At Financial Canadian, we understand that emergencies can strike when you least expect them.

Tax refund cash advance emergency loans in 2025 offer a potential lifeline for those facing urgent financial needs.

This guide will walk you through the process of obtaining a tax refund cash advance, explore its pros and cons, and highlight alternative options for quick cash.

What Are Tax Refund Cash Advances?

Definition and Basic Concept

Tax refund advance loans are short-term loans that are repaid through your upcoming IRS tax refund. These loans are usually offered from December through February by tax preparation companies and some financial institutions.

How Tax Refund Cash Advances Function

When you apply for a tax refund cash advance, the lender estimates your refund based on your tax return. They then offer you a loan for a portion of that amount. The IRS uses your actual refund to repay the loan once they process your return.

In 2025, many lenders offer advances up to $6,000. This can significantly help if you face unexpected expenses. However, it’s important to understand that you borrow against money the government already owes you.

Eligibility Requirements

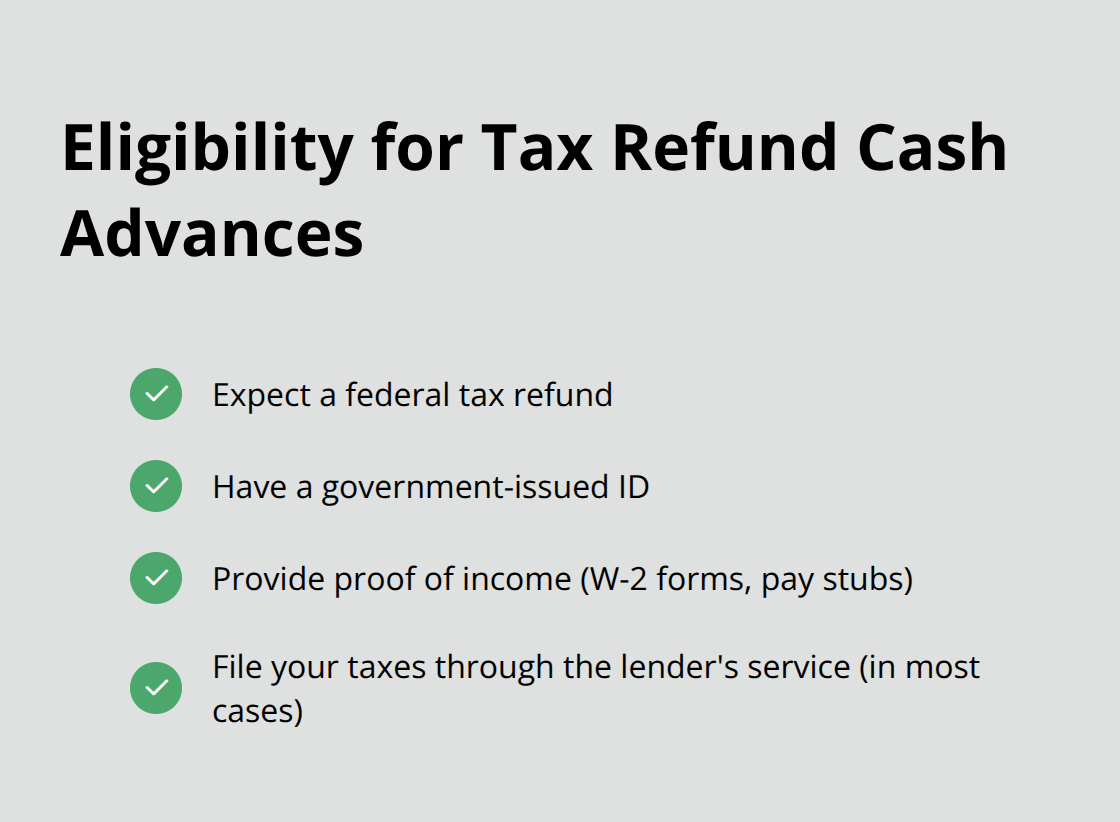

To qualify for a tax refund cash advance, you typically need to meet these criteria:

The application process is usually quick. Many lenders offer same-day approval and funding. However, this convenience often comes at a cost.

The Hidden Costs of Tax Refund Advances

While some lenders advertise “no-fee” or “zero-interest” advances, hidden costs often exist. You might need to pay for tax preparation services, which can range from $50 to $500 (depending on the complexity of your return).

