Building credit from scratch feels impossible when lenders won’t approve you without existing credit history. This catch-22 traps millions of Canadians in a cycle of rejection.

Do secured cards build credit? Absolutely. We at Financial Canadian have seen countless readers transform their credit scores using these powerful tools that require only a small deposit to get started.

How Do Secured Credit Cards Actually Work

Secured credit cards function as traditional credit cards with one major difference: you provide a cash deposit upfront that becomes your credit limit. Most Canadian banks require deposits between $200 and $500, though some accept as little as $75. Your deposit sits in a separate account while you use the card normally for purchases, payments, and credit history development.

The Security Deposit System

The deposit amount directly determines your credit limit. Deposit $300, receive a $300 credit limit. This deposit protects the lender if you default, but you still receive monthly bills and pay interest on unpaid balances just like any credit card. Your deposit earns no interest while the bank holds it. After six to twelve months of on-time payments, many issuers review your account for potential promotion to unsecured status and return your original deposit.

Credit Reporting and Score Impact

Both secured and unsecured cards report payment activity to Equifax and TransUnion in Canada, which creates identical credit histories. Payment history accounts for 35% of your credit score calculation according to FICO models. Late payments damage your score regardless of whether you use a secured or unsecured card. The credit-building impact remains the same for both card types when you maintain consistent, timely payments.

Key Differences from Unsecured Cards

Unsecured cards require no deposit but demand credit scores typically above 660 for approval. Secured cards accept applicants with scores as low as 300, which makes them accessible to newcomers and those who rebuild credit. Secured cards often carry higher annual fees (ranging from $0 to $59), while unsecured cards frequently offer rewards programs and lower interest rates. However, the fundamental credit-building mechanics work identically across both card types.

These mechanics form the foundation for effective credit development, but success depends entirely on how you manage your card once approved.

