At Financial Canadian, we understand the challenges of securing a loan with less-than-perfect credit. Many borrowers seek bad credit personal loans guaranteed approval $5,000, but the reality is more complex.

This guide will explore your options for obtaining a $5,000 personal loan, even with a low credit score. We’ll cover potential lenders, ways to improve your chances of approval, and strategies to manage your loan responsibly.

Understanding Bad Credit and Its Impact on Personal Loans

Defining Bad Credit

Bad credit typically refers to a credit score below 580 on the FICO scale. This low score significantly impacts your ability to secure a loan, as lenders view it as a sign of high risk. Borrowers with bad credit often face higher interest rates and stricter terms when applying for personal loans.

Types of Personal Loans for Bad Credit Borrowers

Personal loans for bad credit borrowers come in various forms:

- Unsecured loans: These are the most common but often have higher interest rates due to the increased risk for lenders.

- Secured loans: These require collateral and may offer more favorable terms but put your assets at risk.

Interest Rates and Terms for Bad Credit Loans

Interest rates for bad credit personal loans can be steep. According to Bankrate Monitor data, as of July 23, 2025, the average personal loan rate is 12.64 percent for customers with a 700 FICO score. Those with poor credit might see rates soaring above this average.

Loan terms for bad credit borrowers are often shorter (typically ranging from 6 to 36 months). This shorter repayment period helps lenders mitigate risk but can result in higher monthly payments for borrowers.

The Real Cost of Bad Credit Loans

To illustrate the impact of credit scores on loan costs, let’s look at some numbers:

- Excellent credit borrower: $5,000 loan at 8% APR for 36 months = $157 monthly payments

- Bad credit borrower: $5,000 loan at 30% APR for 36 months = $207 monthly payments

That’s a significant difference of $50 per month (or $1,800 over the life of the loan).

It’s important to understand that while bad credit personal loans are available, they come at a cost. You should explore all options and consider the long-term financial impact before committing to a high-interest loan.

Now that we’ve covered the basics of bad credit and its impact on personal loans, let’s explore your options for securing a $5,000 loan with less-than-stellar credit.

Where to Find $5,000 Personal Loans for Bad Credit

Online Lenders: A Popular Choice

Online lenders have become a go-to option for bad credit borrowers. Companies like Upstart and Avant specialize in loans for those with lower credit scores. Upstart considers factors beyond your credit score, such as education and employment. This benefits applicants with stable jobs but poor credit histories. Upstart also offers flexible loan amounts.

Avant offers loans starting at $2,000, with APRs ranging from 9.95% to 35.99%. While these rates can be high, they often beat payday loans or some credit cards.

Credit Unions: Community-Focused Lending

Credit unions offer a more personalized approach to lending. As non-profit organizations, they often have more flexible lending criteria. For example, Navy Federal Credit Union offers a variety of personal loans to meet your needs, including savings secured loans and certificate secured loans.

To access credit union loans, you must become a member. This usually involves living in a certain area or working for a particular employer. The membership requirements are typically straightforward, and the benefits can be substantial.

Secured Personal Loans: Using Collateral

If you struggle to qualify for an unsecured loan, consider a secured personal loan. These loans require collateral (such as a car or savings account), which reduces the lender’s risk. As a result, you might qualify for better rates or higher loan amounts.

OneMain Financial offers both secured and unsecured personal loans. Their secured loans can have lower interest rates, potentially making your $5,000 loan more affordable.

Peer-to-Peer Lending: A Modern Alternative

Peer-to-peer (P2P) lending platforms like Prosper connect borrowers directly with individual lenders. These platforms often use alternative data to assess creditworthiness, which can benefit those with bad credit but strong income or other positive factors.

Prosper offers loans from $2,000 to $40,000 with APRs ranging from 7.95% to 35.99%. While the upper end of this range is high, it still undercuts many payday loans.

When exploring these options, always read the fine print and understand the total cost of the loan before signing. High interest rates can significantly increase your debt over time, so borrow responsibly and create a solid repayment plan.

Now that we’ve explored various lenders who might offer you a $5,000 personal loan with bad credit, let’s look at how you can improve your chances of approval.

