Personal lines of credit can be a flexible financial tool, but finding the best rates requires careful research and comparison.

At Financial Canadian, we understand the importance of securing favorable personal line of credit rates to maximize your borrowing power.

This guide will walk you through the key factors that influence these rates and provide practical tips to help you find the most competitive offers available.

What Are Personal Lines of Credit?

Definition and Basic Concept

Personal lines of credit are revolving credit accounts that provide borrowers access to funds up to a predetermined limit. Unlike traditional loans, you pay interest only on the amount you borrow, not the entire credit limit. This flexibility makes them an attractive option for many Canadians.

How Personal Lines of Credit Function

When a lender approves you for a personal line of credit, they set a maximum borrowing limit. You can then withdraw funds as needed, up to this limit. As you repay the borrowed amount, your available credit replenishes. Interest applies only to the outstanding balance, not the entire credit limit.

For instance, if you have a $10,000 line of credit and withdraw $3,000, you’ll pay interest on the $3,000 only. After you repay that amount, you can borrow up to $10,000 again without reapplying.

Secured vs. Unsecured Lines of Credit

Personal lines of credit come in two main types: secured and unsecured.

Secured lines of credit require collateral, often in the form of home equity. These typically offer lower interest rates because the lender has an asset to claim if you default.

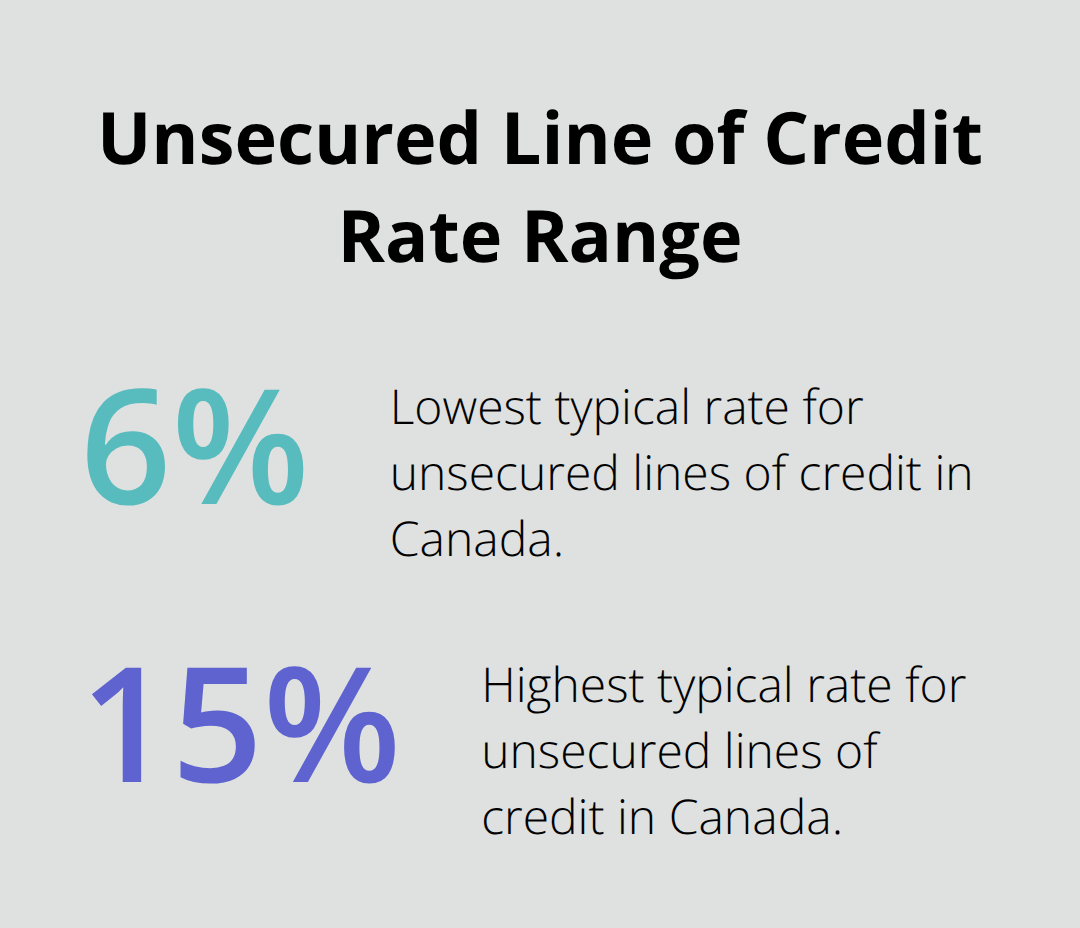

Unsecured lines of credit don’t require collateral but usually have higher interest rates. They depend solely on your creditworthiness. The Financial Consumer Agency of Canada states that unsecured line of credit rates can range from 6% to 15% or more (depending on your credit score and financial situation).

