At Financial Canadian, we understand the challenges of securing a personal loan with a 640 credit score. This fair credit rating can make borrowing more complex, but it doesn’t mean you’re out of options.

In this guide, we’ll explore how to get a personal loan with a 640 credit score and provide practical strategies to improve your chances of approval. We’ll also discuss various lenders who specialize in fair credit loans, helping you find the best financial solution for your needs.

What Does a 640 Credit Score Mean for You?

Understanding the Basics of a 640 Credit Score

A 640 credit score places you in the “fair” credit category, which affects your loan eligibility and interest rates. Your credit score, a numerical representation of creditworthiness, ranges from 300 to 850. A 640 score falls within the fair credit range (typically between 580 and 669). This score indicates to lenders that you’ve faced some credit challenges but generally manage your finances responsibly.

Key Factors That Influence Your Credit Score

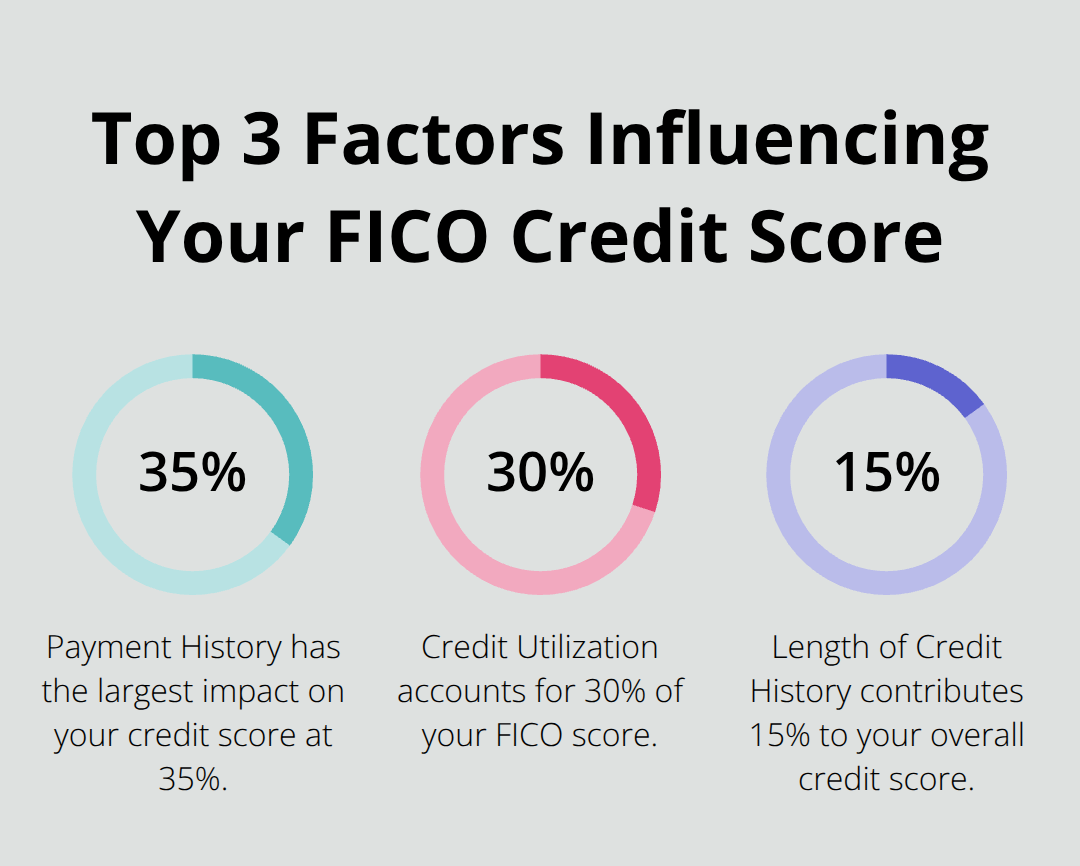

Several elements contribute to your 640 credit score:

- Payment History (35% of FICO score): Late payments, especially within the last two years, significantly impact your score.

- Credit Utilization (30%): This ratio compares your credit use to your credit limits. Try to keep utilization below 30% to improve your score over time.

- Length of Credit History (15%)

- Types of Credit Accounts (10%)

- Recent Credit Inquiries (10%)

Focus on these areas to improve your credit standing.

