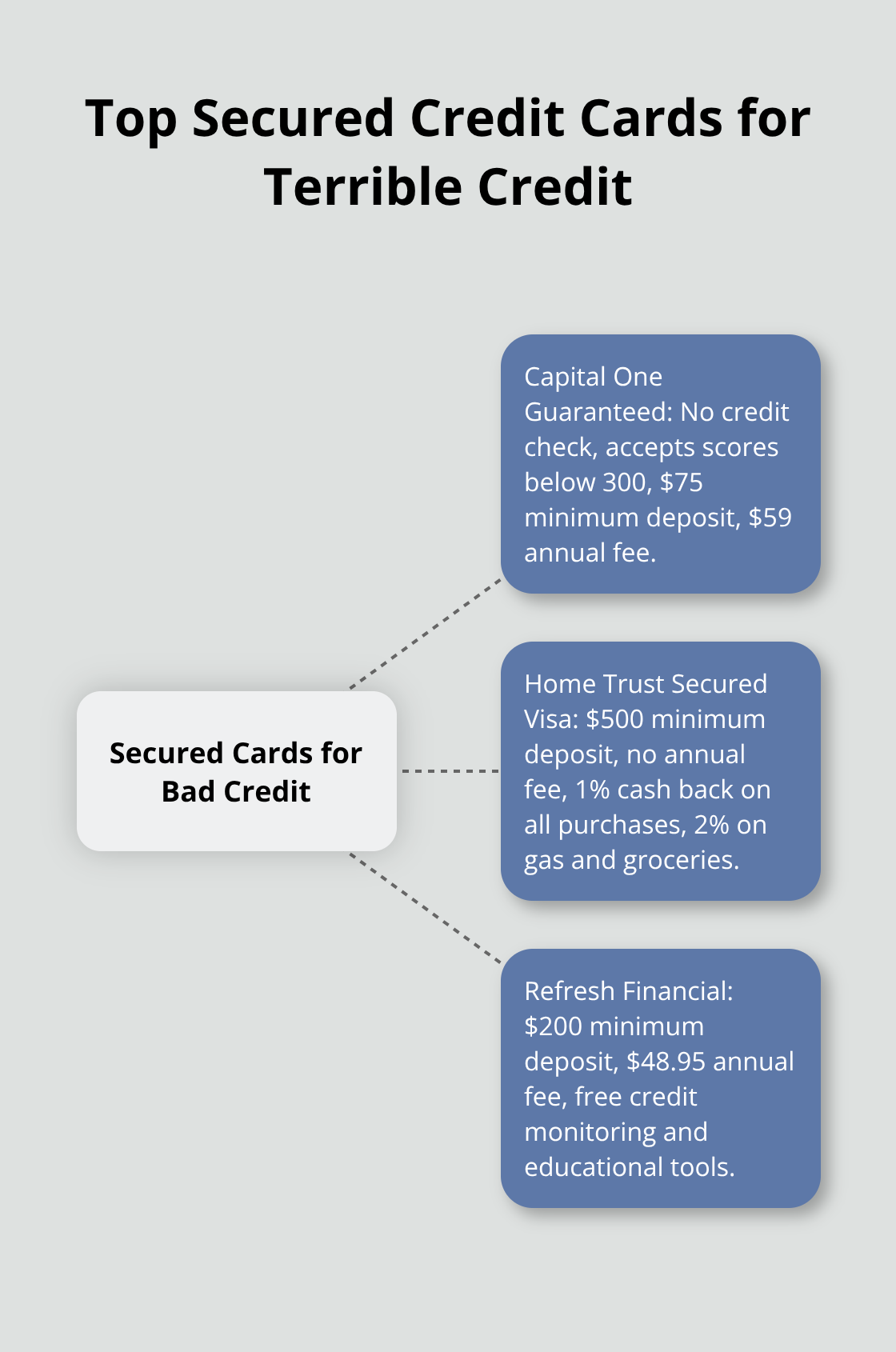

Three Canadian secured credit cards stand out for people with terrible credit scores. Each card offers different advantages for those who want to rebuild their financial reputation. Capital One Guaranteed Secured Mastercard requires no credit check and accepts applicants with scores below 300. This makes it the most accessible option for Canadians with bankruptcy or collections on their record. The card demands a $75 minimum deposit and charges a $59 annual fee, but Capital One reports to both major credit bureaus monthly and typically reviews accounts for graduation to unsecured status after 12 months of consistent payments.

