Getting your first credit card feels overwhelming with hundreds of options available. Most new applicants make costly mistakes that hurt their credit scores for years.

We at Financial Canadian provide straightforward advice for first credit card selection. The right choice depends on your spending habits, credit history, and financial goals rather than flashy promotions.

What Do You Actually Need From a Credit Card

Track Your Real Spending Patterns

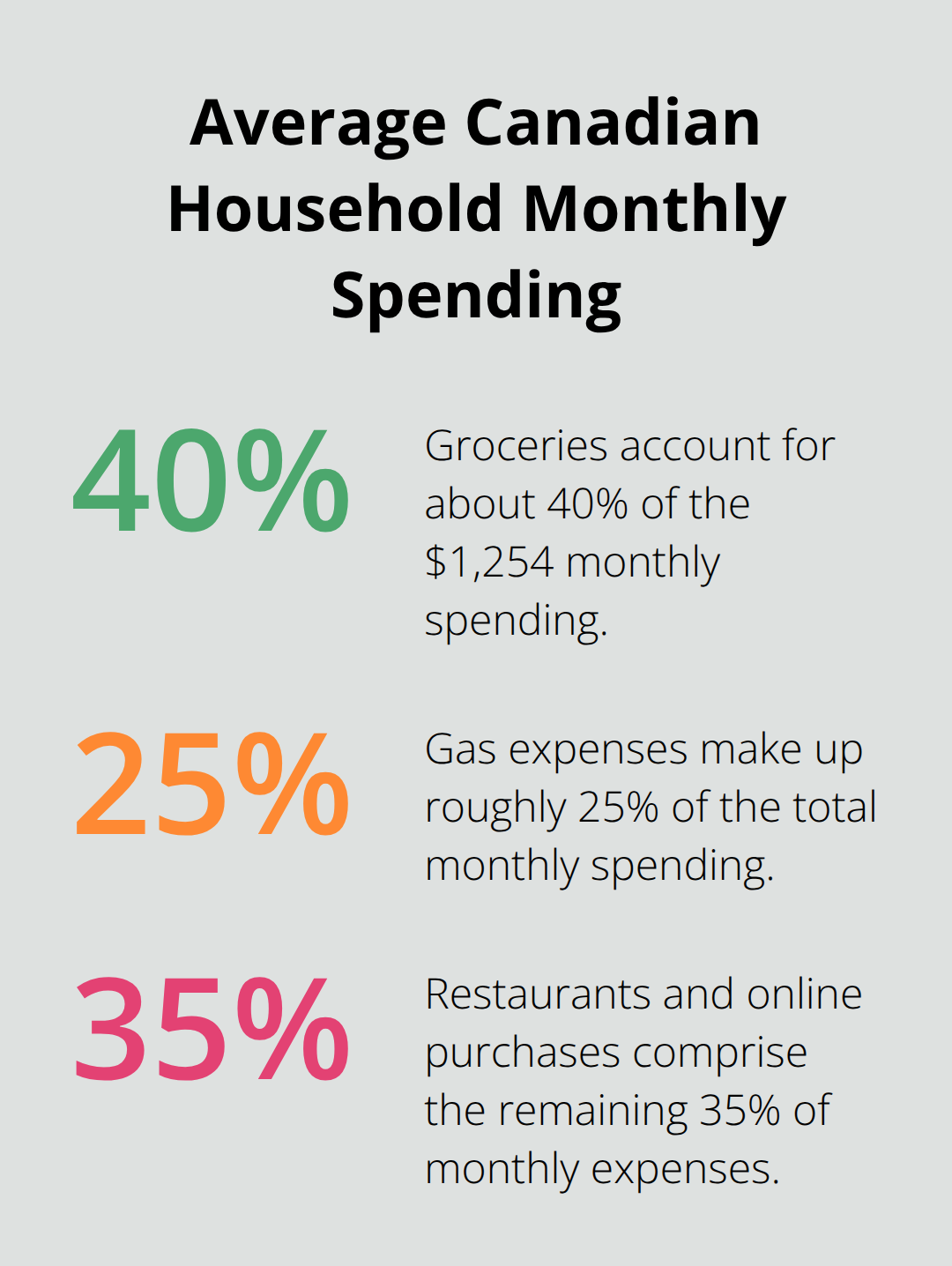

Review your bank statements from the past three months. Calculate how much you spend monthly on groceries, gas, restaurants, and online purchases. The average Canadian household spends $1,254 monthly on these categories according to Statistics Canada.

