Financial emergencies don’t wait for perfect credit scores. When unexpected expenses hit, instant cash loans online no credit check can provide quick relief without traditional credit requirements.

These loans offer fast approval and same-day funding, but they come with significant trade-offs. We at Financial Canadian will guide you through the application process, costs, and risks to help you make an informed decision.

What No Credit Check Loan Options Exist

Payday Loans Deliver Quick Cash With Steep Costs

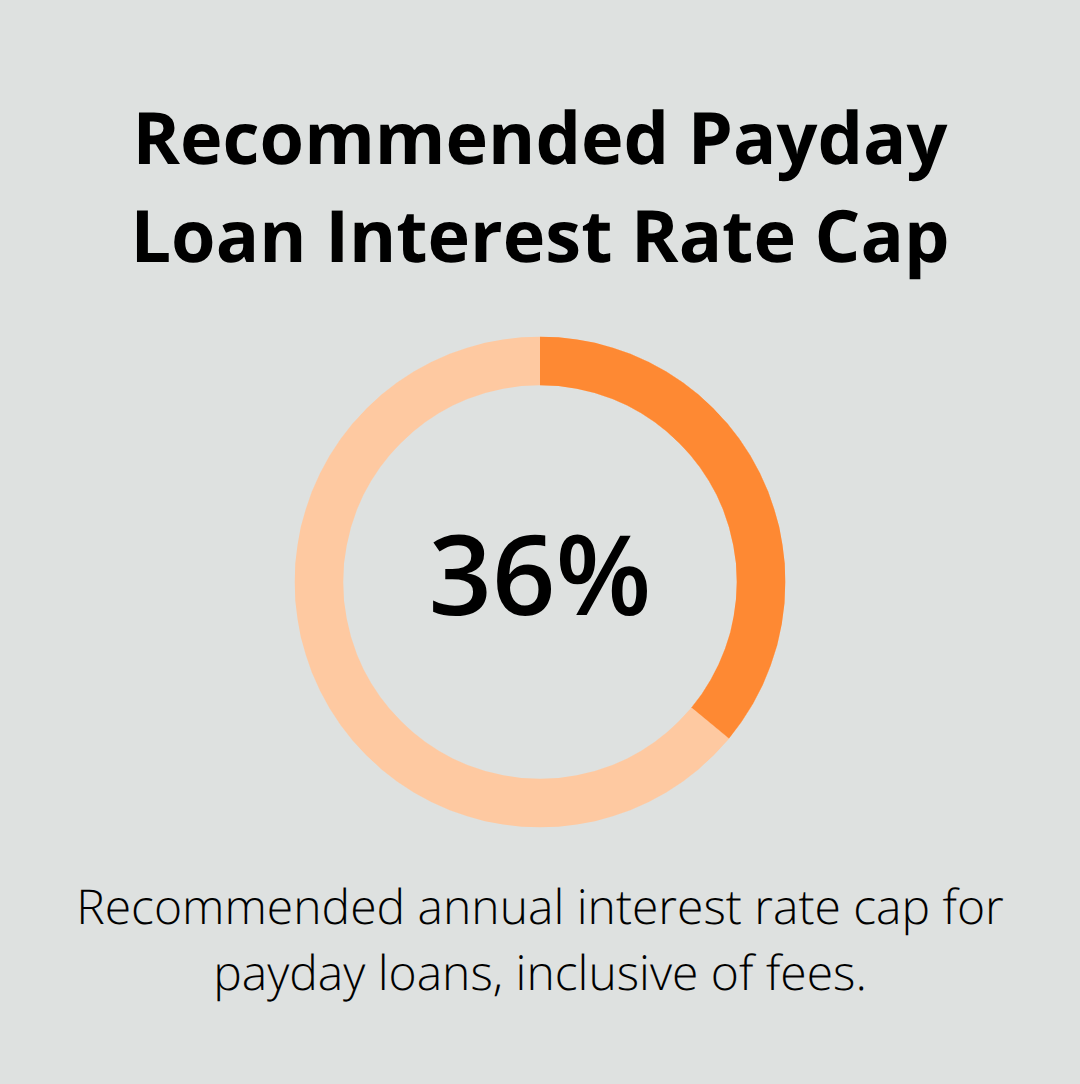

Payday loans provide the fastest cash access, typically offering $100 to $1,500 within hours. These loans require only proof of income and a bank account, with no credit verification. States without meaningful usury caps should implement annual interest rates no higher than 36%, inclusive of fees, making a $300 loan cost $345 after just two weeks.

