Building credit from scratch feels impossible when lenders won’t approve you without existing credit history. Can secured cards build credit effectively? Absolutely.

We at Financial Canadian know secured credit cards offer the perfect solution for establishing creditworthiness. These cards require a refundable deposit but function like traditional credit cards, reporting your payment history to major credit bureaus and helping you build a solid credit foundation.

How Do Secured Credit Cards Actually Work

The Security Deposit System

Secured credit cards require you to pay a cash deposit upfront, typically from $200 to $3,000, which becomes your credit limit. Capital One’s Platinum Secured Credit Card starts with a minimum $200 deposit, while others like the Discover it Secured allow deposits up to $2,500. This deposit acts as collateral for the card issuer and reduces their risk when they lend to people with poor or no credit history. The deposit sits in a savings account and earns minimal interest while your account remains open. Most issuers refund your full deposit when you close the account in good standing or upgrade to an unsecured card.

Credit Bureau Reports Drive Results

The major advantage of secured cards lies in their credit bureau reports. Cards that report to all three major bureaus (Experian, TransUnion, and Equifax) provide maximum credit potential. Payment history accounts for 35% of your FICO score according to credit models, which makes consistent on-time payments your most powerful tool. Unlike prepaid cards that don’t report to credit bureaus, secured cards function identically to unsecured cards in terms of credit development. Many cardholders see credit score improvements within six months of responsible use, with some who achieve scores above 700 over time as Bankrate’s research notes.

Key Differences from Regular Credit Cards

Secured cards carry higher fees and interest rates than unsecured cards, which reflects the perceived risk. Annual fees range from $0 to $99, while APRs often exceed 20%. However, these drawbacks become irrelevant when you pay your balance in full monthly. The credit limits remain fixed to your deposit amount initially, though some issuers allow increases after you demonstrate responsible payment behavior. Many secured cards offer programs that automatically convert to unsecured cards after 6-12 months of positive payment history.

Now that you understand how secured cards work, the next step involves selection of the right card for your specific needs and financial situation.

