Building credit from scratch or repairing damaged credit feels overwhelming when traditional credit cards remain out of reach.

Do secured credit cards build credit effectively? The answer is yes, and they represent one of the most reliable paths to establishing creditworthiness. At Financial Canadian, we’ve seen countless readers transform their financial standing through strategic use of these accessible credit-building tools.

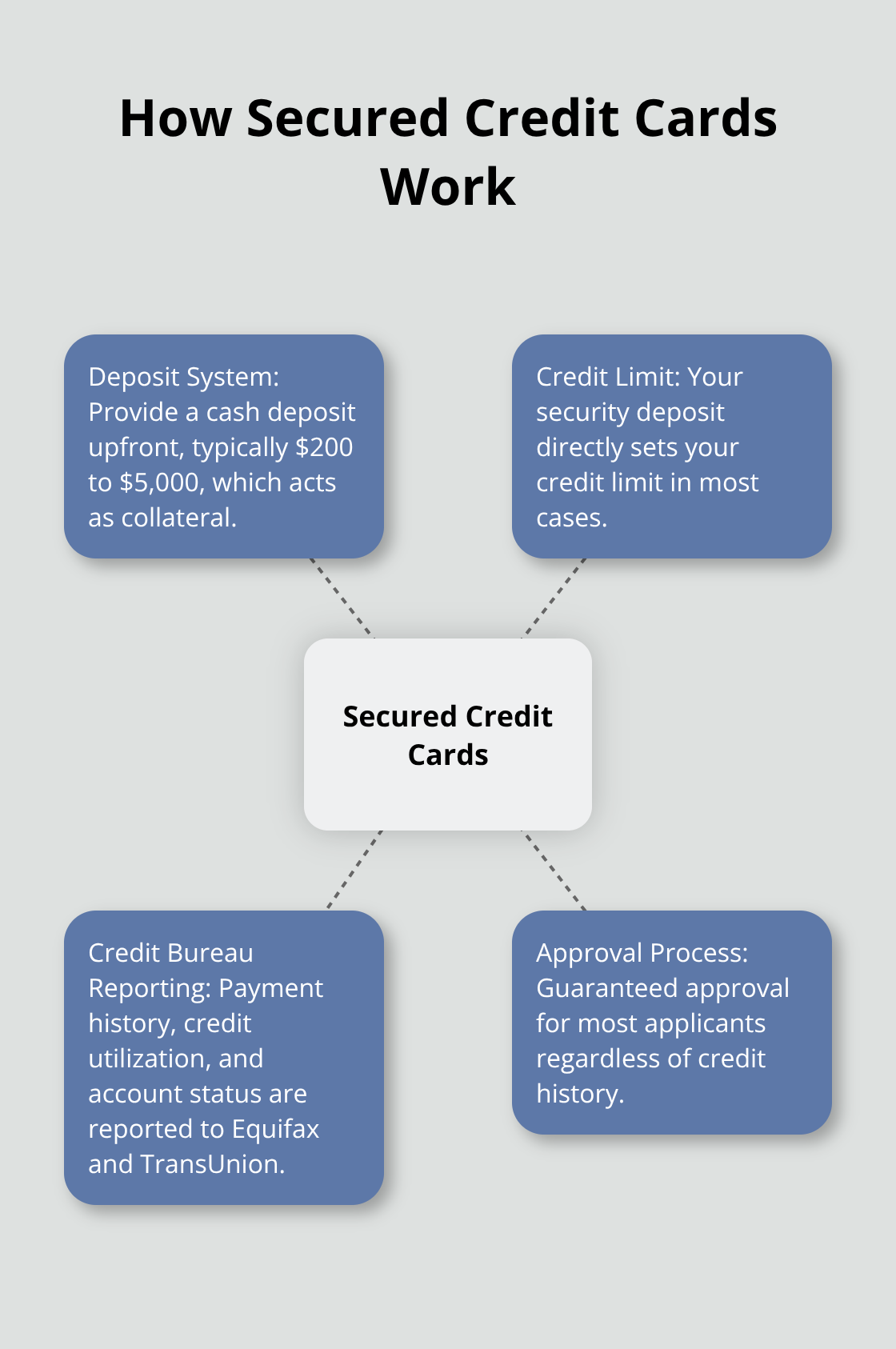

How Do Secured Credit Cards Actually Work

Secured credit cards operate through a straightforward deposit system that removes the guesswork traditional lenders face with high-risk applicants. You provide a cash deposit upfront, typically from $200 to $5,000, which becomes your credit limit. This deposit sits in a separate account with your card issuer and acts as collateral, not a prepayment for purchases. When you make transactions, you still receive monthly bills that require payment just like any regular credit card.