Most borrowers receive funds the same day through direct deposit or cash pickup at storefront locations. Payday lenders like Check Into Cash and Advance America operate in 36 states, though 14 states have banned these loans due to predatory practices. The application process takes less than 15 minutes online or in-store.

Title Loans Use Your Vehicle as Collateral

Car title loans allow you to borrow 25% to 50% of your vehicle’s value, typically $100 to $5,500, while you keep possession of your car. Recent data shows trends in repossessions in the auto finance industry. These loans charge monthly interest rates of 25% (translating to 300% APR annually).

TitleMax and LoanMax are major providers, requiring only your car title, ID, and proof of income. The application takes 30 minutes, with same-day funding available at physical locations. You must own your vehicle outright or have significant equity to qualify.

Alternative Lenders Bypass Traditional Credit Requirements

Online platforms like Upstart and Oportun use alternative data including bank transactions and employment history instead of credit scores. Oportun approves loans starting at $300 for borrowers with no credit history, while cash advance apps like Earnin provide up to $500 against upcoming paychecks.

Credit union payday alternative loans offer better terms, with APRs capped at 28% and amounts up to $2,000. Premier America Credit Union’s Easy Cash program provides instant approval for members, requiring only three months of membership and online banking access. These options typically process applications within 24 hours and deposit funds directly into your account.

Understanding these loan types helps you evaluate which option fits your specific situation, but the application process itself requires careful attention to requirements and documentation.

How Do You Actually Apply for These Loans

Complete Your Application With Essential Personal Details

Most online lenders demand identical information across platforms. You must provide your full name, address, phone number, email, and Social Security number to start any application. Income verification follows, where you enter employer details, monthly gross income, and employment duration. Lenders like Upstart and Oportun process applications within 2 minutes, while traditional payday lenders like Check Into Cash complete reviews in under 15 minutes. Bank account information remains mandatory since lenders deposit funds directly and often require automatic repayment authorization.

Upload Required Documents Through Secure Portals

Active bank statements from the past 30 days serve as your primary documentation. Pay stubs or direct deposit records prove income stability, while government-issued photo ID confirms your identity. Title loan applications additionally require vehicle registration, insurance proof, and clear photos of your car. Credit unions like Premier America require membership verification and may request utility bills for address confirmation. Cash advance apps like Earnin connect directly to your bank account and employer payroll systems (eliminating traditional document requirements). Most lenders use 256-bit encryption for document uploads and store files for 7 years per federal regulations.