Which Secured Card Should You Choose

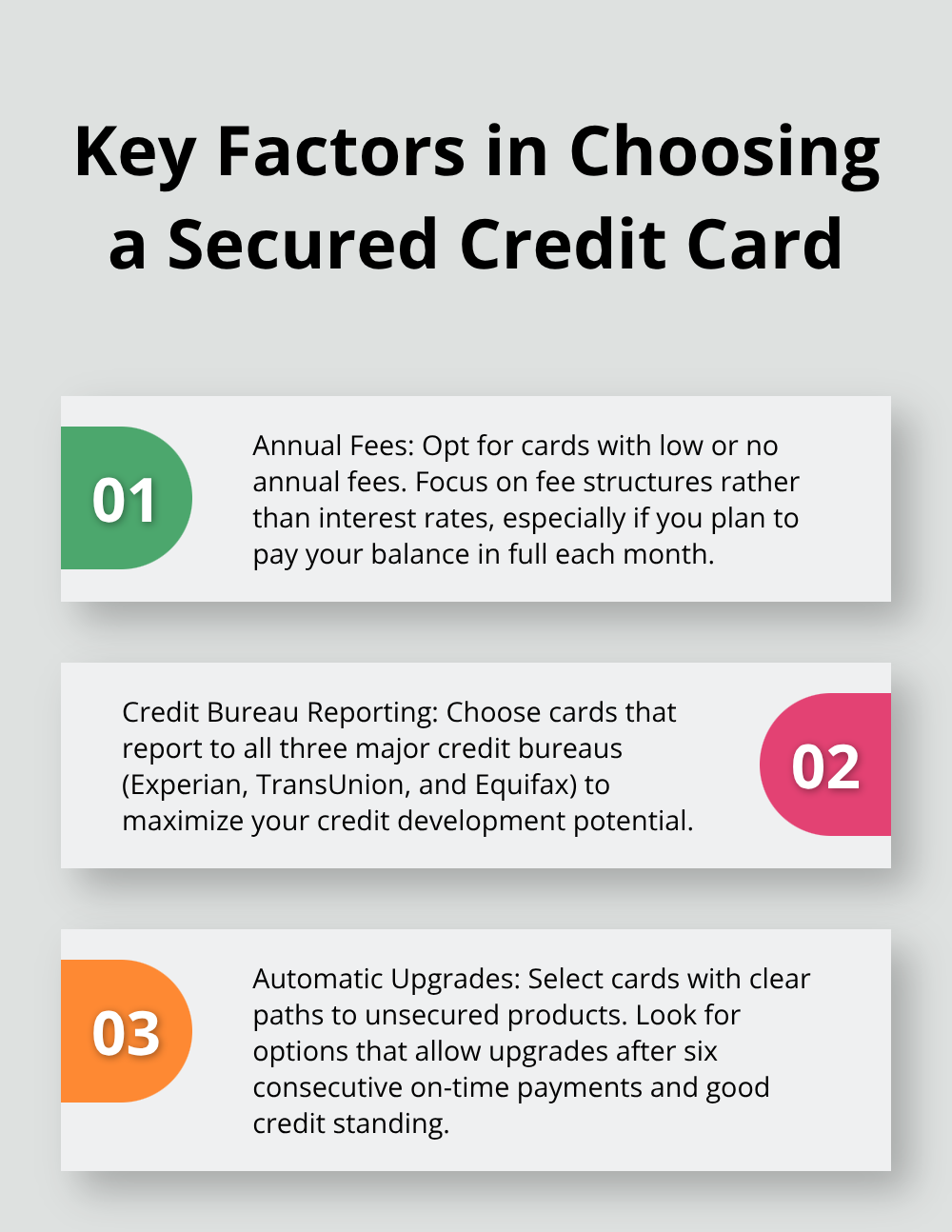

Annual Fees Matter More Than Interest Rates

Skip cards with annual fees above $35 unless they offer exceptional benefits. The Capital One Platinum Secured Credit Card charges no annual fee, while the OpenSky Secured Visa requires $35 annually. Interest rates become irrelevant when you pay balances in full monthly, so focus on fee structures instead. Cards with processing fees or monthly maintenance charges drain your budget without providing value. The Discover it Secured stands out by offering 1% cash back on purchases with no annual fee, making it superior to basic secured options that only build credit.

Credit Bureau Reports Drive Your Success

Choose cards that report to all three major credit bureaus without exception. Some secured cards only report to one or two bureaus, which limits your credit development potential significantly. The Citi Secured Mastercard reports to Experian, TransUnion, and Equifax monthly, which maximizes your credit profile development. Avoid cards that charge extra fees for credit bureau reports or require you to opt-in for these services. Your payment history needs to appear on all three reports to achieve the fastest credit score improvements and qualify for future unsecured cards.

Automatic Upgrades Accelerate Your Progress

Select cards with automatic upgrade paths to unsecured products. You can upgrade to an unsecured card after six consecutive on-time payments and six months of good status on all of your credit accounts. Cards without graduation programs trap you in secured status indefinitely (you must apply for new unsecured cards separately). Some issuers increase credit limits beyond your deposit amount before graduation, which improves your credit utilization ratio. The best secured cards also allow additional deposits to increase credit limits immediately, which gives you flexibility as your financial situation improves.

Minimum Deposit Requirements Affect Access

Consider the minimum deposit requirements when you select your card. Most secured cards require deposits between $200 and $500 to start, though some accept as little as $49. Higher deposits provide larger credit limits but tie up more of your cash. Cards like the Capital One Platinum Secured may approve you for credit limits above your deposit amount after you demonstrate responsible payment behavior (this feature helps improve your credit utilization faster).

Once you select the right secured card, your success depends entirely on how you use it to build positive credit habits.