The Deposit Determines Your Credit Limit

Your security deposit directly sets your credit limit in most cases. Deposit $500, and your credit limit becomes $500. Some issuers like Capital One offer flexibility with deposits as low as $49, while others require minimum deposits of $200. The deposit remains untouched unless you default on payments or close the account. This system allows card issuers to approve applicants who would otherwise face rejection from unsecured cards.

Secured Cards Report to Credit Bureaus

The major advantage lies in credit bureau reports. Secured cards report your payment history, credit utilization, and account status to Equifax and TransUnion in Canada exactly like unsecured cards. Your credit report shows no distinction between secured and unsecured accounts. This system allows you to build positive credit history through on-time payments and low balances. Most secured cards graduate to unsecured status after 6 to 12 months of responsible use (which returns your deposit while maintaining the established credit line).

Key Differences From Unsecured Cards

Unsecured cards rely solely on your creditworthiness and income for approval, while secured cards minimize issuer risk through your deposit. Secured cards typically carry higher interest rates from 19% to 29%, compared to unsecured cards that offer rates as low as 12% for excellent credit. However, secured cards provide guaranteed approval for most applicants regardless of credit history, which makes them accessible when unsecured options remain unavailable.

These mechanics create the foundation for effective credit development, but success depends entirely on how you manage your new account and establish positive payment patterns.

