Building credit from scratch feels impossible when every application gets rejected. Traditional credit cards require established credit history, creating a frustrating catch-22 for newcomers.

A no credit check secured credit card breaks this cycle. At Financial Canadian, we’ve seen how these cards help thousands of Canadians establish their first credit history without the stress of approval uncertainty.

How Do Secured Cards Work Without Credit Checks

The Security Deposit Replaces Credit History

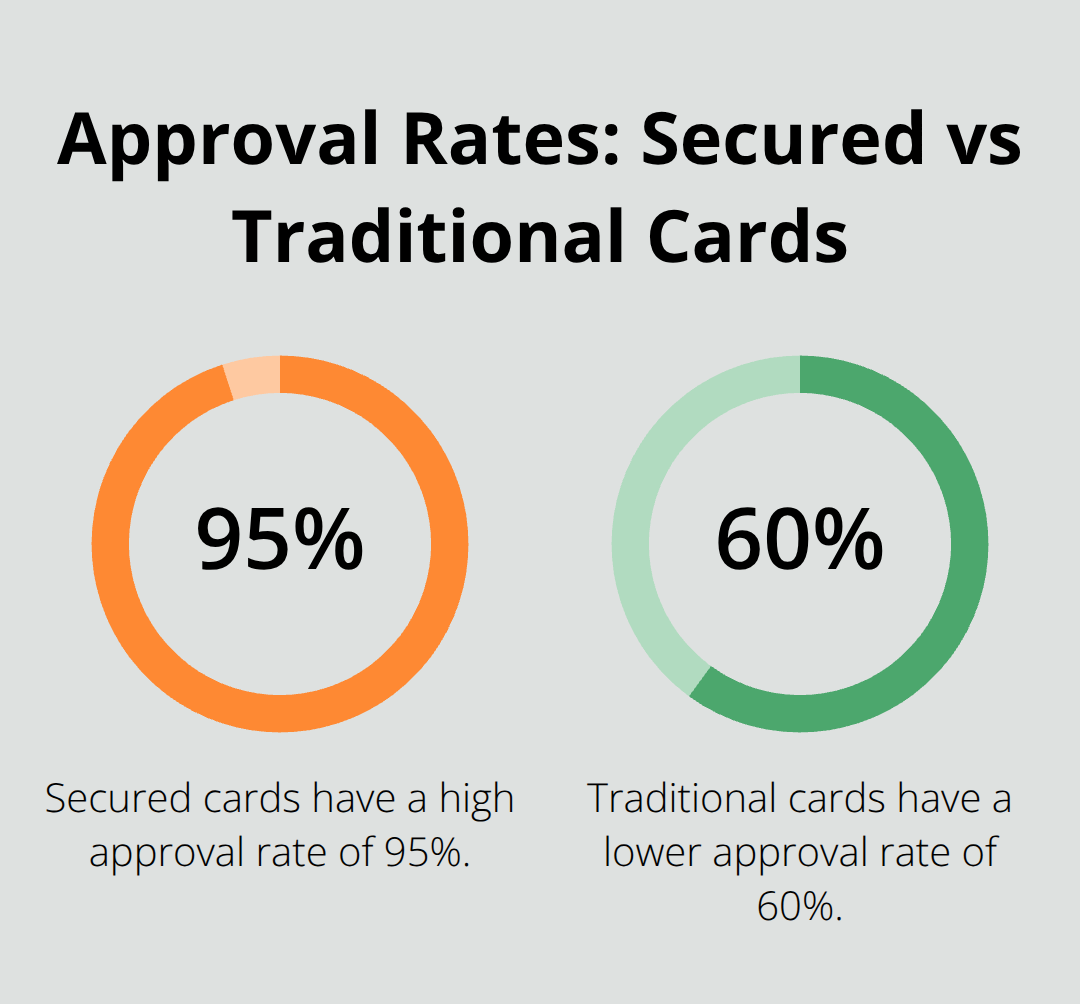

Secured credit cards flip traditional lending upside down. Banks no longer evaluate your credit history when you provide cash upfront as collateral. This deposit typically ranges from $200 to $5,000 and becomes your credit limit. The bank holds your money in a separate account, which reduces their risk to zero. When you make purchases, you essentially borrow against your own funds. This explains why approval rates exceed 95% for secured cards compared to just 60% for traditional cards (according to Experian data).