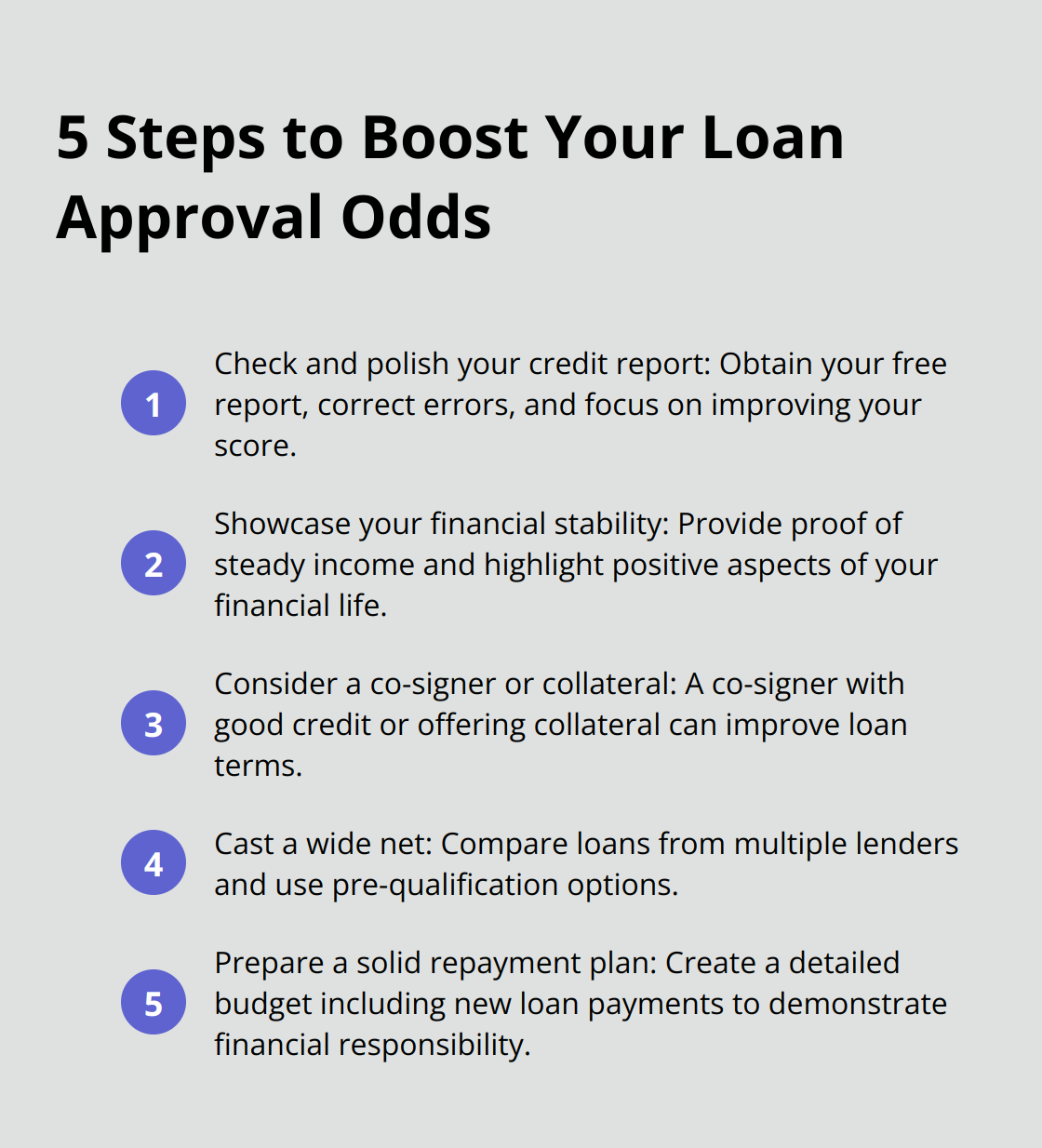

How to Boost Your Loan Approval Odds

Check and Polish Your Credit Report

Start by obtaining your free credit report from Equifax or TransUnion. Scrutinize it for errors. Both Equifax and TransUnion have forms for correcting errors and updating information. Fill out these forms to correct any mistakes and potentially give your score a quick boost.

Next, focus on improving your credit score. Pay all bills on time, reduce credit card balances, and avoid applying for new credit. These actions can have a positive impact on your score within a few months.

Showcase Your Financial Stability

Lenders want assurance that you can repay the loan. Provide solid proof of steady income. This could be recent pay stubs, tax returns, or bank statements. If you’re self-employed, prepare financial statements or contracts showing consistent income.

Some lenders also consider alternative data. For example, they might look at factors like education and employment history. Highlight any positive aspects of your financial life, such as a long-term job or a history of on-time rent payments.

Leverage a Co-Signer or Collateral

A co-signer with good credit can significantly improve your loan terms. They’re essentially lending you their good credit score. However, this is a big ask – your co-signer becomes equally responsible for the debt.

Alternatively, consider offering collateral. A secured loan, backed by assets like a car or savings account, presents less risk to the lender. This can lead to better interest rates and higher approval chances. Just keep in mind, you risk losing the collateral if you default on the loan.

Cast a Wide Net

Don’t settle for the first offer you receive. Compare loans from multiple lenders to find the best terms. Online comparison tools can streamline this process. Look beyond the interest rate – consider factors like fees, repayment terms, and prepayment penalties.

Pre-qualification is your ally here. Many lenders offer this option, allowing you to see potential loan terms without a hard credit check. This lets you shop around without further damaging your credit score (which is especially important when your credit is already less than stellar).

Prepare a Solid Repayment Plan

Before you apply for a loan, create a detailed budget that includes your new loan payments. This demonstrates to lenders that you’ve thought through the financial implications of taking on debt. It also helps you ensure that you can actually afford the loan you’re seeking.

Try to show lenders how you plan to repay the loan. This could involve highlighting upcoming income increases, detailing cost-cutting measures you’re implementing, or explaining how you’ll reallocate existing funds to cover the new expense.

Final Thoughts

Securing a $5,000 personal loan with bad credit presents challenges, but options exist. Online lenders, credit unions, secured loans, and peer-to-peer platforms offer potential solutions. Your best choice depends on your unique financial situation and the terms each lender provides.

Improving your credit report and boosting your score increases approval chances. Providing proof of steady income, finding a co-signer, or offering collateral enhances your loan application. Shop around and compare offers from multiple lenders to find the most favorable terms (this approach beats searching for “bad credit personal loans guaranteed approval $5,000”).

At Financial Canadian, we understand the importance of a strong online presence for businesses. Our web design services can help you create a visually appealing and functional website tailored to your specific needs. A well-designed website attracts more customers and enhances your digital footprint.

Leave a comment