Cards that offer higher rewards on grocery purchases make financial sense if you spend over $500 monthly on groceries. Students spend differently than working professionals, with textbooks, coffee shops, and streaming services that dominate their expenses.

Check Your Credit Score Before You Apply

Your credit score determines which cards you qualify for and what interest rates you receive. Canadians with scores below 650 face limited options and higher interest rates. Use free services like Credit Karma or your bank’s mobile app to check your score.

First-time applicants often have no credit history, which makes secured cards or student cards their only viable options. Cards for excellent credit require scores above 660, while fair credit cards accept scores between 580-669.

Set Clear Financial Priorities

Decide whether you want to build credit, earn rewards, or minimize costs. New credit users should prioritize credit history over reward earnings. Cards with no annual fees save you $120-200 yearly compared to premium reward cards.

Low interest rates become more important than reward percentages if you plan to carry balances occasionally. Balance transfer needs require cards with 0% promotional rates that offer extended periods for debt consolidation.

Match Cards to Your Life Stage

Students benefit most from no-fee cards with basic features rather than complex reward structures. Young professionals who pay balances in full should focus on cash back or travel rewards that match their spending categories.

Cards designed for fair credit often include features like free credit score access and automatic credit limit increases after six months of on-time payments. These features help you monitor and improve your credit profile as you establish your financial foundation.

Now that you understand your needs, you can evaluate the specific features that separate good cards from great ones.