Lender Perspectives on a 640 Credit Score

When you apply for a personal loan with a 640 credit score, lenders view you as a moderate risk. This perception impacts both your approval odds and offered terms.

Many traditional banks and credit unions hesitate to approve loans for scores below 660. However, online lenders often have more flexible criteria.

Personal loan rates for borrowers with excellent credit can start as low as 6.49 percent. However, with a fair credit score, you can expect higher rates. Interest rates for a 640 credit score typically range higher than those offered to borrowers with excellent credit.

Borrowers with 640 credit scores often find success with online lenders specializing in fair credit loans. These lenders understand that credit scores don’t tell the whole story and may consider other factors when evaluating your application.

A 640 credit score may limit some options, but it doesn’t close all doors. Your understanding of how lenders view your score empowers you to make informed decisions. Now, let’s explore the various personal loan options available for individuals with a 640 credit score.

Where Can You Get a Personal Loan with a 640 Credit Score?

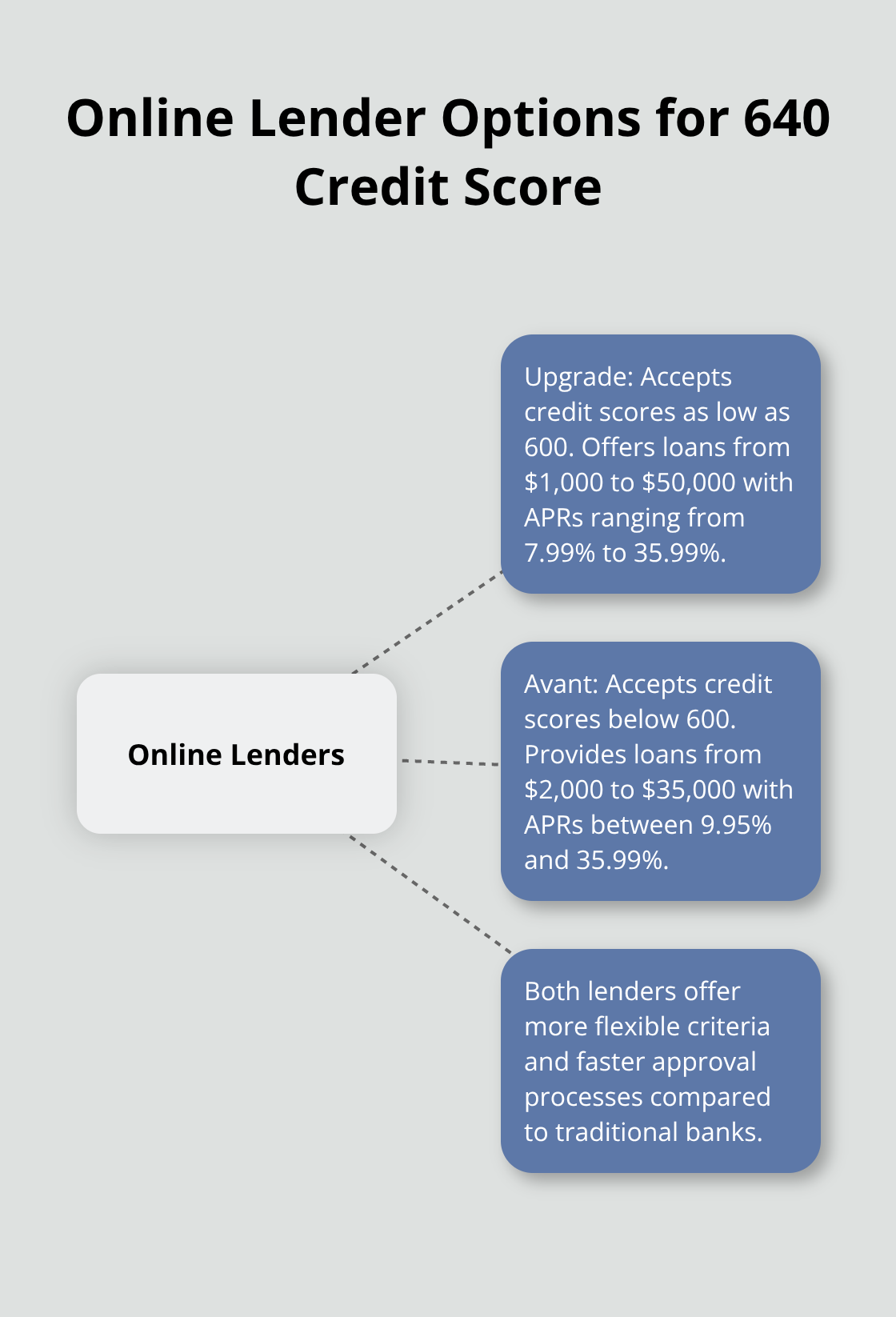

Online Lenders: Your Primary Option

Online lenders offer the most accessible path for those with fair credit. Many specialize in loans for borrowers with credit scores in the 600s. Upgrade, for instance, provides personal loans to applicants with credit scores as low as 600. Their APRs range from 7.99% to 35.99%, with loan amounts from $1,000 to $50,000.

Avant accepts credit scores below 600 and offers loans from $2,000 to $35,000 with APRs between 9.95% and 35.99%. These lenders typically have more flexible criteria and faster approval processes than traditional banks.

Credit Unions: A Community-Focused Alternative

Credit unions can serve as a good option if you’re a member or eligible to join. They often have more lenient requirements than big banks and may offer lower interest rates. Some credit unions offer personal loans with APRs starting around 8% for those with fair credit.

Credit union membership often requires living in a specific area or working for a particular employer. You’ll need to research local credit unions to find one that fits your situation.