Advantages of Personal Lines of Credit

- Flexibility: You borrow what you need, when you need it.

- Lower interest rates: Compared to credit cards, lines of credit usually offer lower rates.

- Interest-only payments: Some lenders allow you to make interest-only payments during the draw period.

Potential Drawbacks

- Variable interest rates: Most lines of credit have variable rates, which can increase over time.

- Overspending risk: Easy access to funds can lead to accumulating more debt than intended.

- Collateral risk: For secured lines of credit, you could lose your asset if you default.

Understanding these aspects of personal lines of credit helps you make an informed decision. Now, let’s explore the factors that influence the rates lenders offer, which will guide you in finding the best deal possible.

What Impacts Your Personal Line of Credit Rates?

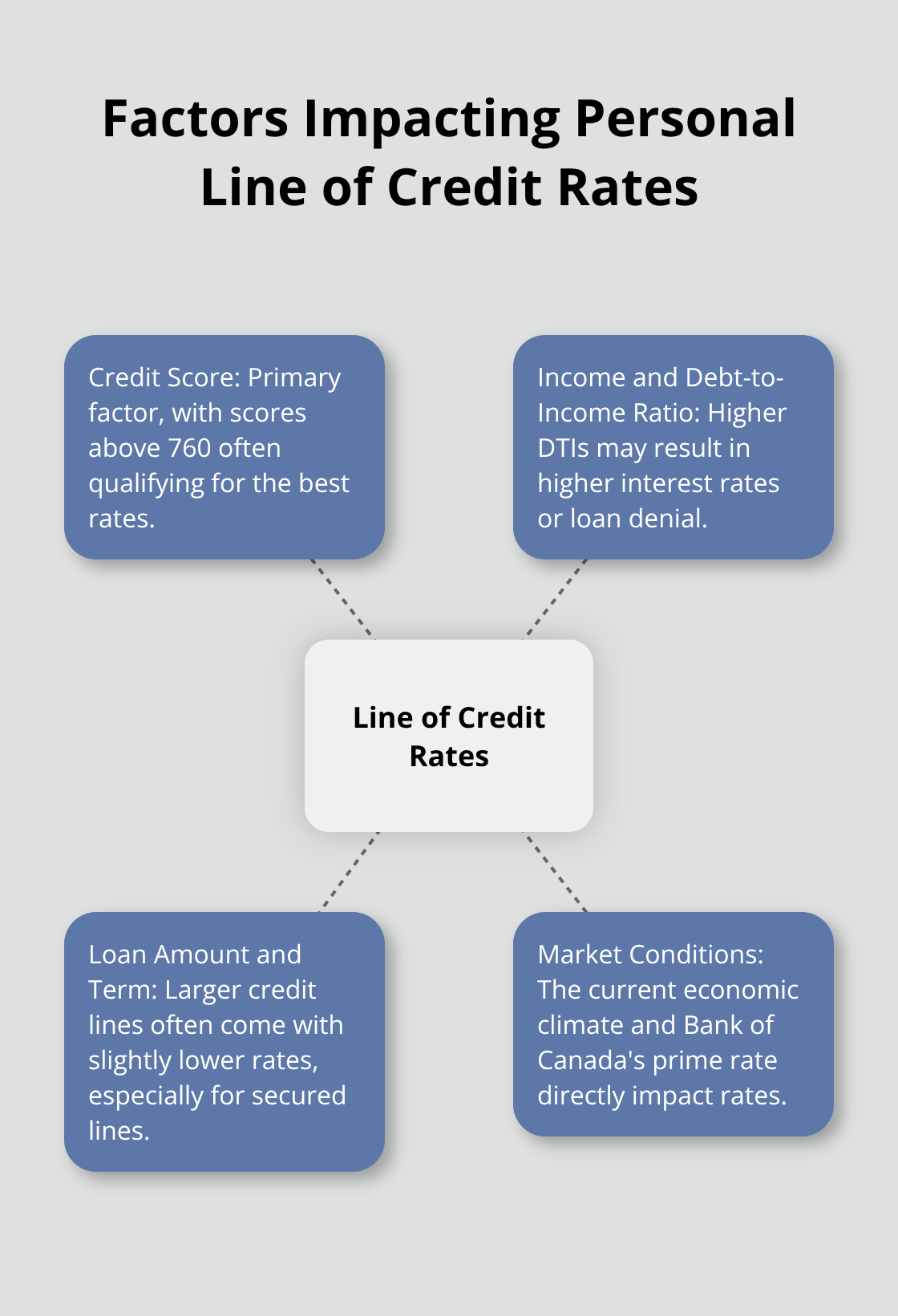

Credit Score: The Primary Factor

Your credit score significantly influences your personal line of credit rates. TransUnion Canada reports that credit scores are calculated based on your track record for repaying loans and credit card balances, as well as how much money you currently owe on your credit accounts. Scores above 760 are considered excellent and often qualify for the best rates. Major Canadian banks might offer prime rates as low as prime + 0.5% for excellent credit scores.

Conversely, scores below 650 could result in rates as high as prime + 5% or more. A 50-point improvement in your credit score can potentially reduce your interest rate by 0.5% to 1%.

Income and Debt-to-Income Ratio