What Card Features Matter Most

Interest Rates Determine Your Real Costs

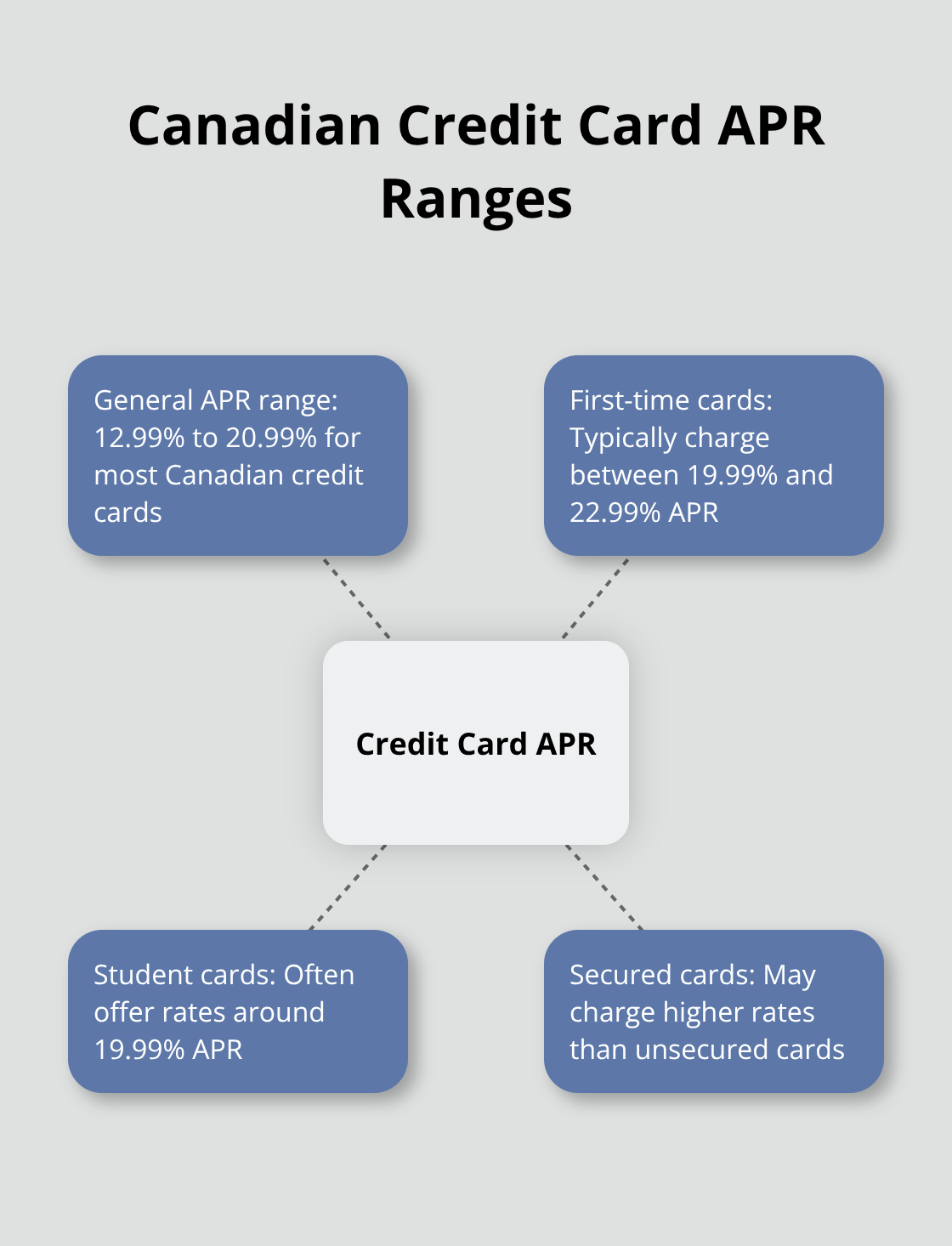

Annual percentage rates on Canadian credit cards range from 12.99% to 20.99%, with most first-time cards charging between 19.99% and 22.99%. Cards marketed to students typically offer rates around 19.99%, while secured cards often charge higher rates.

You can use the credit card calculator to compare different payment options for paying off your credit card balance. Cards with promotional 0% APR periods give you 6-21 months to pay down balances without interest charges.

These promotional rates matter more than ongoing rates if you plan to transfer existing debt or make large purchases. Annual fees range from $0 to $699, with most beginner cards charging nothing. Premium cards justify their $120-200 fees through enhanced rewards, but first-time users rarely spend enough to offset these costs.

Rewards Structure Affects Your Actual Returns

Cash back cards offer 0.5% to 2% on all purchases, with higher rates on specific categories like groceries or gas. Rotating category cards provide 5% cash back on quarterly categories but require activation and have spending caps of $1,500 per quarter.

Fixed-rate cards that offer 1.5% on everything generate more rewards for most people than complicated tiered systems. Travel rewards cards typically provide 1-2 points per dollar, with points worth 1-2 cents each when redeemed properly.

Credit Limits and Additional Benefits

Credit limits start at $500-1,000 for secured cards and can reach $2,000-5,000 for student cards with good applications. Your initial limit depends on your income, credit score, and the card issuer’s risk assessment.

Cards often include purchase protection, extended warranties, and fraud protection as standard benefits. Premium cards add travel insurance and airport lounge access (features that new users rarely need).

Most first-time applicants focus too heavily on flashy features while missing the basics that actually matter. The next section covers the biggest mistakes that cost new cardholders money and damage their credit scores.

Why First-Time Credit Card Applications Fail

Premium Cards Reject Most New Applicants

Many first-time applicants face rejection when they apply for premium rewards cards. Cards like the Scotiabank Gold American Express or BMO World Elite Mastercard require credit scores above 720 and annual incomes that exceed $60,000. New applicants with limited credit history cannot meet these requirements, yet they waste hard credit inquiries on impossible applications.

