Bad credit doesn’t mean you’re locked out of affordable borrowing options. Canadians with poor credit scores can still access bad credit low interest personal loans through strategic approaches and the right lenders.

We at Financial Canadian have researched proven methods to help you secure better rates despite credit challenges. The key lies in understanding your options and taking targeted steps to improve your borrowing position.

What Credit Scores Qualify as Bad Credit in Canada

In Canada, credit scores below 650 place you in the bad credit category. According to credit score ranges, scores from 300-579 represent poor credit, while 580-669 falls into the fair credit range. Most traditional lenders reject applications below 600, which forces borrowers toward specialized bad credit lenders who charge premium rates.

Credit Score Impact on Loan Access

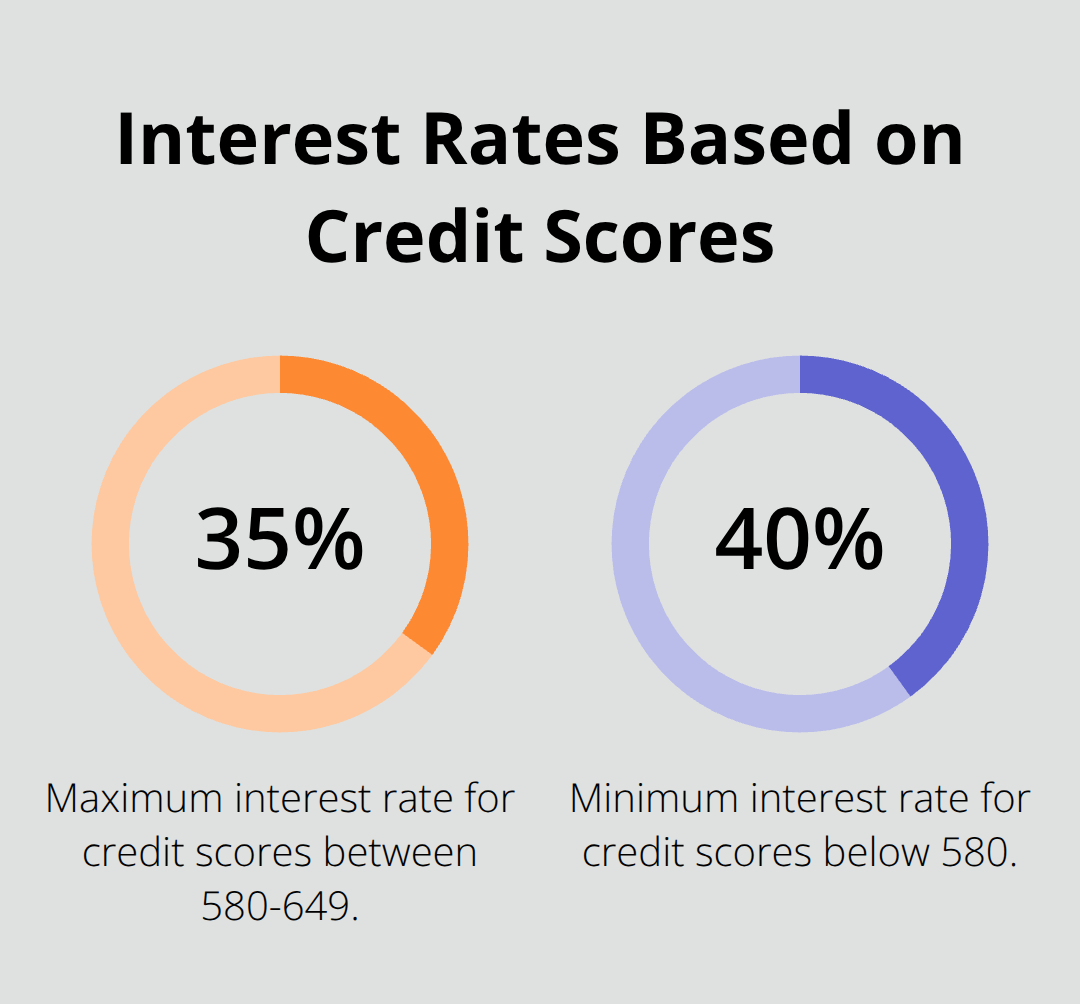

Canadian lenders typically offer their best rates to borrowers with scores above 700. Those with scores between 580-649 face interest rates that range from 15% to 35% on personal loans. Borrowers below 580 often encounter rates that exceed 40% or face outright rejections from mainstream financial institutions. Credit unions like Vancity and Meridian often provide more flexible criteria and accept scores as low as 550 for secured loans.