Peer-to-Peer Lending: A Modern Approach

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. This can sometimes result in more favorable terms for those with fair credit. Prosper (a popular P2P platform) accepts borrowers with credit scores as low as 640. They offer loans from $2,000 to $40,000 with APRs ranging from 7.95% to 35.99%.

While P2P lending can provide a good option, the application process can take longer than with traditional lenders, and funding isn’t guaranteed.

Secured Personal Loans: A Last Resort

If you struggle to get approved for an unsecured loan, a secured personal loan might serve as an option. These loans require collateral (such as a car or savings account), which reduces the lender’s risk. As a result, you might qualify for lower interest rates.

However, we caution against this option unless absolutely necessary. If you default on a secured loan, you risk losing your collateral. Only consider this option if you’re confident in your ability to repay the loan.

Regardless of which option you choose, always compare offers from multiple lenders. This will help you find the best rates and terms for your situation. Also, watch out for predatory lenders offering “guaranteed approval” or extremely high interest rates. If an offer seems too good to be true, it probably is.

Now that you understand your options for obtaining a personal loan with a 640 credit score, let’s explore how you can improve your chances of approval.

How to Boost Your Loan Approval Odds

Review and Correct Your Credit Report

Start by obtaining your free credit report from Equifax and TransUnion. Check every detail for errors. A 2012 Federal Trade Commission study found that 1 in 5 consumers had an error on at least one of their credit reports. These errors can significantly impact your credit score.

If you spot inaccuracies, dispute them with the credit bureaus immediately. Provide supporting documentation to back up your claim. The credit bureaus must investigate and respond to your dispute within 30 days. Removing negative errors can give your credit score a quick boost (potentially improving your loan terms).