Moreover, if your refund is less than expected or delayed, you could end up owing money to the lender.

Comparing Offers and Understanding Terms

It’s essential to review all terms and conditions before signing up for any financial product. If you consider a tax refund cash advance, compare offers from multiple lenders to find the best deal. Try to understand all associated costs and potential risks.

While tax refund cash advances can provide quick access to funds, they come with potential drawbacks. In the next section, we’ll explore the steps to obtain a tax refund cash advance and provide tips to navigate the process effectively.

How to Secure a Tax Refund Cash Advance

Prepare Your Documentation

Start by collecting all necessary documents. You’ll need:

- Government-issued ID

- Social Security number

- Proof of income (W-2 forms from employers, 1099 forms for freelance work)

- Profit and loss statements (for self-employed individuals)

- Receipts for deductible expenses (charitable donations, medical expenses, business-related purchases)

The more thorough your documentation, the more accurate your refund estimate will be.

Select a Reputable Provider

Choose the right tax preparation service. Look for providers with a strong track record and positive customer reviews. H&R Block, TurboTax, and Jackson Hewitt are well-known options (but don’t overlook smaller, local tax preparers who might offer more personalized service).

Compare fees carefully. Some providers advertise “free” tax preparation but charge for the refund advance. Others might have lower upfront costs but higher interest rates on the advance. Read the fine print and calculate the total cost before making a decision.

File Early and Accurately

File your taxes as early as possible. Many lenders offer higher advance amounts to early filers. Plus, filing early reduces the risk of identity theft and gives you a head start on repaying any debts.

Accuracy is paramount. Double-check all entries on your tax return. Simple mistakes can delay your refund (or even trigger an audit). If your tax situation is complex, work with a professional tax preparer to ensure everything is correct.

The IRS typically starts accepting tax returns in late January. Mark your calendar and try to file as soon as possible after this date.