Lenders evaluate your income and debt-to-income ratio (DTI) when determining rates. Your DTI is calculated by dividing your monthly debt payments by your gross monthly income. According to Rates.ca, the national debt-to-income ratio topped 177.5% by the end of 2018. Higher DTIs may result in higher interest rates or even loan denial.

For example:Monthly income: $5,000Monthly debt payments: $1,500DTI: 30% ($1,500 / $5,000)

This 30% DTI is generally viewed favorably by most lenders.

Loan Amount and Term

The amount you want to borrow and the term of the line of credit can affect your rates. Larger credit lines often (but not always) come with slightly lower rates, as they’re more profitable for lenders. This trend is less common for unsecured lines of credit.

Most personal lines of credit in Canada don’t have a set repayment term. However, some lenders offer promotional rates for a fixed period, after which the rate may increase.

Market Conditions and Prime Rate

The current economic climate and the Bank of Canada’s prime rate directly impact personal line of credit rates. When the prime rate increases, so do the rates on variable-rate lines of credit. It’s important to monitor these factors (especially if you’re considering a variable-rate product).

Understanding these key factors will help you navigate the personal line of credit landscape more effectively. In the next section, we’ll explore practical strategies to secure the best rates available.

How to Secure the Best Personal Line of Credit Rates

Compare Multiple Offers

Don’t accept the first offer you receive. Contact at least three to five different lenders to compare their rates, terms, and fees.