Home Trust Delivers Premium Features

Home Trust Secured Visa Card provides the most comprehensive package with a $500 minimum deposit requirement and no annual fee structure. The bank reports payment history to Equifax and TransUnion within 30 days of account activation. Cardholders earn 1% cash back on all purchases plus 2% on gas and grocery purchases. Home Trust reviews accounts for unsecured conversion after six months of perfect payment history.

Refresh Financial Focuses on Credit Education

Refresh Financial Secured Credit Card combines credit construction with educational tools through their free credit monitor platform and monthly credit score updates. The card requires a $200 minimum deposit with annual fees that start at $48.95. The package includes access to personalized credit improvement recommendations and expense analysis reports. Refresh Financial reports to both credit bureaus and allows deposit increases up to $10,000 for higher credit limits. This gives cardholders room to grow their available credit as their financial situation improves.

Application Requirements Vary by Issuer

Each secured card issuer maintains different documentation standards and approval criteria (even though your deposit protects them from losses). Capital One accepts the widest range of credit situations but requires proof of income and Canadian residency. Home Trust demands more comprehensive financial documentation but offers faster graduation timelines. Refresh Financial falls between these two approaches with moderate requirements and strong educational support. The specific documents and information you need depend on which card matches your current financial situation and credit goals.

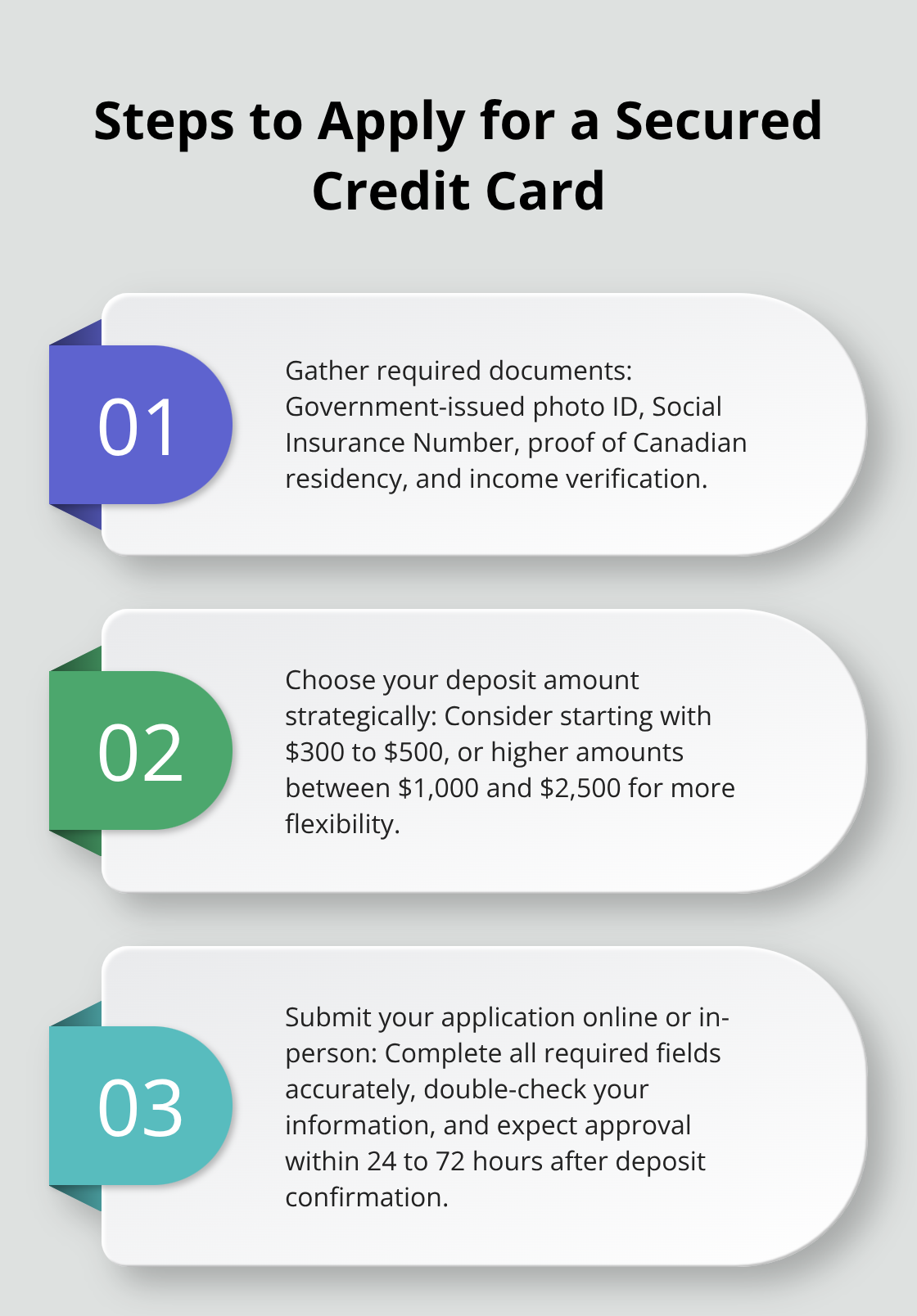

How to Apply for a Secured Credit Card

Gather these specific documents before you start your secured credit card application: two pieces of government-issued photo identification, your Social Insurance Number, proof of Canadian residency like a utility bill, and income verification through recent pay stubs or tax returns. Banks process applications faster when you submit complete documentation upfront.

Capital One accepts T4 slips or employment letters, while Home Trust requires three months of bank statements plus income proof. Refresh Financial demands the most comprehensive package with proof of address, employment verification, and bank history. Income requirements vary dramatically between issuers, with Capital One accepting applicants who earn as little as $12,000 annually while Home Trust typically requires $15,000 minimum annual income.

Pick Your Deposit Amount Strategically

Your security deposit directly determines your credit limit, but the right amount requires strategic thought beyond just affordability. Start with $300 to $500 deposits because amounts below $200 create artificially low credit utilization scenarios that may not provide meaningful credit building opportunities.