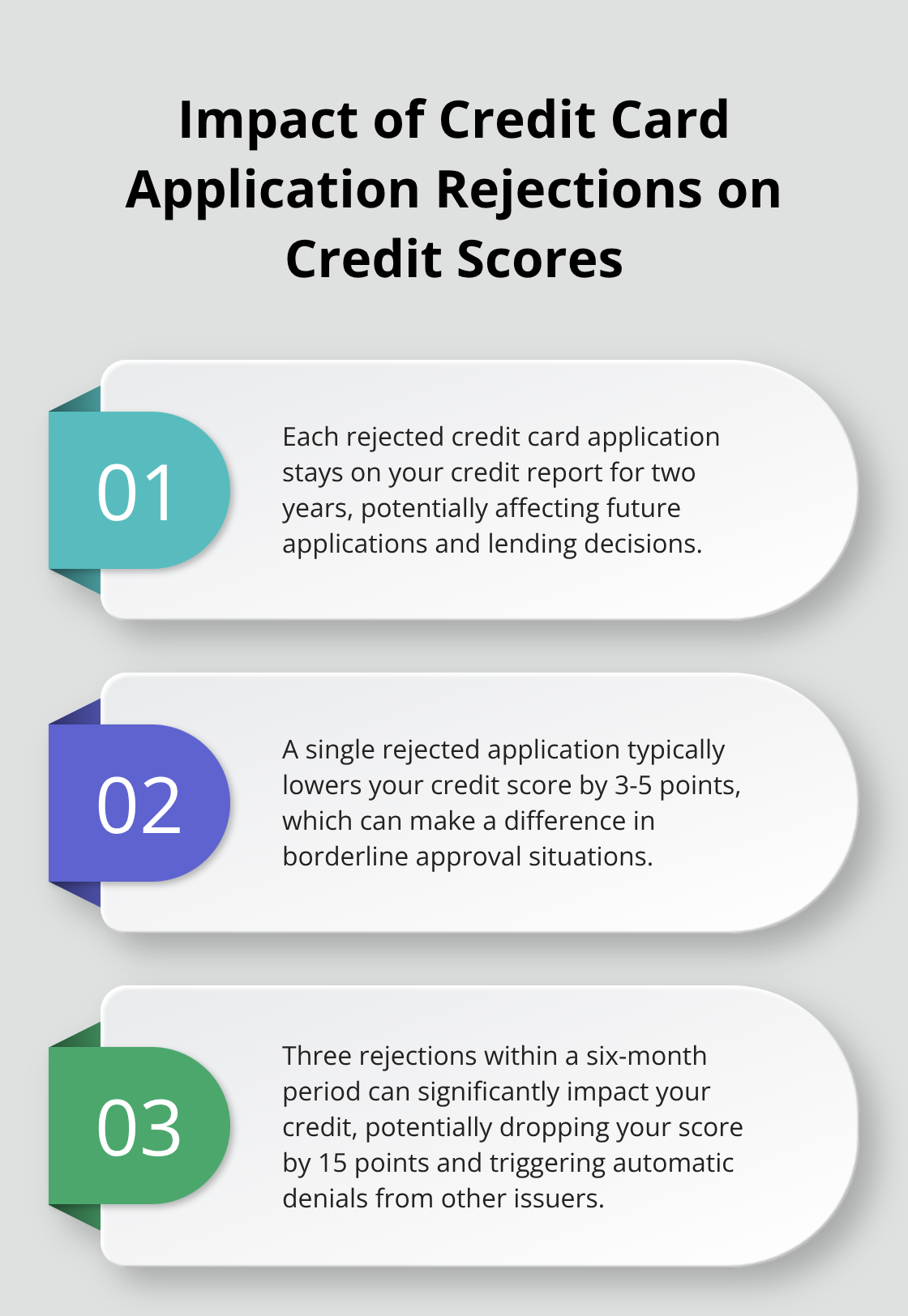

Each rejected application stays on your credit report for two years and lowers your score by 3-5 points. Three rejections within six months can drop your score by 15 points and trigger automatic denials from other issuers. Student cards and secured cards approve applicants with scores as low as 300 (which makes them realistic options for credit development).

Hidden Fees Cost More Than Advertised Rates

Card agreements contain fees that many applicants miss during their research. Cash advance fees typically cost 3.5% of the withdrawal amount plus daily interest charges that start immediately. Foreign transaction fees add 2.5% to every international purchase, which makes a $100 restaurant bill cost $102.50 in Europe.

Balance transfer fees range from 1% to 3% of the transferred amount, so a $5,000 transfer could cost $150 upfront. Late payment fees start at $29 and can reach $40 for subsequent violations within six months. Cards marketed as low-rate options often charge higher fees that offset their interest benefits for typical usage patterns.

Sign-Up Bonuses Create Overspend Patterns

Cards that offer $200 cash back after you spend $1,000 in three months seem attractive, but they encourage overspend beyond normal budgets. Cash-back rewards lead to increased card usage in the form of spending. This expense increase often continues after you earn the bonus and creates financial damage.

Premium cards require you to spend $3,000 to $5,000 for their largest bonuses (amounts that exceed most students’ quarterly budgets). Cards with no sign-up requirements but consistent reward rates generate better long-term value for new users who prioritize credit development over short-term gains.

Final Thoughts

Your first credit card choice shapes your financial future for years. Focus on cards that match your actual spending patterns rather than promotional offers that encourage overspending. Students and new applicants should prioritize no-fee cards with basic features over complex reward structures that require high spending thresholds.

Check your credit score before you apply and target cards within your approval range. Secured cards work best for scores below 650, while student cards suit those with limited credit history (avoid premium cards that require excellent credit and high incomes until you establish a solid payment record). Set up automatic payments for the full balance to avoid interest charges and late fees.

Keep your credit utilization below 30% of your available limit and pay attention to your monthly statements for unauthorized charges. These habits build strong credit scores that qualify you for better cards and lower interest rates on future loans. We at Financial Canadian provide advice for first credit card selection that emphasizes practical choices over flashy marketing promises that lead to financial mistakes.

Leave a comment