At Financial Canadian, we understand the challenges of rebuilding credit or establishing a credit history. High limit secured credit cards can be a powerful tool in this journey.

These cards offer higher credit limits than traditional secured cards, providing more flexibility and spending power. In this guide, we’ll explore how to obtain a high limit secured credit card and maximize its benefits for your financial future.

What Are High Limit Secured Credit Cards?

Definition and Purpose

Secured credit cards serve as financial tools for individuals who want to build or rebuild their credit. These cards require a cash deposit as collateral, which typically determines the credit limit. High limit secured credit cards elevate this concept by offering higher spending limits, often ranging from $1,000 to $25,000 or more.

Distinguishing Features

The primary distinction between high limit and regular secured cards lies in the credit limit. Standard secured cards might cap at $500 or $1,000, while high limit options can reach much higher. For example, the NIH Federal Credit Union Platinum Secured Card offers limits up to $25,000, matching the security deposit amount.

This increased limit affects more than just spending power. It can substantially impact your credit utilization ratio (a key factor in credit scoring). Credit bureaus prefer lower utilization rates (typically below 30%). With a higher limit, you can maintain a lower utilization rate even with larger purchases, potentially boosting your credit score faster.

Benefits of Higher Limits

High limit secured cards offer several advantages for credit builders:

- Financial Flexibility: You can make larger purchases or cover emergency expenses without maxing out your card, which is essential for maintaining a good credit score.

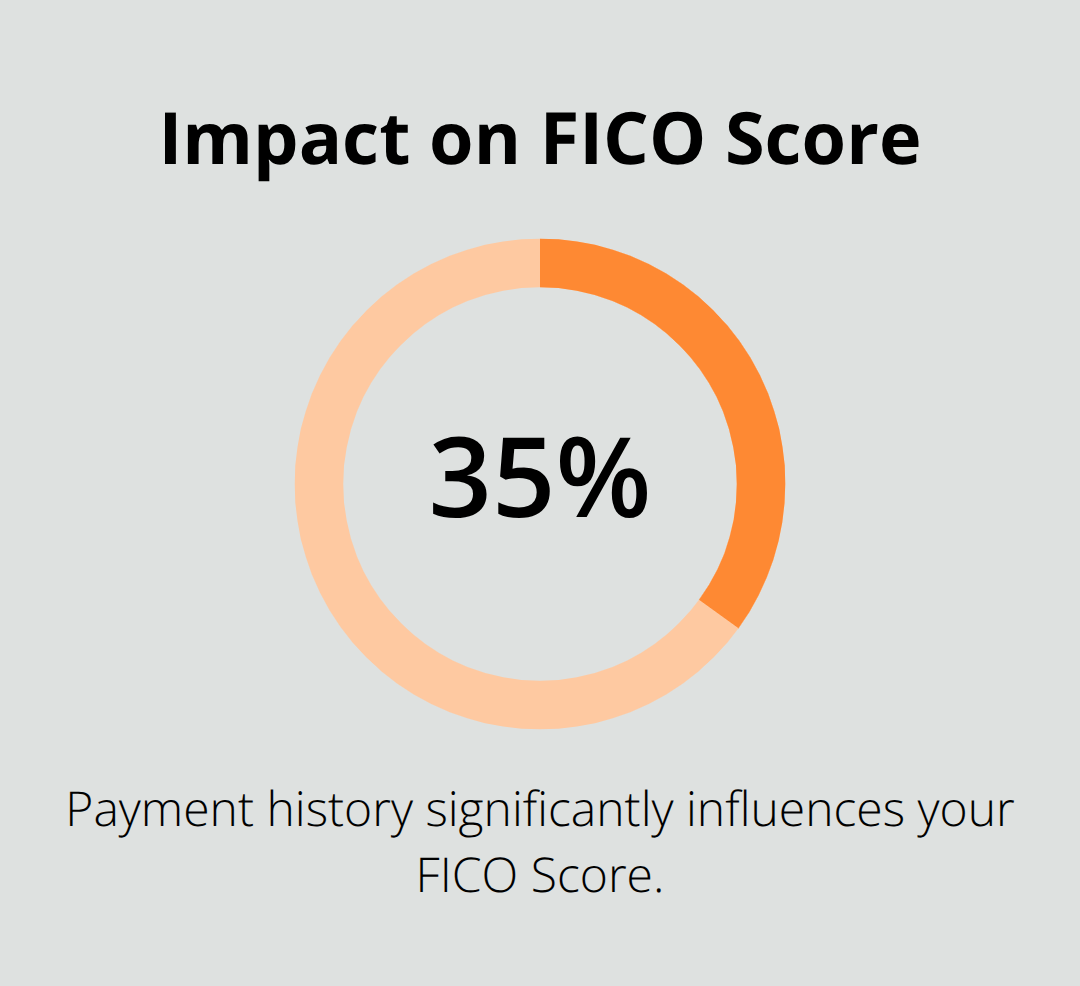

- Accelerated Credit Building: Payment history accounts for 35% of your FICO Score (according to Experian). A higher limit provides more opportunities to demonstrate responsible credit use through regular, on-time payments.

