At Financial Canadian, we understand that getting a personal loan with no credit check can be tempting for those with poor credit or no credit history. However, these loans often come with significant risks and high interest rates.

In this post, we’ll explore the various types of no-credit-check personal loans available, their pros and cons, and some alternatives you might want to consider. Our goal is to help you make an informed decision about your borrowing options.

What Are No Credit Check Personal Loans?

Definition and Process

No credit check personal loans are financial products that don’t require a traditional credit check for approval. These loans target individuals with poor credit or no credit history. The application process differs from traditional loans, as lenders skip the hard inquiry on your credit report. Instead, they assess other factors like income, employment history, and bank account details. This approach often results in a faster application process.

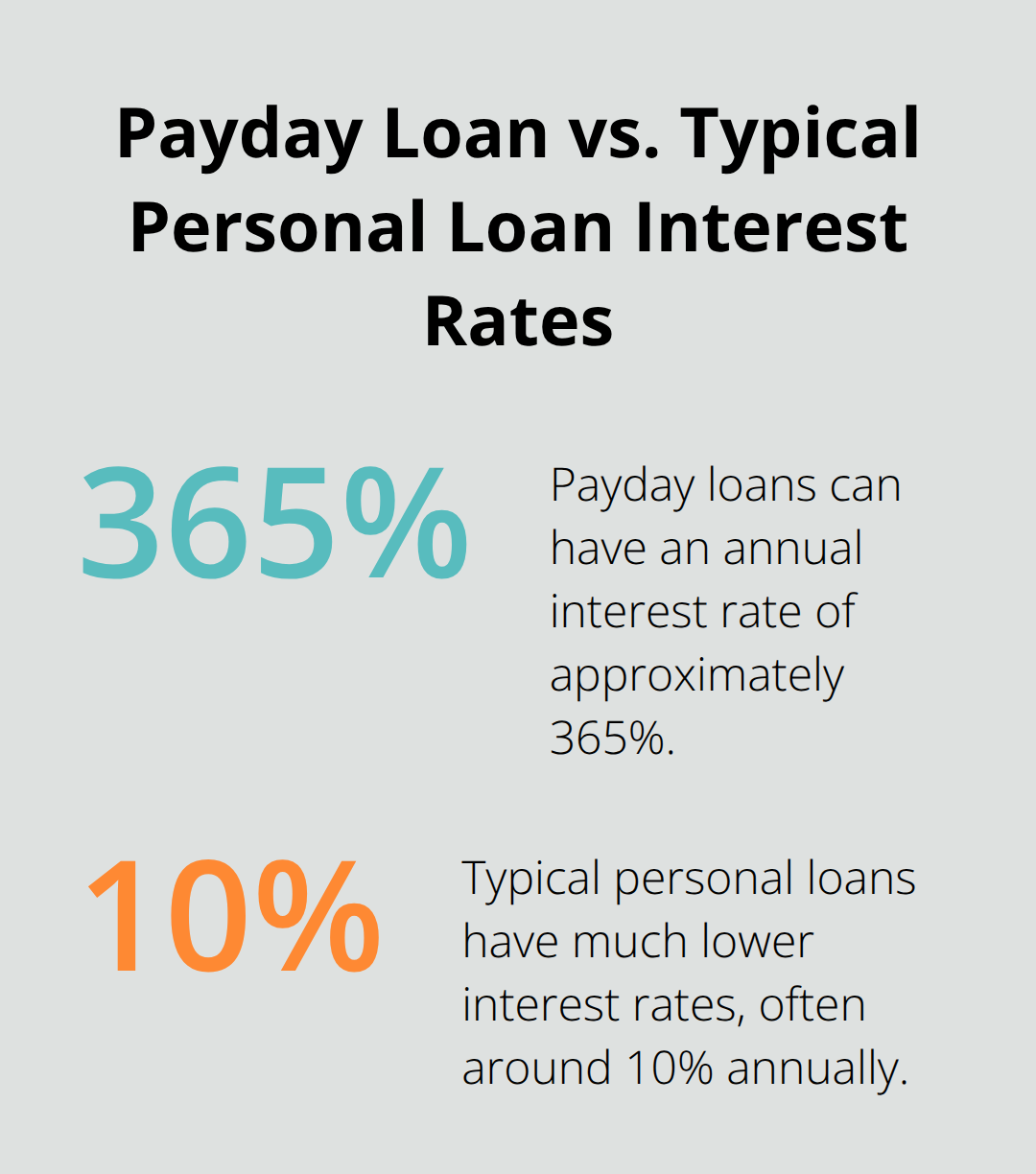

The Price of Convenience

The convenience of no credit check loans comes at a steep price. Payday loans (a common type of no credit check loan) can have annual interest rates of approximately 365%. This high cost can quickly accumulate, making it difficult for borrowers to repay the loan.