Higher deposits between $1,000 and $2,500 demonstrate stronger financial commitment and provide more purchase flexibility for daily expenses. Home Trust allows deposits up to $10,000 for substantial credit limits, while Capital One caps deposits at $1,500 for new applicants. Banks typically hold your deposit in separate accounts that earn 0.05% to 0.25% annual interest during the secured card period.

Expect Quick Approval and Immediate Activation

Secured card approvals happen within 24 to 72 hours after deposit confirmation because your money eliminates the bank’s risk assessment process. You receive approval notifications via email or text message, followed by physical card delivery within 5 to 10 business days through Canada Post.

Activate your card immediately through phone systems or mobile apps to start payment history without delay. Most issuers allow online account setup during activation (which gives you instant access to balance monitoring and payment scheduling tools) that prevent late fees and maximize credit score improvements.

Submit Your Application Online or In-Person

Most banks offer both online and branch applications for secured credit cards. Online applications process faster and allow you to upload documents directly through secure portals. Branch applications provide face-to-face support but may take longer due to manual document verification processes.

Complete all required fields accurately to avoid delays or rejections. Double-check your personal information, income details, and contact information before submission. Banks verify this information against credit bureau records (even for secured cards), so inconsistencies can trigger additional review periods that slow your approval.

Final Thoughts

Banks approve secured credit card applications for terrible credit at rates above 95% when applicants meet basic income and residency requirements. Your security deposit removes their financial risk and opens doors that traditional credit cards keep locked. This protection allows you to start credit repair immediately regardless of past financial mistakes.

Payment history represents 35% of your credit score calculation, which makes consistent monthly payments your strongest weapon against bad credit. Keep balances below 30% of your available limit and pay bills on time to see improvements within three to six months. Most cardholders gain 50 to 100 points during their first year of responsible card management.

Contact your issuer about graduation to an unsecured card after six to twelve months of perfect payment history. This process returns your deposit and often increases your credit limit without additional fees (plus it removes the secured card status from your credit report). We at Financial Canadian help businesses establish strong digital presence through our comprehensive web design service that creates visually stunning, responsive websites with SEO optimization.

Leave a comment