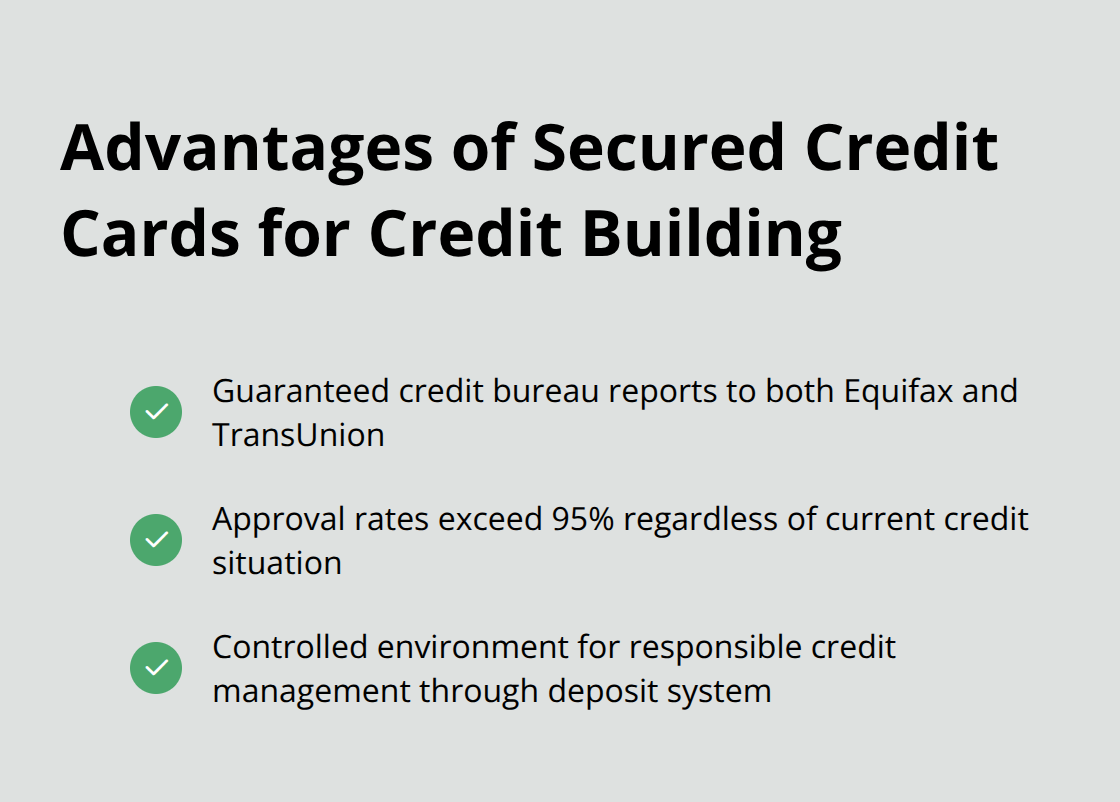

Why Secured Cards Excel at Credit Building

Secured credit cards deliver three fundamental advantages that make them superior to alternative credit-building methods. First, they guarantee credit bureau reports to both Equifax and TransUnion, which means every payment you make contributes directly to your credit score calculation. Second, approval rates exceed 95% regardless of your current credit situation, which makes them accessible when other credit products remain unavailable. Third, they provide a controlled environment where responsible credit management becomes automatic through the deposit system.

Guaranteed Credit Bureau Reports Create Real Results

Most secured card issuers report your account activity monthly to both major Canadian credit bureaus without exception. This report includes payment history (which represents 35% of your credit score according to FICO models) and credit utilization ratios that account for another 30%. Payment history improvements typically appear on your credit report within 30 to 45 days of your first payment. Credit score improvements become achievable through consistent on-time payments and utilization below 10%. The report process operates identically to unsecured cards, which means secured card accounts contribute to your credit age and account mix calculations.

Approval Rates Surpass Traditional Credit Options

Secured cards approve applicants with credit scores as low as 300, while unsecured cards typically require scores above 600 for approval. Major Canadian issuers like Capital One and Home Trust approve over 95% of secured card applications, compared to approval rates below 20% for unsecured cards among applicants with poor credit. The deposit requirement eliminates the primary risk factor that causes unsecured card rejections. Income requirements remain minimal, often requiring proof of just $12,000 annual income compared to $30,000 or higher for premium unsecured cards.

This accessibility creates the foundation for immediate credit development, but success depends on how you implement specific strategies to maximize your credit score growth.