Weighing Benefits and Risks

While these loans provide quick cash in emergencies, the risks often outweigh the benefits. Many lenders create a debt trap with short repayment terms and high fees for late payments or rollovers. The average payday loan borrower is in debt for five months of the year, spending an average of $520 in fees to repeatedly borrow $375.

Impact on Credit Building

It’s important to note that no credit check loans won’t help you build credit. Most of these lenders don’t report to credit bureaus, so even if you make timely payments, your credit score won’t improve. This situation can leave you reliant on high-interest loans in the future.

Alternatives to Consider

Before you opt for a no credit check loan, try to explore alternatives. Credit union loans or secured credit cards often offer more favorable terms and can help you build credit over time. These options might require more effort upfront but can lead to better financial outcomes in the long run.

As we move forward, let’s examine the various types of no credit check personal loans available in the market, each with its own set of characteristics and potential pitfalls.

Types of No Credit Check Loans

No credit check loans come in various forms, each with its own set of characteristics and potential risks. Understanding these options is essential before making any financial decisions.

Payday Loans: High-Cost Short-Term Options

Payday loans are perhaps the most well-known type of no credit check loan. These short-term loans typically range from $100 to $1,500 and are due on your next payday. As of January 1, 2025, Canada capped payday loan costs at $14 per $100 borrowed and lowered the criminal interest rate from 48% annual.

Car Title Loans: Your Vehicle at Risk

Car title loans use your vehicle as collateral. While they may offer larger loan amounts than payday loans, they come with significant risks. If you fail to repay the loan, you could lose your car. The Consumer Financial Protection Bureau reports that 1 in 5 car title loan borrowers have their vehicle seized for failing to repay their loan.