Banks Skip Credit Checks Because Risk Disappears

Financial institutions offer no credit check secured cards because your deposit eliminates their financial exposure. Traditional credit cards require extensive underwriting because banks lend unsecured money. With secured cards, your cash deposit covers any potential losses, which makes credit history irrelevant. Major Canadian banks like RBC and TD now offer these products specifically to capture customers they previously couldn’t serve. The monthly reporting to Equifax, TransUnion, and Experian remains identical to regular cards, so your credit building potential stays completely intact.

Converting Deposits Into Credit History

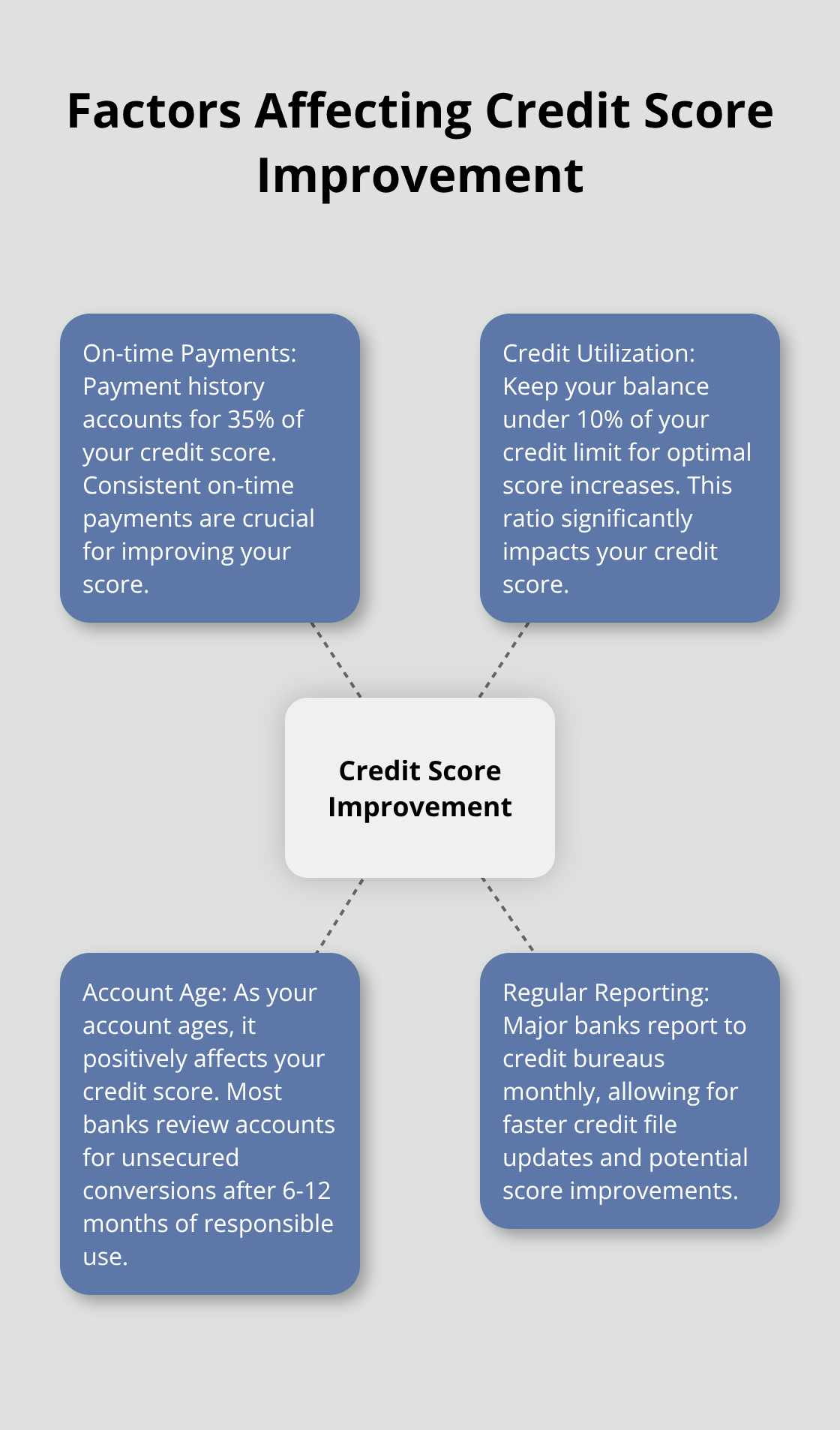

The genius of secured cards lies in their reporting structure. Your payment history, credit utilization, and account age get reported exactly like traditional cards. Most issuers review accounts after 6-12 months of responsible use and offer unsecured conversions. They return your deposit while maintaining the credit line during this process. Secured cardholders often qualify for unsecured products after demonstrating responsible payment behavior.