Apply for the Cash Advance

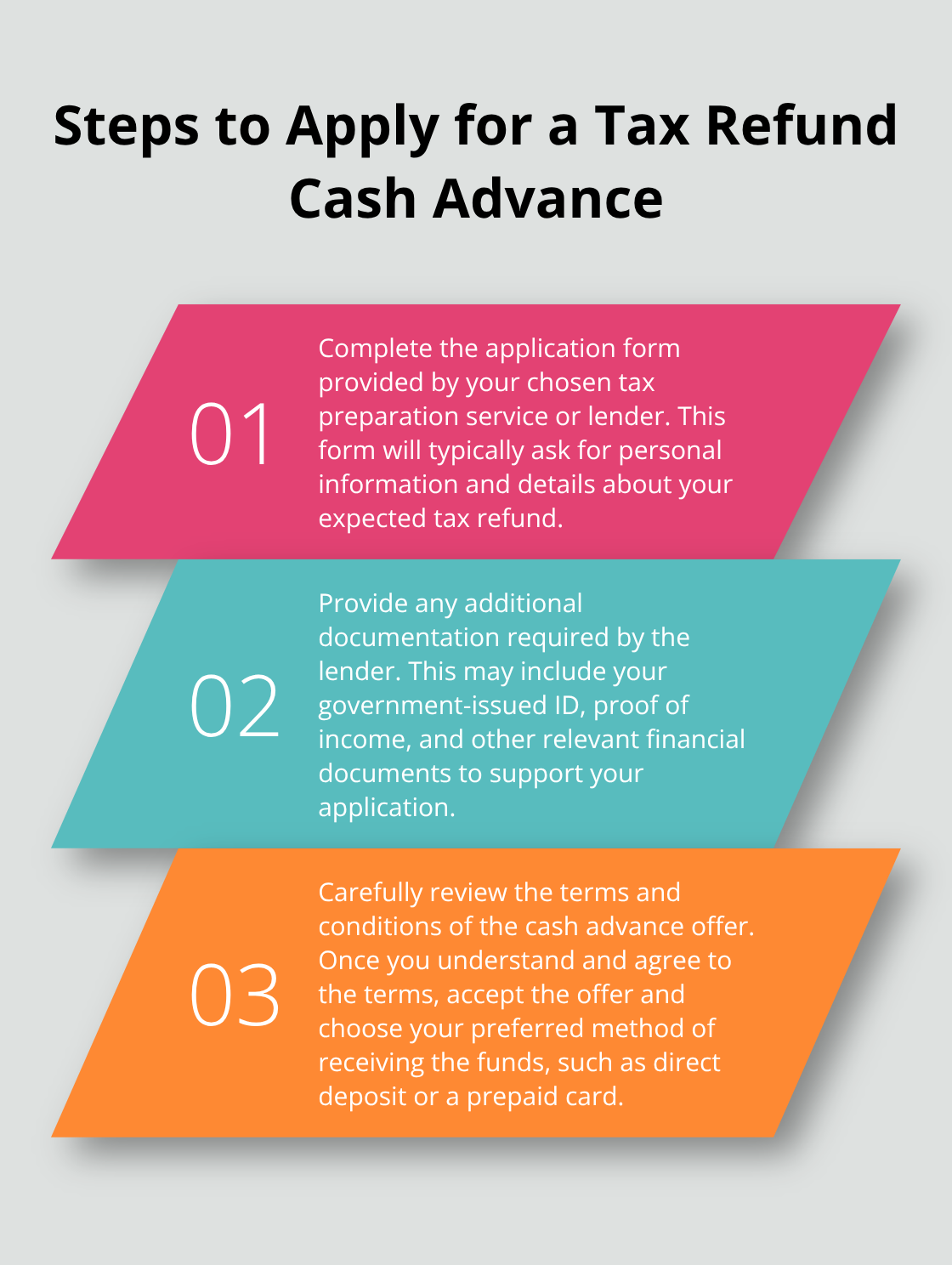

Once you’ve filed your taxes, you can apply for the cash advance. The process usually involves:

Understand the Terms and Conditions

Before accepting any offer, make sure you fully understand the terms and conditions. Pay attention to:

- The amount of the advance

- Any fees or interest charges

- Repayment terms

- What happens if your actual refund is less than expected

While tax refund cash advances can provide quick access to funds, they’re not always the best financial choice. In the next section, we’ll explore alternatives that might better suit your needs and potentially save you money in the long run.