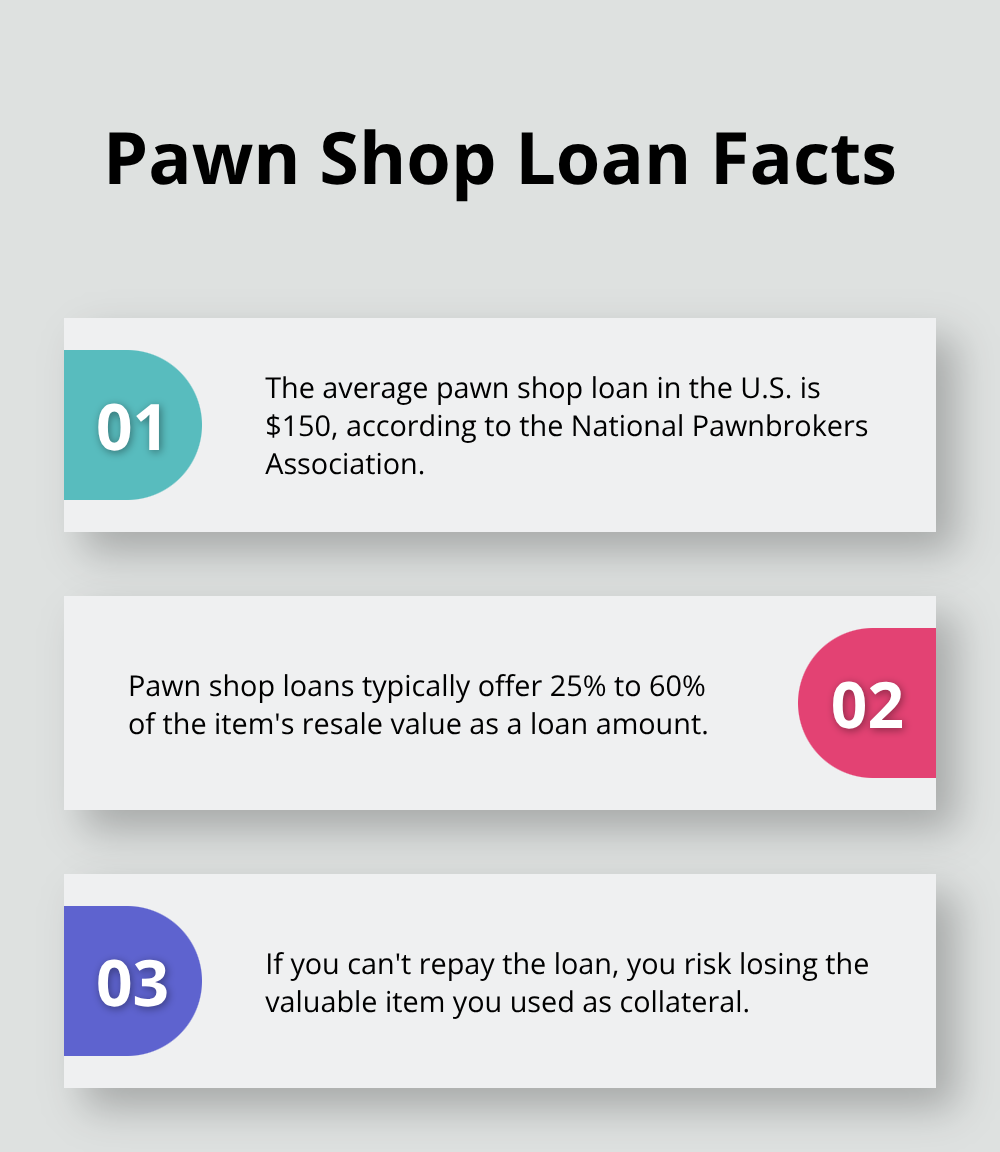

Pawn Shop Loans: Quick Cash for Valuables

Pawn shop loans involve leaving a valuable item as collateral in exchange for a loan. These loans typically offer 25% to 60% of the item’s resale value. You risk losing your item if you can’t repay the loan. The National Pawnbrokers Association states that the average pawn shop loan in the U.S. is $150.

Secured Credit Cards: A Credit Building Path

Secured credit cards require a cash deposit that typically becomes your credit limit. While not technically a loan, they can serve as a useful alternative for those with poor credit. The deposit reduces the lender’s risk, often resulting in easier approval and lower fees compared to unsecured cards for bad credit.

Credit-Builder Loans: Save and Build Credit

Credit-builder loans work differently from traditional loans. Credit-building products are secured small-dollar products that allow consumers to either establish or improve their credit scores. These loans are reported to credit bureaus, helping you build credit over time.

While these options might seem appealing in a financial pinch, it’s important to consider their high costs and potential risks. Exploring alternatives like credit union loans or secured personal loans (which often offer more favorable terms) can be a wiser choice. In the next section, we’ll examine these alternatives in more detail to help you make an informed decision about your borrowing options.