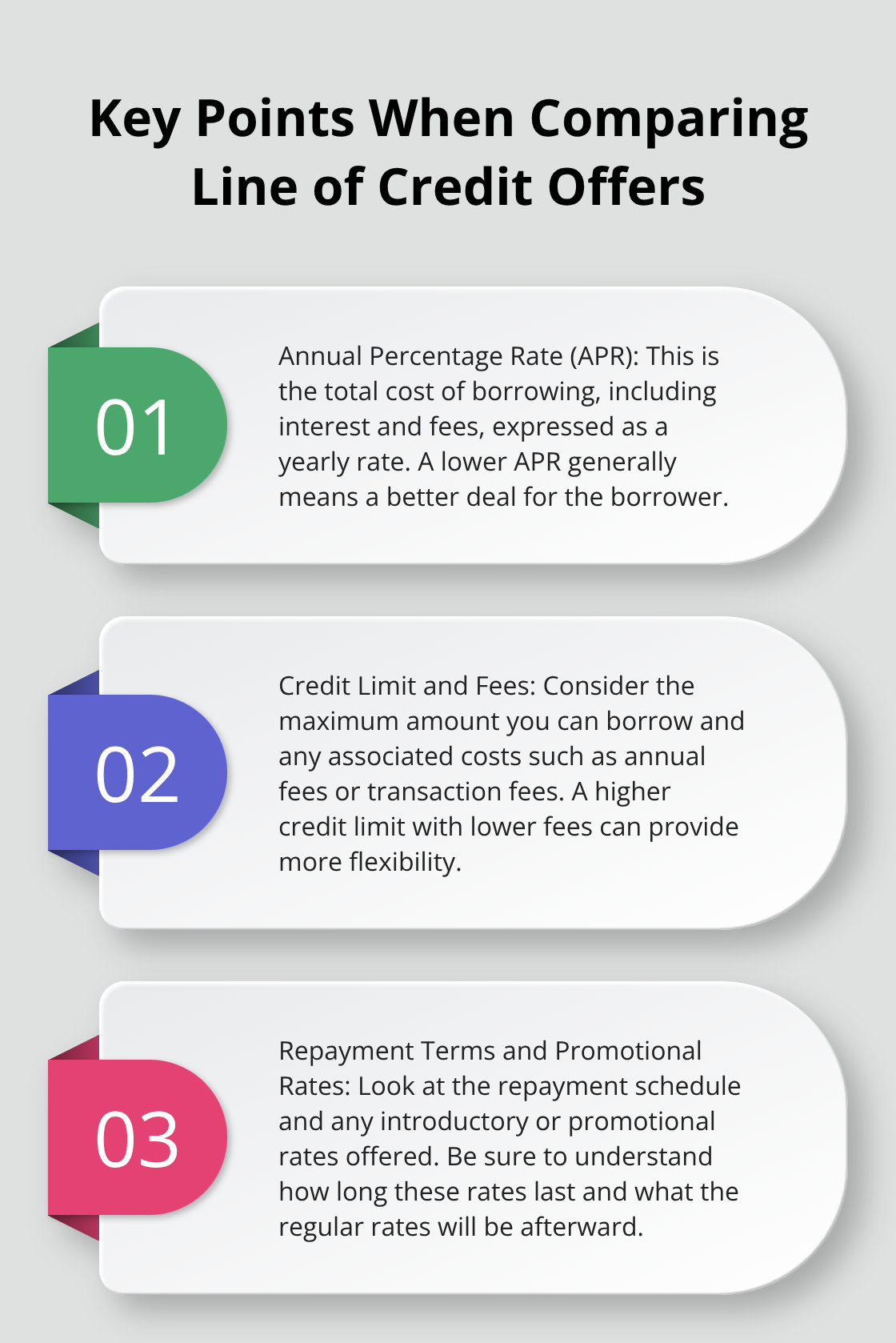

When you compare offers, focus on:

- Annual Percentage Rate (APR)

- Credit limit

- Fees (annual fees, transaction fees, etc.)

- Repayment terms

- Promotional rates and their duration

Use Existing Banking Relationships

Your current bank or credit union might offer preferential rates to existing customers. TD Bank offers a rebate of $3.00 U.S. on Borderless Plan monthly fee for customers who also have a TD All-Inclusive Banking Plan account throughout the entire month.

Consider Online and Alternative Lenders

Online lenders and peer-to-peer lending platforms often have lower overhead costs, which can result in more competitive rates for borrowers. Borrowell (a Canadian online lender) offers personal lines of credit with rates starting from 5.99% APR for borrowers with excellent credit.

Exercise caution and research any online lender thoroughly before applying. Verify their registration with your provincial or territorial securities regulator.

Negotiate with Lenders

Don’t hesitate to negotiate. If you have a strong credit profile or a competing offer, use this as leverage.

Effective negotiation tactics include:

- Highlight your positive financial attributes

- Present competing offers

- Ask about loyalty discounts or bundling options

- Inquire about temporary rate reductions

Improve Your Credit Score

A better credit score can significantly impact the rates you’re offered.

Quick ways to boost your credit score:

- Pay all bills on time

- Reduce credit card balances

- Avoid new credit applications

- Keep old credit accounts open

- Dispute any errors on your credit report

These strategies will position you to secure the most favorable personal line of credit rates available. Financial Canadian remains committed to helping you make informed financial decisions that align with your unique needs and goals.

Final Thoughts

You can secure the best personal line of credit rates through strategic research and understanding of key factors. Your credit score significantly impacts these rates, with a 50-point improvement potentially lowering your interest rate by 0.5% to 1%. Compare offers from multiple lenders, including banks, credit unions, and online platforms to find competitive rates.

Negotiate with lenders and leverage existing banking relationships for better terms. Take steps to improve your credit score, as it can greatly affect the rates you receive. Stay informed and make decisions that align with your financial goals to secure a personal line of credit that meets your needs.

At Financial Canadian, we provide resources to help you make sound financial choices. Our comprehensive web design service can help establish your strong online presence (showcasing your business to potential customers). Use the right resources to secure a personal line of credit that supports your financial well-being.

Leave a comment