Secured Personal Loans for Bad Credit

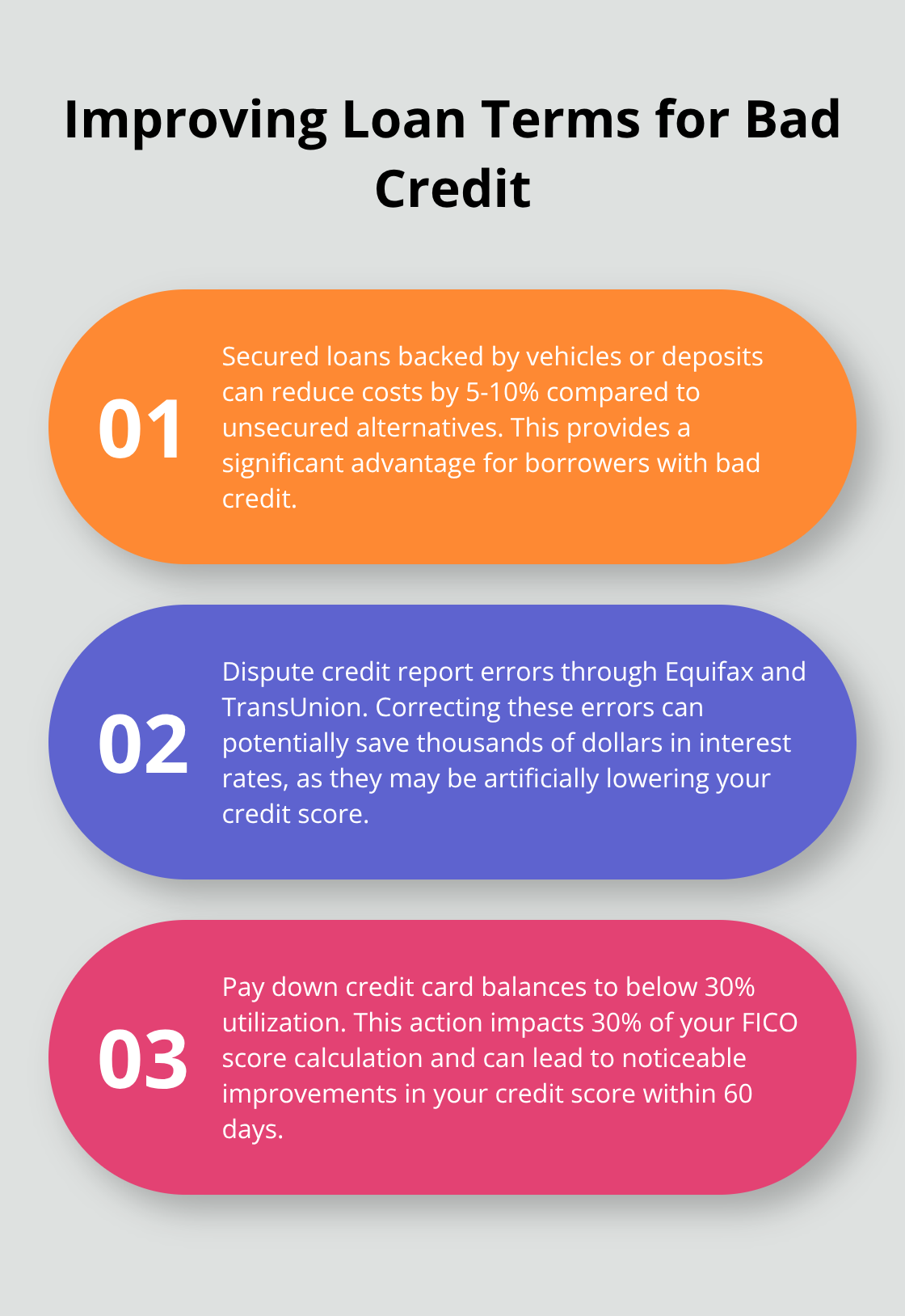

Secured personal loans represent the most affordable option for bad credit borrowers, as they use assets like vehicles or savings as collateral. These loans typically offer rates 5-10% lower than unsecured alternatives. The collateral reduces lender risk, which translates to better terms for borrowers despite poor credit history.

Alternative Loan Options

Online lenders like Paymi and Payymi specialize in bad credit applications and consider income stability and employment history alongside credit scores. Guarantor loans, where a creditworthy cosigner backs the application, can reduce rates by 8-15% compared to solo applications.