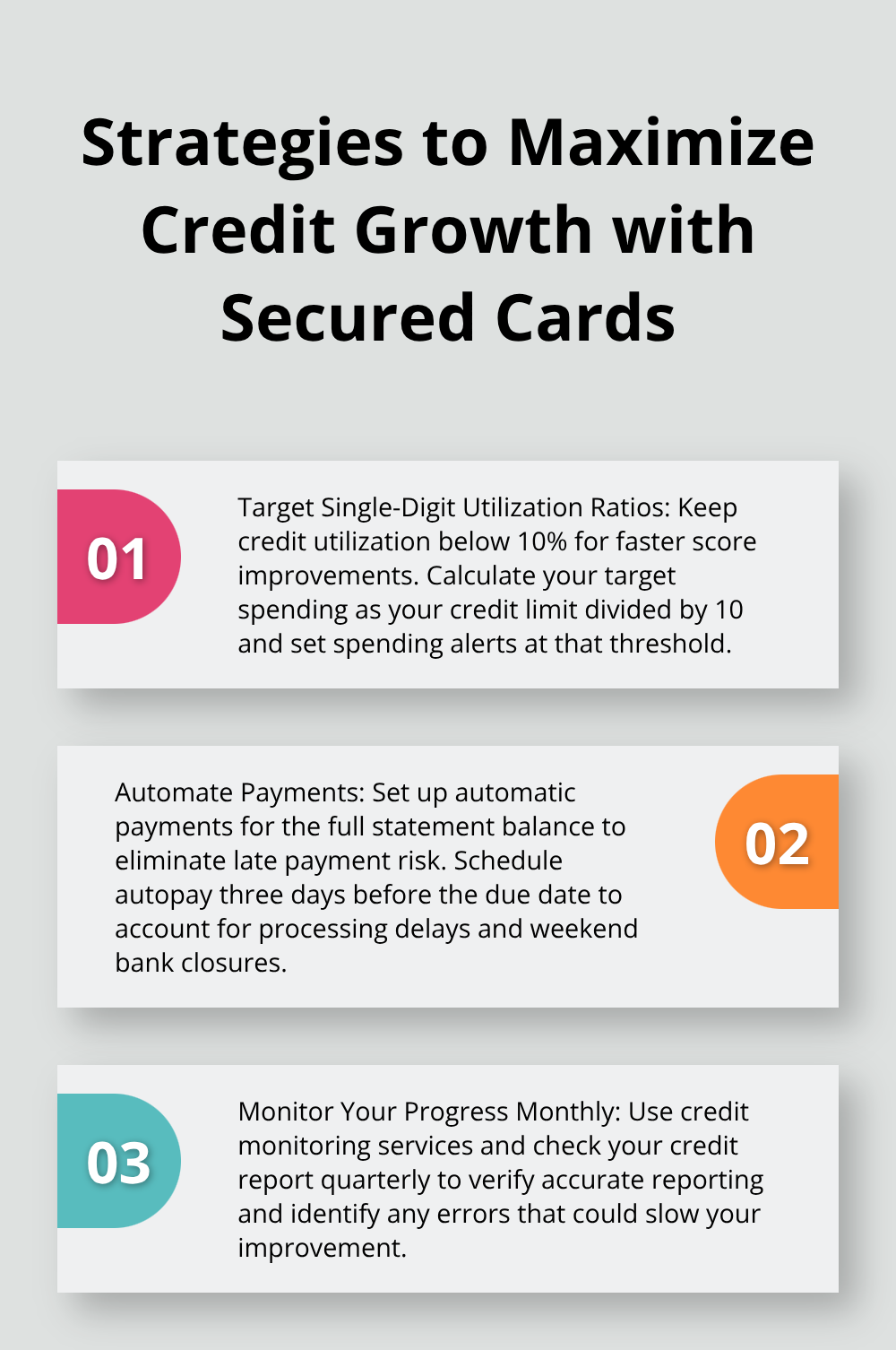

How to Maximize Credit Growth with Secured Cards

Success with secured cards requires precision in three specific areas that directly impact your credit score trajectory. Credit utilization below 10% accelerates score improvements faster than the commonly recommended 30% threshold, while payment timing affects more than just late fee avoidance. Treat your secured card like a debit card with monthly autopay to eliminate human error from the credit-building equation.

Target Single-Digit Utilization Ratios

Credit scores respond dramatically to utilization below 10%, with improvements when cardholders maintain single-digit ratios compared to the 30% guideline most advisors suggest. Calculate your target spending as your credit limit divided by 10, then set spending alerts at that threshold. A $500 credit limit means you spend no more than $50 per month, while a $1,000 limit allows $100 monthly spending. Pay your balance twice monthly rather than once to keep reported balances minimal, since card issuers report your statement balance to credit bureaus regardless of whether you pay in full afterward.

Automate Payments to Eliminate Late Payment Risk

Payment history accounts for 35% of your credit score according to FICO models, making a single late payment potentially devastating to credit progress. Set up automatic payments for the full statement balance (not the minimum payment) to avoid interest charges that can reach 29% annually on secured cards. Schedule autopay three days before your due date to account for processing delays and weekend bank closures. Manual payments create unnecessary risk when credit building requires consistency over 6 to 12 months for meaningful score improvements.

Monitor Your Progress Monthly

Credit monitoring services like Credit Karma update scores monthly and alert you to changes, while your card issuer likely provides free score tracking that updates every 30 days to show your progress. Check your credit report quarterly through Equifax and TransUnion to verify accurate reporting and identify any errors that could slow your improvement. Most secured cardholders see initial score increases within 60 to 90 days of responsible use, with significant improvements appearing after six months of consistent payment history.

Final Thoughts

Do secured credit cards build credit? Yes, they provide the most accessible path to creditworthiness for Canadians with poor or limited credit history. These cards deliver guaranteed credit bureau reports, approval rates above 95%, and controlled environments that make responsible credit management automatic. Most cardholders see initial credit score improvements within 60 to 90 days of consistent use.

Your secured card typically graduates to unsecured status after six months of on-time payments and low utilization ratios (which returns your deposit while maintaining the credit line). This graduation opens access to unsecured cards with better terms, lower interest rates, and rewards programs. Your improved credit score creates opportunities for mortgages, auto loans, and other financial products at competitive rates.

At Financial Canadian, we help businesses establish strong digital footprints through our comprehensive web design service that creates visually stunning, responsive websites tailored to specific business needs. Credit development requires consistent effort and strategic planning for long-term success. Your financial future depends on the actions you take today with your secured card.

Leave a comment