Smart Alternatives to Tax Refund Cash Advances

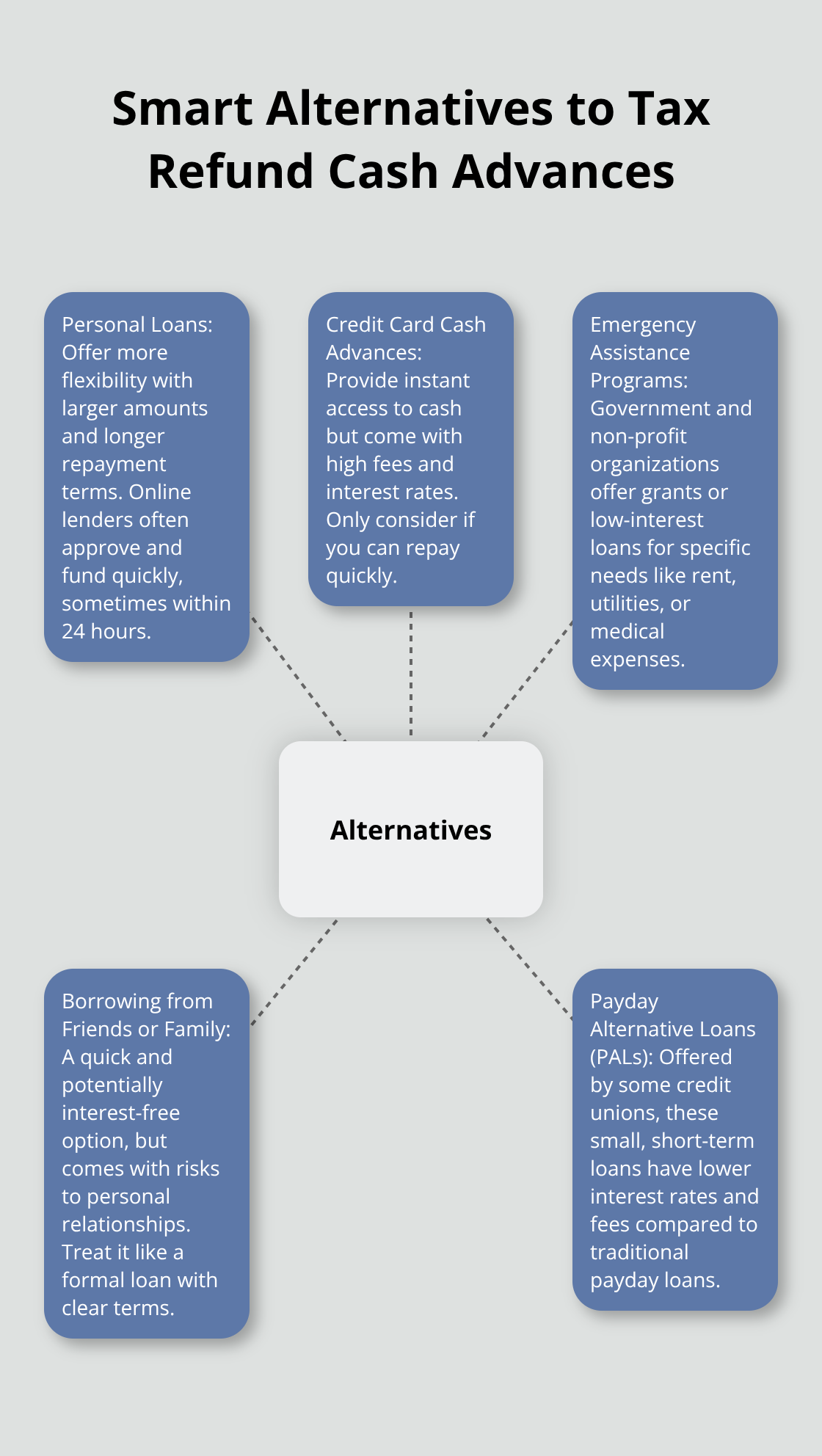

Personal Loans: A Flexible Option

Personal loans offer more flexibility than tax refund advances. You can borrow larger amounts and have longer repayment terms. Online lenders often approve and fund loans quickly, sometimes within 24 hours.

For example, OneMain Financial offers personal loans with repayment terms between 24 months and 60 months. They provide more flexible options compared to other lenders.

You should compare rates from multiple lenders. Even a small difference in interest rate can save you hundreds of dollars over the life of the loan.

Credit Card Cash Advances: A Cautionary Option

Credit card cash advances allow you to withdraw money from your credit limit. They provide instant access to cash, but come with high fees and interest rates.

For instance, some banks charge a $3.50 fee for cash advances at their ATMs, plus interest rates around 22.99% that start accruing immediately.

You should only consider this option if you can repay the advance quickly. The costs can spiral out of control if you don’t.

Emergency Assistance Programs: Government and Non-Profit Help

Many government and non-profit organizations offer emergency financial assistance. These programs can provide grants or low-interest loans for specific needs (like rent, utilities, or medical expenses).

Some organizations offer emergency financial assistance to those affected by disasters. They can provide funds for food, clothing, and temporary lodging.

You should check with your local social services office or community organizations to find programs in your area. These options often have no interest or fees, which makes them a cost-effective choice for emergency expenses.

Borrowing from Friends or Family

Borrowing from friends or family can be a quick and potentially interest-free option. However, it comes with its own set of risks (such as strained relationships if repayment becomes an issue).

If you choose this route, treat it like a formal loan. Write down the terms, including the amount borrowed, repayment schedule, and any interest (if applicable). This approach helps prevent misunderstandings and protects your relationships.

Payday Alternative Loans (PALs)

Some credit unions offer Payday Alternative Loans (PALs). These small, short-term loans have lower interest rates and fees compared to traditional payday loans.

To qualify for a PAL, borrowers must be members of the credit union for at least three months and in good standing on all accounts. PALs typically range from $200 to $1,000 and have repayment terms of 1 to 6 months. The application process is often simpler than for traditional loans, making them accessible to those with less-than-perfect credit.

Final Thoughts

Tax refund cash advance emergency loans in 2025 offer quick financial relief, but they aren’t always the best solution. We recommend exploring alternatives like personal loans, credit union offerings, or emergency assistance programs. These options often provide more favorable terms and could save you money in the long run.

Responsible borrowing is essential when facing financial emergencies. Borrow only what you need and can afford to repay, and create a solid repayment plan before taking on any debt. If possible, build an emergency fund to avoid relying on loans in the future.

At Financial Canadian, we understand the importance of making informed financial decisions. We specialize in creating stunning and functional websites for businesses while also providing valuable financial knowledge to our readers. Whether you need to improve your online presence or navigate financial challenges, we’re here to help you succeed.

Leave a comment