These loan types provide different pathways to affordable credit, but success depends on your approach to the application process and your ability to present yourself as a reliable borrower despite past credit challenges.

How Bad Credit Affects Interest Rates and Loan Terms

Higher interest rates directly influence consumer credit behaviour, making borrowers more cautious about taking on debt. Start with disputes of errors on your credit report through Equifax and TransUnion, as credit reporting errors are costing unsuspecting consumers thousands of dollars in higher interest rates. Pay down credit card balances to below 30% utilization, which impacts 30% of your FICO score calculation. Add yourself as an authorized user on a family member’s account with good payment history to boost your score within 30-60 days.

Target Quick Score Improvements

Focus on actions that deliver fast results rather than long-term credit reconstruction. Pay off collections under $500 first, as these create disproportionate damage relative to their size. Set up automatic minimum payments on all accounts to avoid future late payments (which stay on your report for seven years). Request credit limit increases on existing cards without use of the extra credit, as this improves your utilization ratio immediately. Credit unions like Meridian often approve secured credit cards with deposits as low as $200, which provides a pathway to rebuild payment history.

Compare Secured Loan Options Aggressively

Secured loans backed by vehicles or savings deposits offer the lowest rates for bad credit borrowers, typically 8-15% versus 25-40% for unsecured options. Your car can secure loans up to 80% of its value at rates that start around 12% through lenders like Fairstone. Registered retirement savings plans can back loans at prime plus 2-4% through major banks, though this requires careful consideration of withdrawal penalties (consult your financial advisor first). Shop at least five lenders for secured options, as rate differences of 10% or more are common between institutions for identical collateral.

Alternative Lenders and Rate Negotiation

Online lenders like Paymi and Payymi specialize in bad credit applications and consider income stability alongside credit scores. These platforms often approve borrowers with scores as low as 550 when monthly income exceeds $2,000. Credit unions typically offer rates 3-5% lower than traditional banks for similar risk profiles. Present multiple pre-approval offers to lenders as leverage for better terms – competition drives down rates even for bad credit applicants.

The next step involves identification of specific lenders who excel at bad credit personal loans and understand which institutions offer the most competitive terms for your situation.

Which Lenders Offer the Best Bad Credit Personal Loans

Fairstone Financial accepts applications with scores as low as 500 and provides secured loans against vehicles at rates that start around 12%. Their loan amounts reach $50,000 for qualified borrowers, and they process applications within 24 hours through their network of 240+ locations across Canada. Paymi and Payymi focus on income verification over credit scores and approve borrowers with monthly income above $2,000 even with scores below 580. These platforms typically fund loans within 48 hours at rates between 19-35%, much faster than traditional bank processes.