How Do You Build Credit Fast with Secured Cards

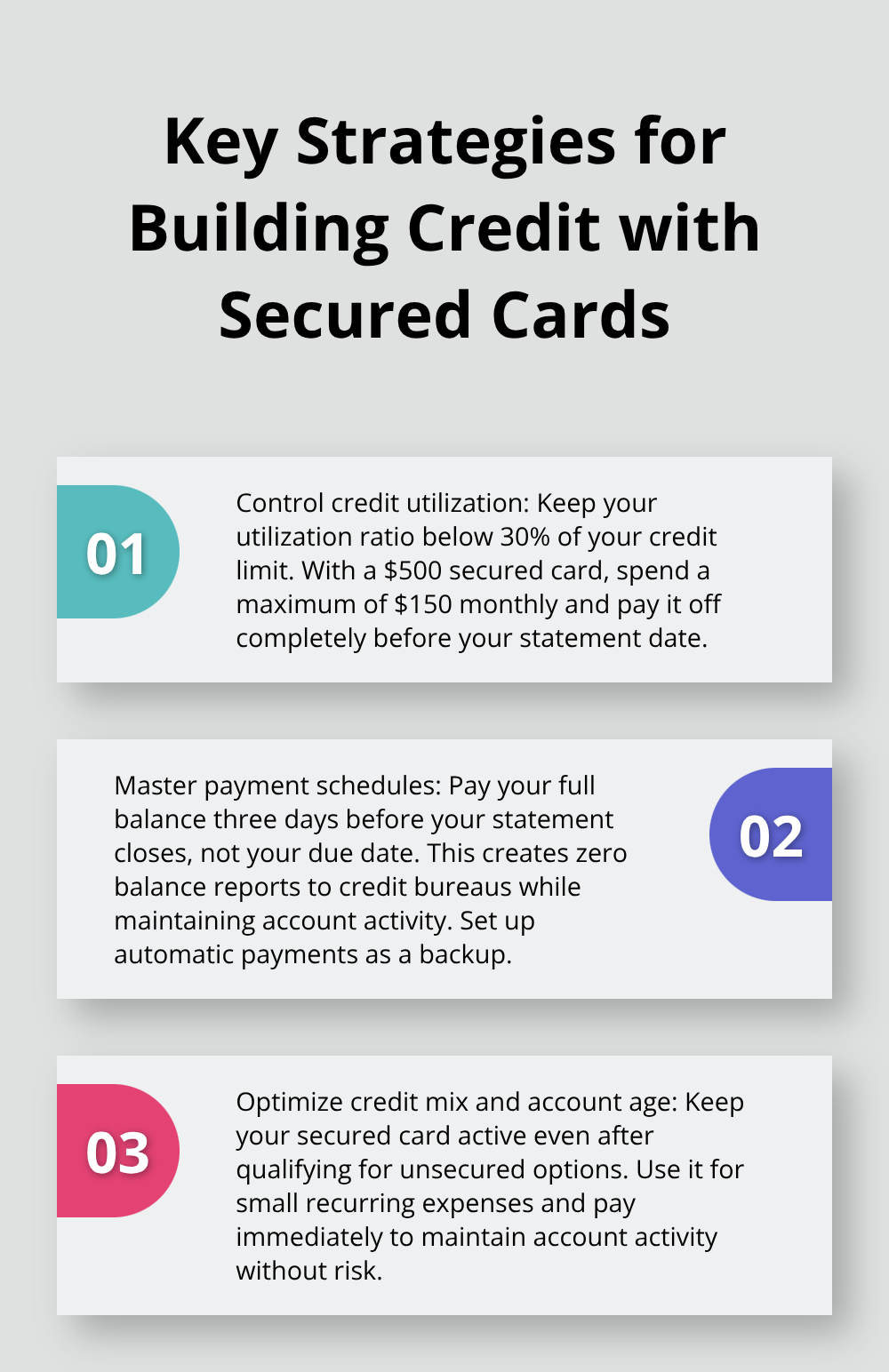

Smart secured card management requires aggressive credit utilization control and precise payment schedules. Your utilization ratio should never exceed 30% of your credit limit, as utilizing less than 30% of your available credit is a common guideline. With a $500 secured card, spend maximum $150 monthly and pay it off completely before your statement date. This strategy shows lenders you need minimal credit while you maintain active usage patterns that credit bureaus reward with score increases.

Track Your Progress Through Monthly Checks

Equifax offers free monthly credit score updates through their app, while TransUnion provides similar services through Credit Karma Canada. Check both scores monthly because Canadian lenders use different bureaus for approval decisions. Your score should increase 20-40 points within three months of consistent low utilization and perfect payment history. Document these improvements in a spreadsheet with dates, scores, and utilization percentages to identify patterns that accelerate your progress.

Master the Payment Schedule Strategy

Payment schedules beat payment amounts for credit development velocity. Pay your full balance three days before your statement closes, not your due date. This creates zero balance reports to credit bureaus while you maintain account activity. Set up automatic payments for your full statement balance as backup protection, but manually pay early to optimize your credit reports. One missed payment destroys months of progress and drops scores significantly according to FICO data, making payment schedules your most valuable credit development weapon.

Optimize Your Credit Mix and Account Age

Keep your secured card active even after you qualify for unsecured options. Credit scoring models favor longer account histories and diverse credit types. Use your secured card for one small recurring expense like Netflix or Spotify ($15-20 monthly) and pay it immediately. This maintains account activity without risk while you build your unsecured credit portfolio. Account age contributes to your credit score calculation, so premature closures hurt your long-term credit profile.

These aggressive strategies prepare you for the next step: selecting the right secured card that maximizes your credit development potential while minimizing costs. Whether you have good credit, or bad credit, these techniques accelerate your credit building timeline through disciplined execution.