- Additional Perks: Some high limit secured cards come with extra benefits. The First Tech Federal Credit Union Platinum Secured Mastercard (with limits up to $25,000) includes perks like travel insurance and extended warranties on purchases.

Responsible Usage

While these cards offer higher limits, they require responsible use. We advise our readers to treat these cards as tools for financial growth, not as invitations to overspend. The goal is to build credit, not accumulate debt.

As we explore the top high limit secured credit cards available in Canada, you’ll discover how these financial tools can help you achieve your credit-building goals.

Top Secured Credit Cards in Canada

Home Trust Secured Visa Card

The Home Trust Secured Visa Card offers a solid option for credit rebuilding. It provides a credit limit of $500 to $10,000, based on your security deposit. The card comes with an annual fee of $59, but a no-fee version exists with a higher interest rate.

Key features:

- Interest rate: 14.90% (annual fee version) or 19.99% (no-fee version)

- No credit check required

- Reports to both TransUnion and Equifax

This card benefits those who prefer a lower interest rate and don’t mind an annual fee.

Refresh Financial Secured Card

The Refresh Financial Secured Card presents another excellent choice for Canadians aiming to build or rebuild credit. It offers a credit limit between $200 and $10,000, matching your security deposit.

Key features:

- Interest rate: 17.99%

- No credit check required

- Reports to both TransUnion and Equifax

- Monthly fee: $12.95

Despite the monthly fee, this card suits those previously rejected for other secured credit cards due to a low credit score or bankruptcy.

Capital One Guaranteed Secured Mastercard

The Capital One Guaranteed Secured Mastercard stands out for its lower initial deposit requirement. Secured credit cards require a security deposit, which in some cases may be the same as your secured credit card limit.

Key features:

- Interest rate: 19.8%

- Annual fee: $59

- Reports to all three major credit bureaus

This card proves more accessible for those on a tight budget due to its lower initial deposit requirement.