Credit Unions Deliver Superior Rates

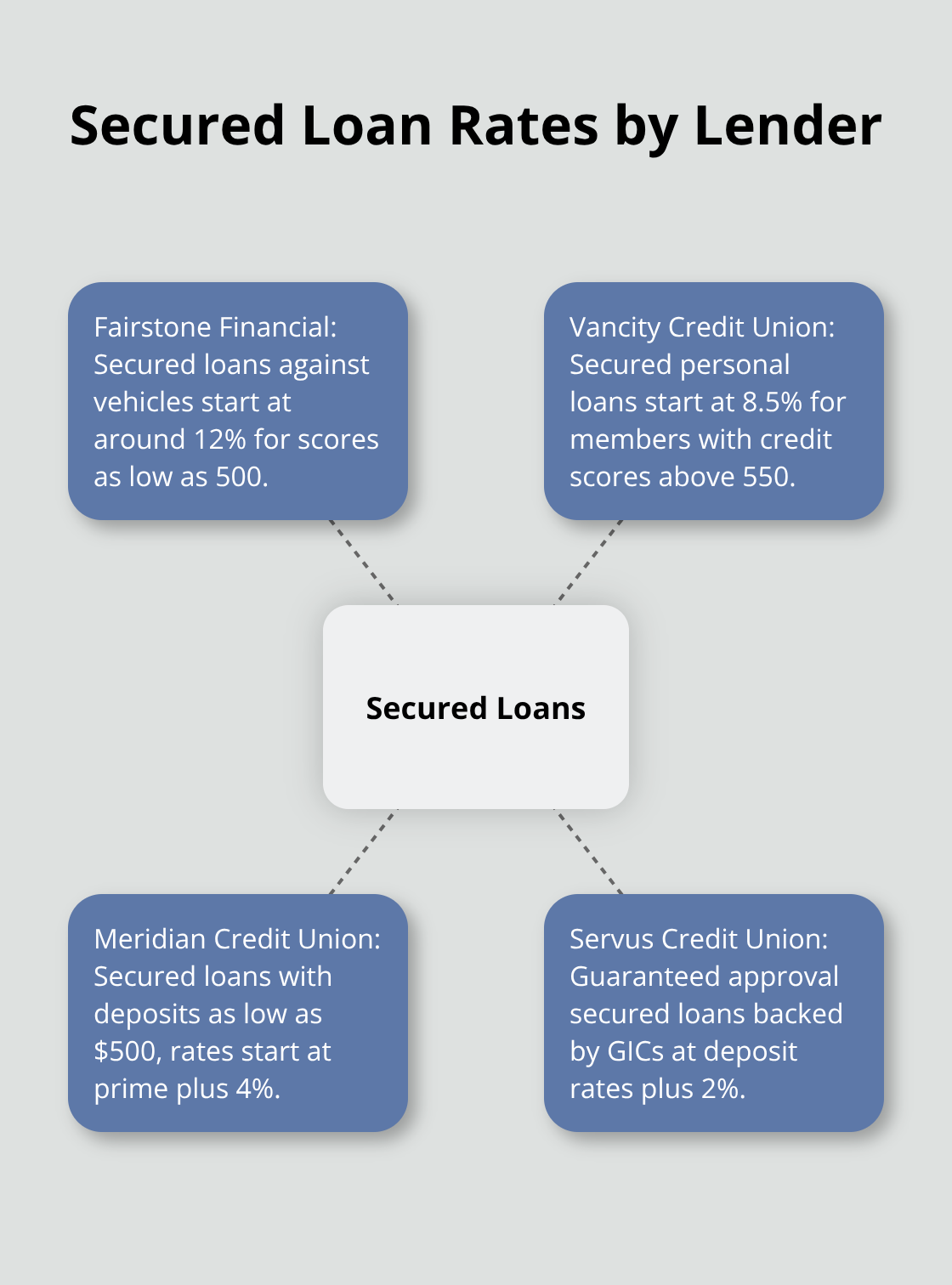

Vancity Credit Union consistently offers competitive rates for identical risk profiles, with secured personal loans that start at 8.5% for members with credit scores above 550. Credit unions provide good interest rates and are more flexible than banks, with Meridian Credit Union specializing in credit rebuilding relationships and accepting secured loan applications with deposits as low as $500, with rates that start at prime plus 4%. Servus Credit Union provides guaranteed approval secured loans backed by GICs at rates that match their deposit rates plus 2% (creating predictable costs). Credit unions require membership but often waive fees for new members, which makes the total cost lower than online alternatives.

Alternative Platforms Target Specific Borrower Profiles

Lending Loop focuses on small business owners with personal credit challenges and offers loans up to $100,000 based on business cash flow rather than personal credit scores. Their approval rates exceed 70% for applicants with revenue above $100,000 annually, despite personal credit scores below 600. Paymi specializes in employment-verified loans for borrowers with steady income but poor credit, and requires only 90 days of employment history plus bank statements. These platforms charge fees between 2-8% but often provide better total costs than traditional high-interest personal loans for qualified applicants (especially those with stable income).

Bank-Affiliated Options for Secured Loans

TD Bank offers secured personal loans backed by term deposits at competitive rates for borrowers with credit scores above 580. RBC provides vehicle-secured loans through their dealer network at rates that start at 9.9% for qualified applicants. BMO accepts RRSP-backed loans at prime plus 3-4% for existing customers with poor credit but stable income. These major bank options require existing relationships but provide stability and predictable terms that smaller lenders cannot match.

Final Thoughts

Bad credit low interest personal loans remain accessible through strategic approaches and careful lender selection. Credit unions consistently deliver the most competitive rates for borrowers with scores below 650, while secured loans backed by vehicles or deposits reduce costs by 5-10% compared to unsecured alternatives. Online lenders like Paymi and Payymi focus on income verification over credit scores, which creates opportunities for stable earners with poor credit histories.

Your path to better rates starts with disputes of credit report errors and reduction of credit card balances below 30% utilization. These actions can improve your score within 60 days and unlock better loan terms. Multiple lender comparisons remain essential, as rate differences of 10% or more exist between institutions for identical borrower profiles (especially between credit unions and traditional banks).

Responsible repayment builds your credit foundation for future needs. Each on-time payment contributes to credit score improvement and expands your access to mainstream options. We at Financial Canadian help businesses establish strong online presence through our comprehensive web design services, which supports growth and customer reach in today’s digital marketplace.

Leave a comment