Receive Funds Within Hours to One Business Day

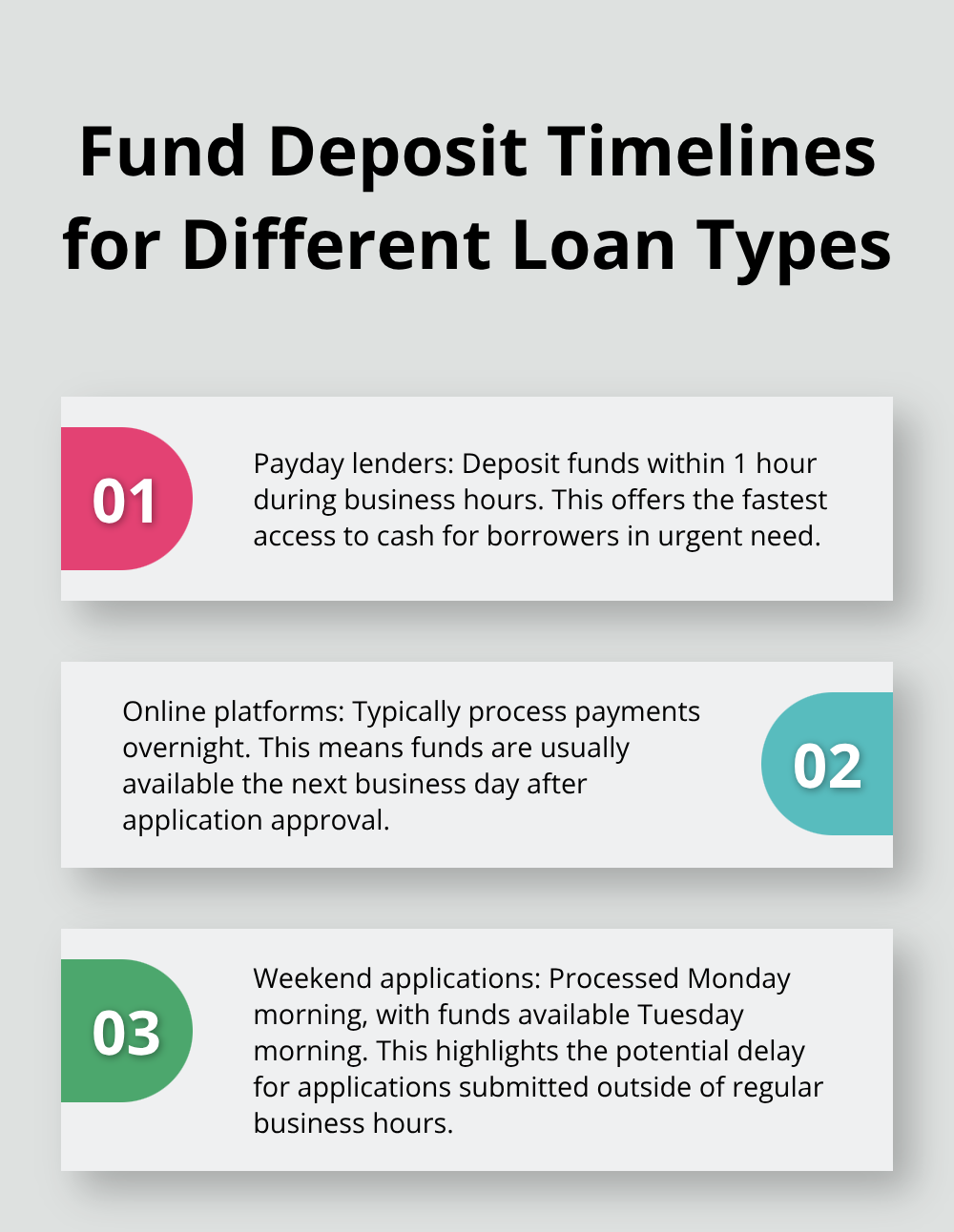

Same-day deposits occur when you apply before cutoff times on business days. Payday lenders deposit funds within 1 hour during business hours, while online platforms typically process payments overnight. Weekend applications get processed Monday morning, with funds available Tuesday morning. Title loan companies provide immediate cash at physical locations, while online applications require 24-hour processing. Credit union loans are cheaper and easier to repay over time compared to payday loans, which are fast but expensive with high interest rates.

These quick approval times come with substantial financial costs that borrowers must understand before accepting any loan offer.