Which Secured Cards Offer the Best Value in Canada

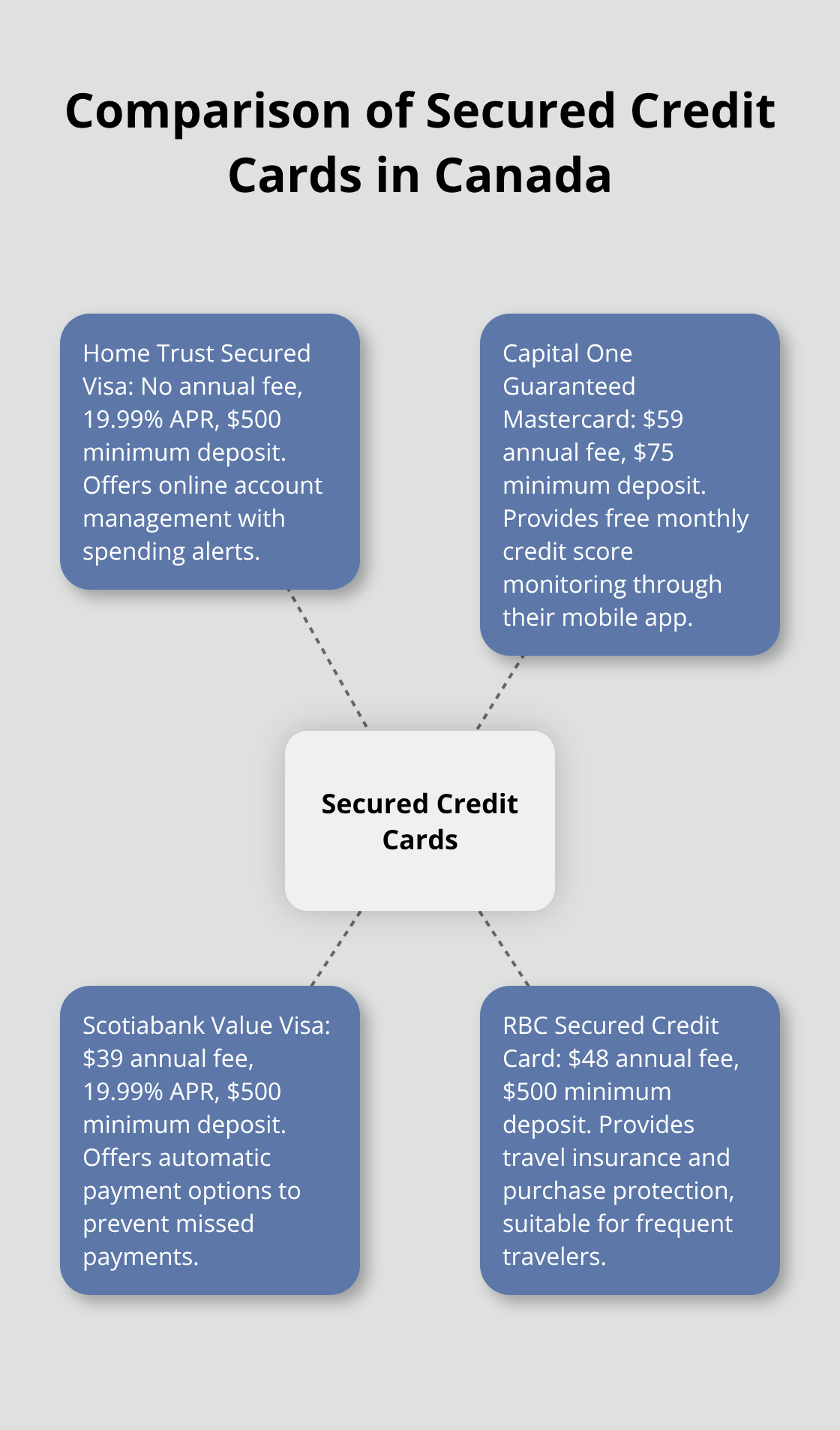

Canadian secured cards vary dramatically in costs and benefits, which makes your choice critical for credit development while you minimize expenses. The Home Trust Secured Visa stands out with no annual fee and competitive 19.99% APR, though it requires a minimum $500 deposit. Capital One Guaranteed Mastercard charges $59 annually but accepts deposits as low as $75, which makes it accessible for tight budgets. Scotiabank Value Visa demands $39 yearly with 19.99% interest rates and $500 minimum deposits. RBC Secured Credit Card offers premium benefits at $48 annually but provides travel insurance and purchase protection that justify higher costs for frequent travelers.

Graduation Policies That Actually Work

Most Canadian banks review secured accounts after 12 months, but their graduation criteria differ significantly. Capital One reviews accounts regularly and may upgrade customers who demonstrate responsible credit management. RBC requires formal applications for unsecured conversions but typically approves customers with 650+ credit scores and consistent payment patterns. Home Trust operates the most restrictive policy, often requiring 18-24 months before it considers upgrades and demands income verification during reviews. Scotiabank provides graduation opportunities for customers who maintain responsible credit usage and payment patterns.

Features That Accelerate Credit Development

Smart secured cards offer tools beyond basic credit reporting that speed your progress toward unsecured status. Capital One provides free monthly credit score monitoring through their mobile app, which allows you to track improvements in real-time. RBC includes fraud protection and mobile payment compatibility that lets you build credit through everyday purchases safely. Home Trust offers online account management with spending alerts that prevent accidental over-limit charges (which damage credit scores). Scotiabank provides automatic payment options that eliminate missed payment risks, though manual early payments still optimize your credit utilization reporting for maximum score improvements.

Cost Analysis for Budget-Conscious Applicants

Annual fees impact your total cost of credit development over time. Capital One’s $59 fee equals $4.92 monthly, but its low $75 minimum deposit requirement saves you $425 in upfront costs compared to $500 deposit cards. Home Trust eliminates annual fees entirely, which saves you $59-$48 yearly compared to competitors. RBC’s $48 fee becomes worthwhile if you use travel insurance benefits (valued at $100+ annually for frequent travelers). Calculate your total first-year costs including deposits and fees to determine true value for your situation.

Application Requirements and Approval Odds

Canadian secured cards accept most applicants regardless of credit history, but income requirements vary. Capital One requires minimum $12,000 annual income and accepts government benefits as qualifying income. RBC demands $15,000 yearly income from employment sources only. Home Trust accepts $10,000 minimum income and includes pension payments in calculations. Scotiabank requires $12,000 annual income but offers the most flexible documentation requirements for newcomers to Canada.

Final Thoughts

Your credit score improves within 30 days of your first secured card payment, with significant gains after three months of consistent usage. Most cardholders see 40-60 point increases within six months when they maintain utilization below 10% and perfect payment records. Do secured cards build credit effectively? The data proves they do, often faster than traditional credit repair methods.

Upgrade timing depends on your credit score reaching the 650-670 range (typically after 8-12 months of responsible secured card management). Apply for unsecured cards once you achieve this threshold, but keep your secured account open to preserve credit history length. Many issuers automatically review accounts for graduation after 12 months, which creates opportunities for advancement without additional applications.

We at Financial Canadian provide resources and insights to help you make informed financial decisions. Visit Financial Canadian to access our comprehensive guides and tools that support your credit development journey. Your secured card transforms from a credit development tool to a credit management foundation within 12-18 months of disciplined usage.

Leave a comment