Smarter Borrowing Options

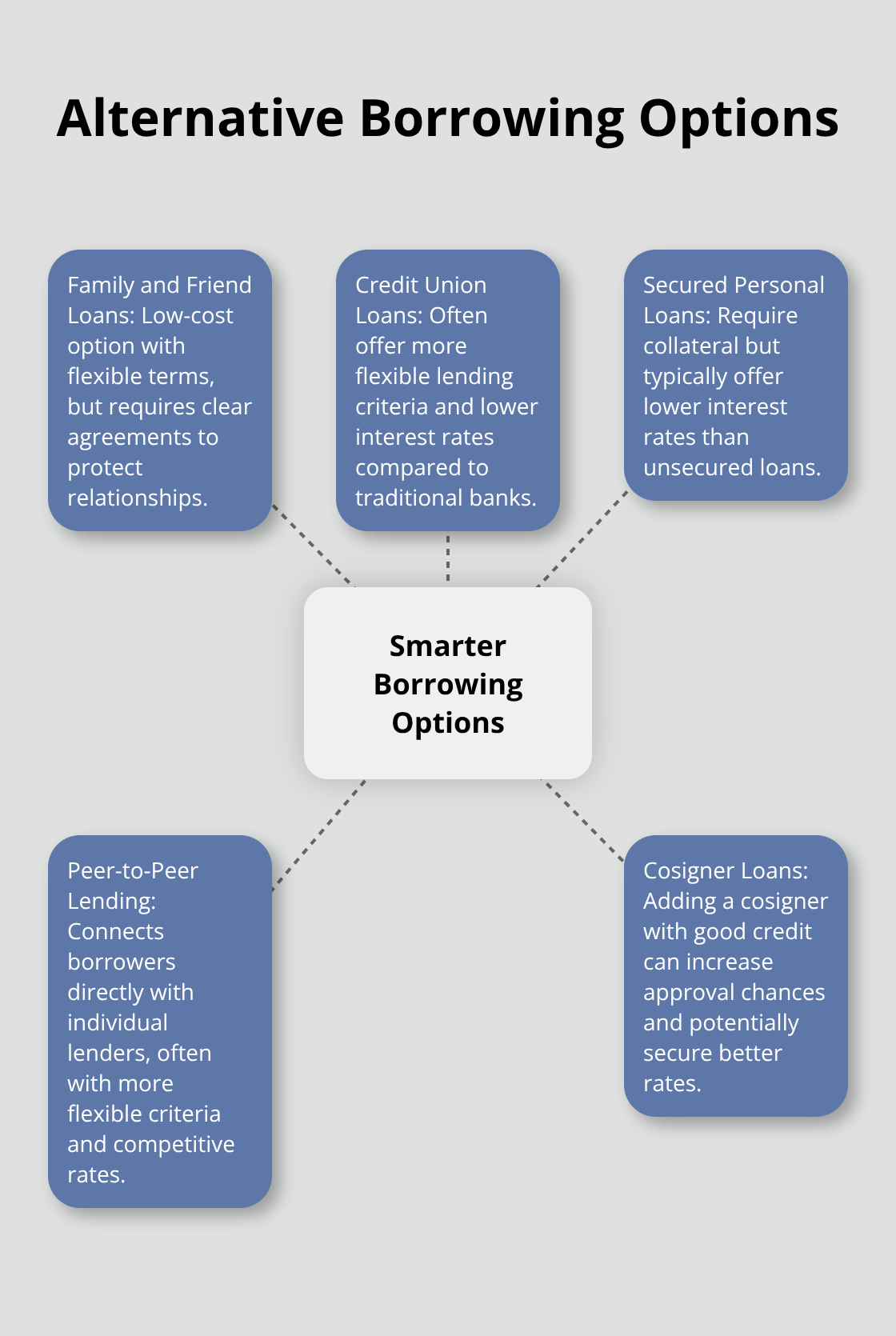

At Financial Canadian, we recommend exploring alternative borrowing options that offer more favorable terms and potentially help build your credit. These choices could save you money and reduce stress in the long run.

Family and Friend Loans

Borrowing from family or friends can provide a low-cost alternative to high-interest loans. We suggest drafting a simple loan agreement that outlines the loan amount, interest rate (if any), and repayment terms. This approach prevents misunderstandings and protects relationships.

Credit Union Advantages

Credit unions often offer more flexible lending criteria and lower interest rates compared to traditional banks. The Bank of Canada provides data on interest rates for new and existing loans in Canadian dollars, which can help you compare options between credit unions and banks.

Secured Personal Loans

Secured personal loans require collateral but typically offer lower interest rates than unsecured loans. Common forms of collateral include vehicles, savings accounts, or other valuable assets. While this option carries the risk of losing your collateral if you default, it can provide a viable choice for those with poor credit.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms connect borrowers directly with individual lenders. In Canada, platforms like goPeer and Lending Loop offer this service. These platforms often have more flexible lending criteria and competitive interest rates. Some platforms specialize in loans for borrowers with less-than-perfect credit, providing an alternative to traditional lending institutions.

Cosigner Loans

Adding a cosigner with good credit to your loan application can increase your chances of approval and potentially secure better interest rates. This option works well if you have a trusted friend or family member with a strong credit history willing to cosign. However, both parties should understand the responsibilities and risks involved in cosigning a loan.

Final Thoughts

Personal loans with no credit check offer quick cash but come with significant risks. High interest rates and short repayment terms can lead to financial instability. We recommend exploring alternatives such as credit union loans, secured personal loans, or peer-to-peer lending platforms. These options often provide better terms and can help improve your credit score over time.

At Financial Canadian, we prioritize informed financial decisions. We understand the temptation of no-credit-check loans but urge caution. Take time to evaluate all borrowing options and choose one that aligns with your long-term financial goals. Your future financial health depends on the choices you make today.

We strive to provide comprehensive resources for your financial journey. If you need to establish a strong online presence for your business, our web design services can create a tailored, visually appealing website. We aim to support your financial and business growth in every way possible.

Leave a comment