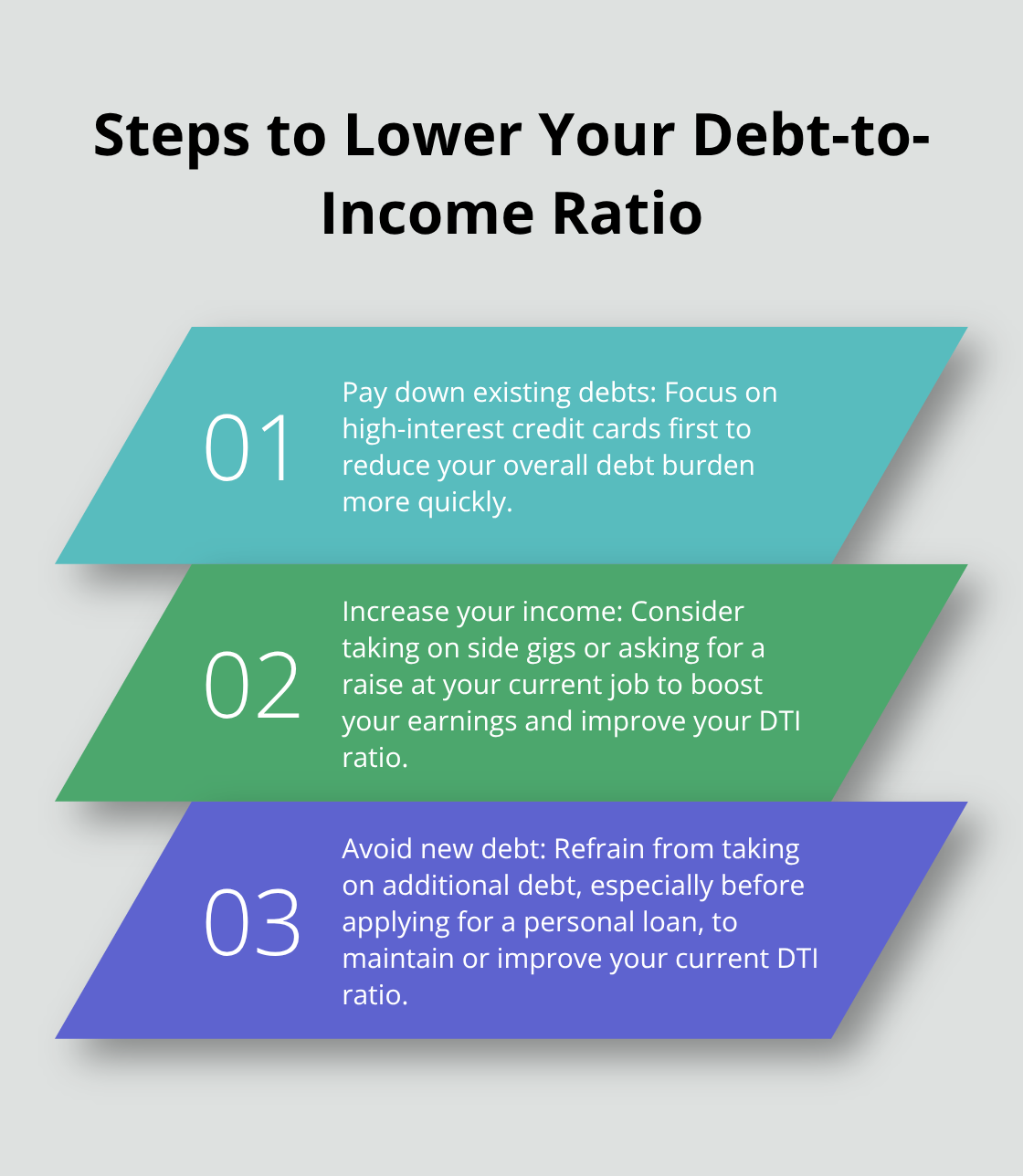

Lower Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor lenders consider. To calculate your estimated DTI ratio, simply enter your current income and payments. Most lenders prefer a DTI below 36% (with some accepting up to 50%).

To lower your DTI:

Add a Co-signer or Submit a Joint Application

Adding a co-signer with a stronger credit profile can significantly improve your loan approval odds and potentially secure better rates. However, this strategy comes with risks for the co-signer, as they become equally responsible for the loan.

Alternatively, some lenders allow joint applications. This differs from co-signing as both parties have access to the loan funds. It’s an option worth exploring if you have a trusted partner or family member willing to apply with you.

Consider Secured Loan Options (With Caution)

Some lenders offer secured personal loans that use your car, savings account, or other assets as collateral. These loans typically have lower interest rates and more lenient credit requirements.

However, proceed with extreme caution. Only consider this option if you’re confident in your ability to repay the loan and understand the risks involved. The potential loss of your collateral makes this a last resort for those struggling to get approved.

Final Thoughts

You can obtain a 640 credit score personal loan through various lenders, but it requires careful research and comparison. Interest rates and terms differ significantly between lenders, so take the time to obtain quotes from multiple sources. This approach increases your chances of finding favorable terms and provides a clear picture of expected rates with your current credit profile.

Securing a loan with a 640 credit score presents challenges, but it’s not impossible. The strategies we outlined can help you improve your creditworthiness and access better loan options in the future. Consistent on-time payments, debt reduction, and maintaining a low credit utilization ratio will boost your credit score over time.

We at Financial Canadian understand the importance of a strong online presence for businesses. Our web design services can help create a professional and engaging website tailored to your specific needs. A well-designed website attracts potential customers and showcases your products or services effectively (enhancing your business’s visibility and credibility).

Leave a comment