Factors to Consider When Choosing a Secured Credit Card

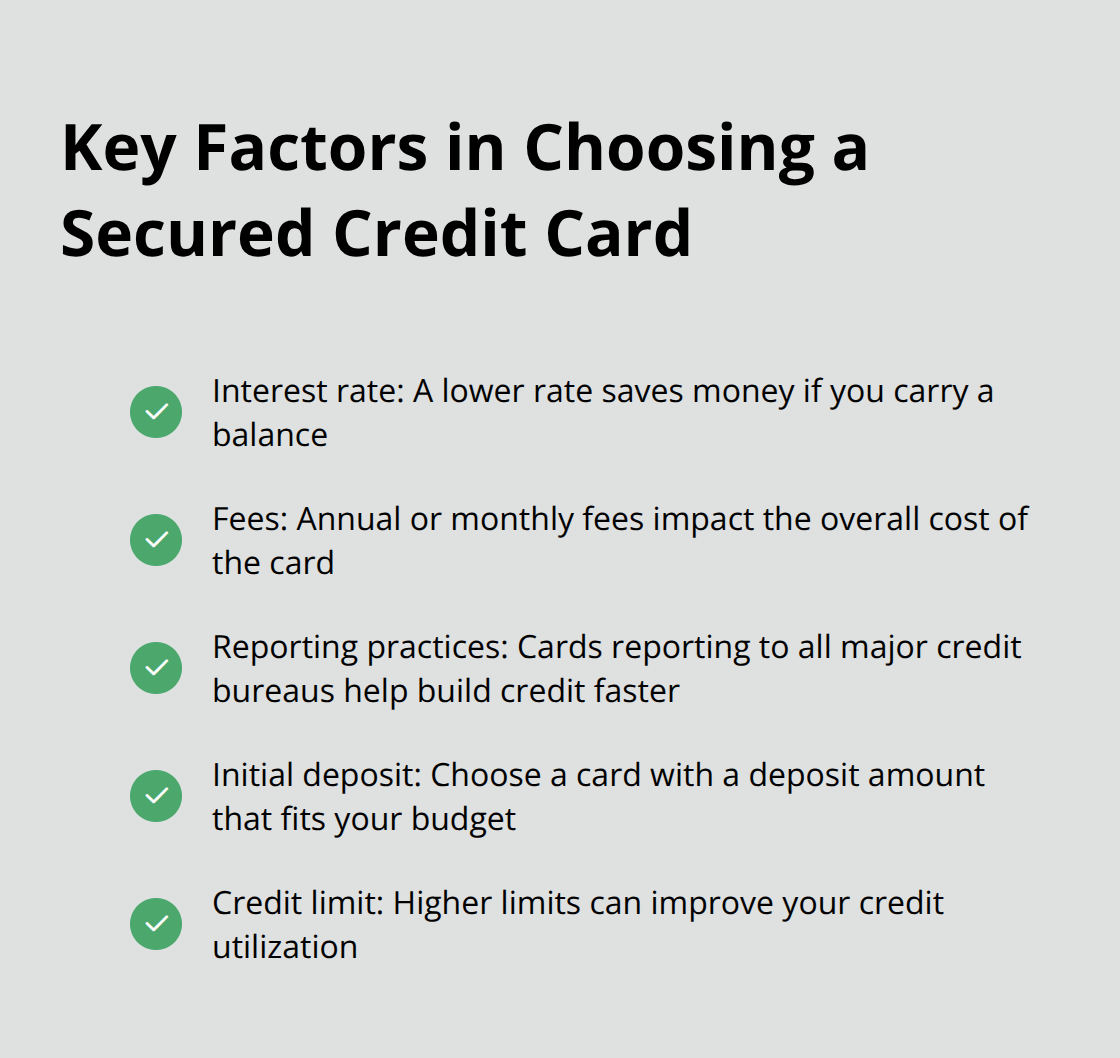

When selecting a secured credit card, consider these key factors:

- Interest rate: A lower rate saves you money if you carry a balance.

- Fees: Annual or monthly fees impact the overall cost of the card.

- Reporting practices: Cards that report to all major credit bureaus (Equifax, TransUnion, and Experian) help build your credit faster.

- Initial deposit: Choose a card with a deposit amount that fits your budget.

- Credit limit: Higher limits can improve your credit utilization, potentially boosting your credit score.

The right secured credit card can significantly impact your credit-building journey. In the next section, we’ll explore the steps to obtain a high-limit secured credit card and maximize its benefits for your financial future.

How to Apply for a High Limit Secured Credit Card

Assess Your Financial Situation

Check your credit score and report. You can obtain a free credit report annually from Equifax and TransUnion in Canada. Review it for errors and dispute any inaccuracies. Your current credit score will help you understand which cards you might qualify for and what deposit amount you’ll need.

Determine how much you can afford to deposit. With most secured cards, your credit limit will match your deposit. For a high limit card, you’ll need a substantial deposit. For example, if you want a $5,000 limit, you should have $5,000 ready to deposit.

Research and Compare Options

Explore your options. Look for cards that offer the highest limits and best terms. The Capital One Platinum Secured Credit Card, for instance, allows you to get a limit of $200 with a lower deposit.

Compare interest rates, annual fees, and additional perks. Some cards, like the Home Trust Secured Visa, offer a choice between a lower interest rate with an annual fee or a higher rate with no fee. Choose based on how you plan to use the card.

Prepare Your Application

Gather all necessary documentation before applying. This typically includes:

- Proof of identity (government-issued ID)

- Proof of address (utility bill or bank statement)

- Proof of income (pay stubs or tax returns)

- Social Insurance Number

Having these documents ready can speed up the application process and increase your chances of approval.

Submit Your Application

Most card issuers allow online applications, making the process quick and convenient. Fill out the application form carefully, double-check all information for accuracy. Any errors could delay your application or lead to a denial.

After submitting, prepare to wait. Processing times vary, but you should hear back within 7-10 business days. If approved, you’ll need to make your security deposit before receiving your card.

Maximize Your Chances of Approval

To increase your odds of getting approved for a high limit secured credit card, consider these strategies:

- Apply for a card from your current bank. Existing relationships can work in your favor.

- Demonstrate stable income. A steady job or consistent income stream reassures issuers of your ability to make payments.

- Offer a larger deposit. If possible, prepare to put down more than the minimum required deposit. This shows financial responsibility and may lead to a higher initial credit limit.

- Explain past credit issues. If you have a low credit score due to past problems, include a brief explanation with your application. Focus on how you’ve addressed these issues and your plan for responsible credit use moving forward.

Final Thoughts

High limit secured credit cards provide a powerful tool for credit building. These cards offer higher credit limits, which can positively impact credit utilization ratios and credit scores. Users can access limits up to $25,000, granting more financial flexibility and spending power than traditional secured cards.

Responsible use of high limit secured credit cards will maximize their benefits. Users should make timely payments, keep balances low, and avoid overspending. Consistent and responsible use can lead to substantial improvements in credit scores, potentially opening doors to unsecured credit cards with better terms and rewards.

We at Financial Canadian understand the importance of building a strong online presence. Our web design services can help businesses establish a robust digital footprint (much like how a high limit secured credit card helps build credit). We offer visually stunning, highly functional websites tailored to specific business needs, ensuring your online presence aligns with your financial goals.

Leave a comment