What Happens During the Application Process

The application process for no credit check secured cards takes minutes rather than weeks. You provide basic personal information, verify your identity, and submit your deposit amount. Banks focus on your ability to fund the deposit rather than your credit score or payment history. Most applications receive instant approval, and cards arrive within 7-10 business days. This streamlined process makes secured cards the fastest path to active credit building for Canadians with limited credit history.

Now that you understand how these cards operate without traditional credit requirements, let’s explore where to find the best options available to Canadian consumers.

Where Can You Find No Credit Check Secured Cards

Major Canadian Financial Institutions Lead the Market

RBC offers the RBC Secured Visa with no annual fee and requires a minimum $500 deposit that becomes your credit limit. TD provides the TD Secured Credit Card with similar terms but includes purchase protection benefits. Scotiabank’s secured option requires just $500 minimum deposit and reports to all three credit bureaus monthly. Capital One Canada stands out with their Guaranteed Mastercard, which accepts deposits from $75 to $500 for newcomers to Canada. These major banks dominate the secured card market because they maintain established credit bureau relationships and can offer immediate report capabilities that smaller institutions often lack.

Credit Unions Provide Competitive Alternatives

Vancity Credit Union provides secured cards with $300 minimum deposits and lower interest rates than major banks. Coast Capital Savings offers secured Visa cards with no process fees and flexible deposit amounts that start at $500. Local credit unions typically charge 18.99% APR compared to 22.99% at major banks, which saves cardholders approximately $40 annually on a $1,000 balance. Credit unions also process applications faster and often provide same-day approval for members with accounts.