What Are the True Costs of No Credit Check Loans

Interest Rates That Devastate Your Budget

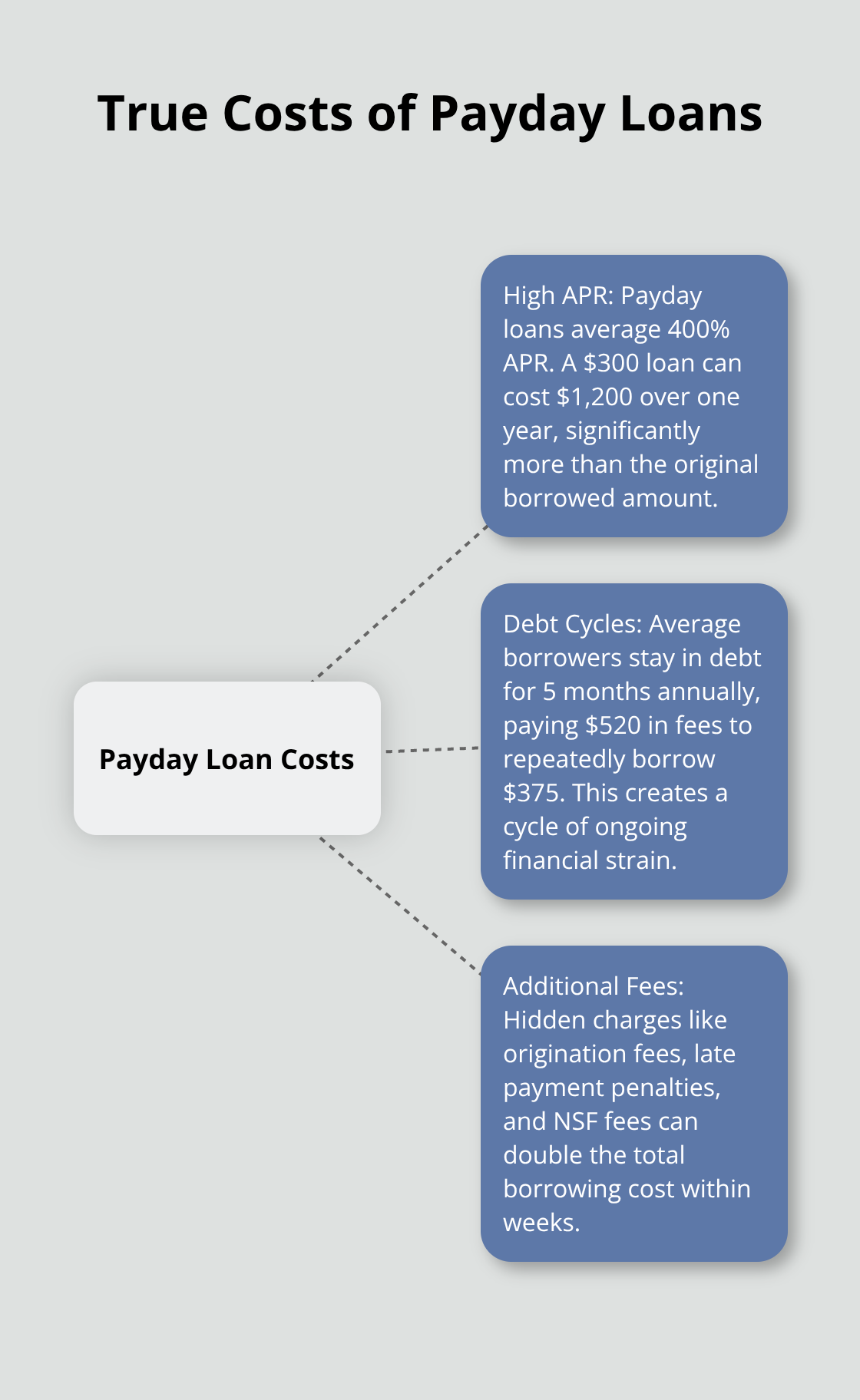

No credit check loans carry astronomical costs that traditional banks would never charge. Payday loans average 400% APR according to the Consumer Financial Protection Bureau, which means a $300 loan costs $1,200 over one year. Title loans charge 300% APR monthly, which creates $900 in interest on a $3,000 loan within 12 months. Cash advance apps like Earnin charge $3 to $14 per transaction (this translates to 365% APR for a $100 advance repaid in two weeks).

Premier America Credit Union’s Easy Cash program charges 28% APR, which makes it significantly cheaper than payday alternatives. Credit union payday alternative loans cap rates at 28% APR with $20 application fees maximum. Compare this to Check Into Cash, which charges $15 per $100 borrowed for two weeks and equals 391% APR annually.

Debt Cycles That Trap Borrowers Long-Term

Research demonstrates that payday loans frequently lead to a continuous cycle of debt according to Consumer Financial studies. Average payday borrowers stay in debt 5 months annually and pay $520 in fees to repeatedly borrow $375. Title loan borrowers lose their vehicles 20% of the time according to Consumer Federation of America research.

Loan rollovers create exponential cost increases. A $300 payday loan becomes $800 after four rollovers within two months. Title loan companies like TitleMax actively encourage extensions and generate more fee revenue while borrowers struggle with payments. The Federal Trade Commission reports that borrowers who use payday loans more than 10 times per year account for 90% of total loan volume (this indicates systematic dependency rather than emergency relief).

Financial Health Deteriorates Rapidly

No credit check loans worsen current financial problems rather than solve them. Research from Pew Charitable Trusts shows payday loan users are more likely to overdraft bank accounts, delay medical care, and struggle with basic expenses compared to similar borrowers who don’t use these products. Default rates exceed 20% for online payday loans and damage credit scores when lenders report to bureaus.

Hidden Fees Multiply Your Debt Burden

Lenders add multiple fees beyond advertised rates that borrowers often overlook. Origination fees range from $15 to $30 per loan, while late payment penalties reach $40 or 5% of the overdue amount (whichever is greater). NSF fees cost $35 when automatic payments fail, and loan extension fees add another $15 to $45 per rollover. These additional charges can double the total cost of borrowing within weeks.

Final Thoughts

Instant cash loans online no credit check provide immediate financial relief but create long-term financial damage for most borrowers. The 400% APR rates and debt cycles trap 90% of users and make these products unsuitable for anything beyond true emergencies. Better alternatives exist for urgent cash needs through credit union payday alternative loans with 28% APR caps and reasonable repayment terms.

Cash advance apps charge lower fees than payday lenders, while personal loans for bad credit cost significantly less than no credit check options. Exhaust other options first by asking family for help, negotiating payment plans with creditors, or selling unused items. Choose credit unions over payday lenders and borrow only what you can repay quickly if you must borrow.

We at Financial Canadian understand that financial emergencies require immediate solutions (though smart borrowing decisions protect your financial future). Our team helps readers navigate complex financial decisions through comprehensive research and practical guidance. Visit Financial Canadian to access more resources that build the foundation for long-term financial stability.

Leave a comment