How Do You Build Credit Fast with Your Secured Card

Stick to the 10 Percent Rule

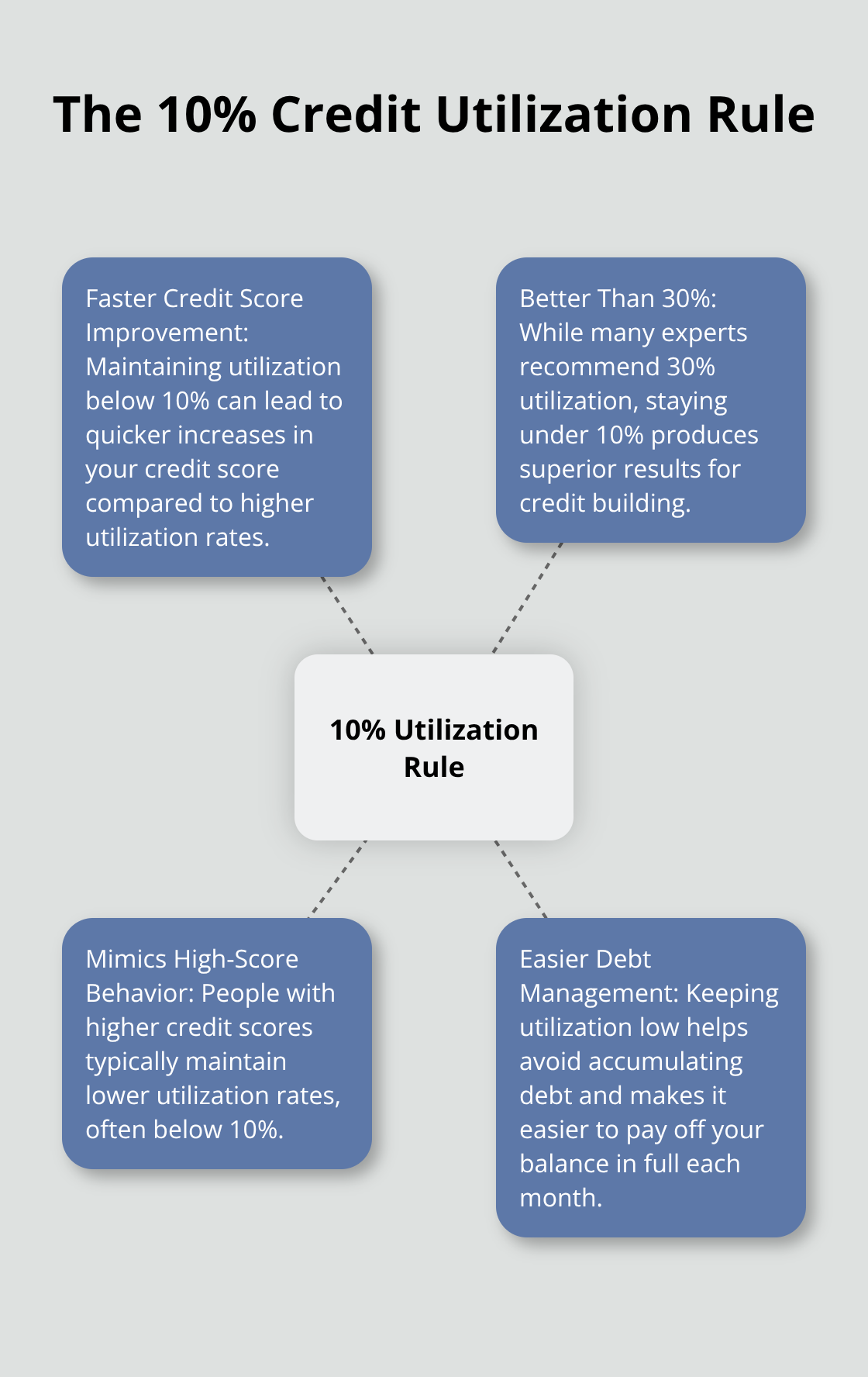

Most financial experts recommend credit utilization below 30 percent, but this advice produces mediocre results. Credit scores improve faster when you maintain utilization below 10 percent of your credit limit. With a $500 secured card limit, spend no more than $50 monthly and pay it off immediately. People with higher credit scores typically maintain lower utilization rates.

High utilization ratios above 30 percent can significantly impact your credit score, even with perfect payment history. Set up automatic payments for the full balance to avoid debt month-to-month, which eliminates interest charges and keeps utilization at zero when statements close.

Payment Schedule Beats Payment Amount

On-time minimum payments build credit faster than large payments made late. Payment history contributes 35 percent to your FICO score calculation, which makes punctuality more valuable than payment size. Set up autopay for at least the minimum payment amount five days before your due date to account for processing delays.

Late payments remain on credit reports for seven years and can significantly reduce scores. Pay your balance twice monthly instead of once to keep reported balances lower and improve your utilization ratio. Some cardholders pay their balance immediately after each purchase to maintain zero utilization (this produces the fastest credit score improvements).

Track Progress with Free Tools

Check your credit score monthly through free services like Credit Karma or your secured card issuer’s app to monitor improvements. Most people see initial score increases within 90 days of responsible secured card use, with significant improvements after six months. Consistent on-time payments can produce substantial score increases within the first year for people who start with poor credit.

Set up credit monitoring alerts to catch errors or suspicious activity immediately. Document your score progression to identify which habits produce the biggest improvements and maintain motivation during the credit process (this helps you stay committed to good financial habits).

Final Thoughts

Most people see their first credit score improvements within three months of responsible secured card use. Significant increases typically occur after six months of consistent on-time payments and low utilization. Can secured cards build credit effectively? The data proves they can, with many cardholders who achieve scores above 700 within their first year.

Consider an upgrade to an unsecured card after six consecutive months of perfect payment history and when your credit score reaches 650 or higher. Most secured card issuers offer automatic upgrades, return your deposit while they maintain your account history. This transition preserves your credit age and payment history while it eliminates deposit requirements (which saves you money and improves your financial flexibility).

Beyond secured cards, diversify your credit mix with credit-builder loans or become an authorized user on family members’ accounts. These strategies accelerate score improvements and demonstrate responsible credit management to future lenders. We at Financial Canadian help financial professionals establish strong digital presence through our comprehensive services to grow their businesses and serve clients better.

Leave a comment