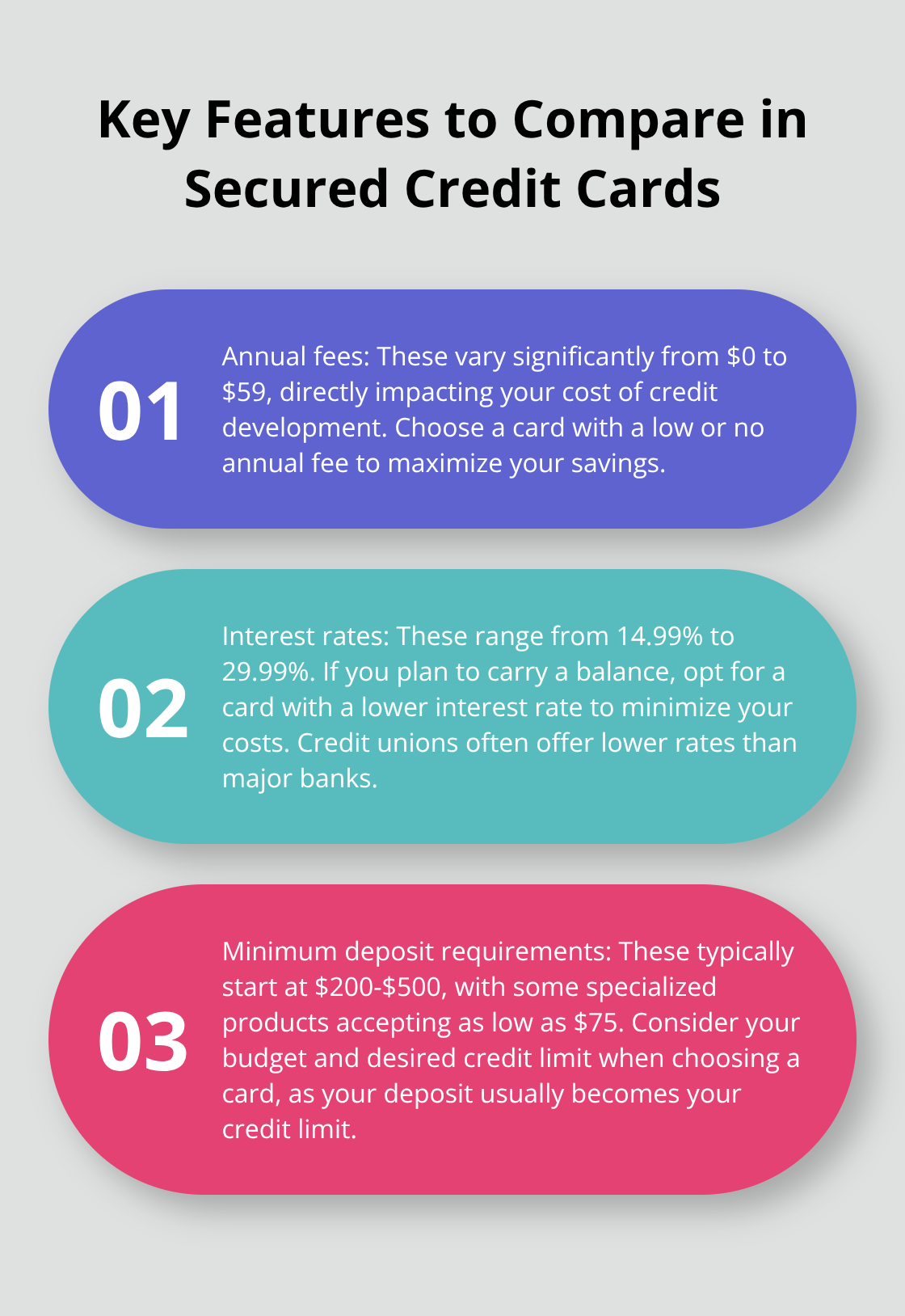

Compare These Essential Features Before You Apply

Annual fees vary dramatically from $0 at RBC to $59 at some smaller issuers, which directly impacts your cost of credit development. Interest rates range from 14.99% to 29.99% (this comparison becomes vital if you plan to carry balances). Deposit requirements start at $75 for specialized newcomer products but typically require $200-$500 for standard secured cards. Report frequency matters significantly because monthly reports build credit faster than quarterly updates. Upgrade timelines differ substantially, with some banks that review accounts after six months while others require 12-24 months of payment history before they consider unsecured conversions.

Once you secure your card, the real work of credit development begins through strategic use and responsible management practices. If you need additional funding options while building credit, consider exploring personal loans without credit checks as an alternative financial solution.

How Fast Does Your Credit Score Improve

Credit Bureau Reports Arrive Within 30 Days

Your secured card builds credit immediately after your first statement closes. Major Canadian banks report to Equifax, TransUnion, and Experian within 30 days of account opening, which means your credit file shows active credit history faster than most people expect. RBC and TD report monthly on the same date each month, while smaller credit unions may report every 45 days. Payment history accounts for 35% of your credit score according to Equifax, which makes on-time payments the single most powerful factor in score improvement. Late payments appear on your credit report within 30 days and can drop your score by 60-110 points, so automated payments become essential for secured cardholders.

Keep Utilization Below 10% for Maximum Score Growth

Credit utilization below 30% represents standard advice, but secured cardholders need stricter discipline. Keep your balance under 10% of your credit limit for optimal score increases. A $500 secured card should carry maximum balances of $50, while a $1,000 limit allows $100 maximum usage. Your credit utilization ratio is a percentage of how much credit you’re using compared to your total credit limit and represents an important credit score factor. Pay your balance before the statement closes rather than wait for the due date, because reported balances determine your utilization ratio.

Expect 40-80 Point Score Increases Within Six Months

Secured cardholders with zero credit history typically see 40-60 point score increases within three months and 60-80 points after six months of responsible use. Existing credit files with damaged history show slower progress and average 20-40 points over the same timeframe. Your score updates monthly when new information reports to credit bureaus, so check your Equifax or TransUnion score on the same date each month to track progress. Most banks review secured accounts for unsecured conversions after 6-12 months and require scores above 650 plus perfect payment history during the review period.

Final Thoughts

No credit check secured credit cards provide the most reliable path to establish credit history in Canada. These cards eliminate approval uncertainty while they build legitimate credit through monthly reports to all three major bureaus. Your deposit protects the bank while your responsible usage creates the payment history that drives score improvements.

The timeline for credit development remains consistent across all secured card products. Expect meaningful score increases within three to six months of responsible use, with most cardholders who qualify for unsecured products after 12 months of perfect payment history. Keep utilization below 10% and automate payments to maximize your credit potential.

Consider upgrades to unsecured cards once your score exceeds 650 and you have established six months of payment history (most major banks offer automatic conversions that return your deposit while they maintain your credit line). This transition marks your graduation from credit development to credit optimization. At Financial Canadian, we help businesses establish strong digital footprints through comprehensive web design services that drive growth and visibility.

Leave a comment