Bad credit doesn’t mean you’re locked out of affordable borrowing options. Canadians with credit scores below 650 can still access competitive financing through strategic approaches and alternative lenders.

We at Financial Canadian have identified proven methods to help you secure low rate personal loans bad credit, even when traditional banks say no. The key lies in knowing where to look and how to position yourself as a lower-risk borrower.

Understanding Bad Credit and Personal Loan Options

What Credit Scores Qualify as Bad Credit in Canada

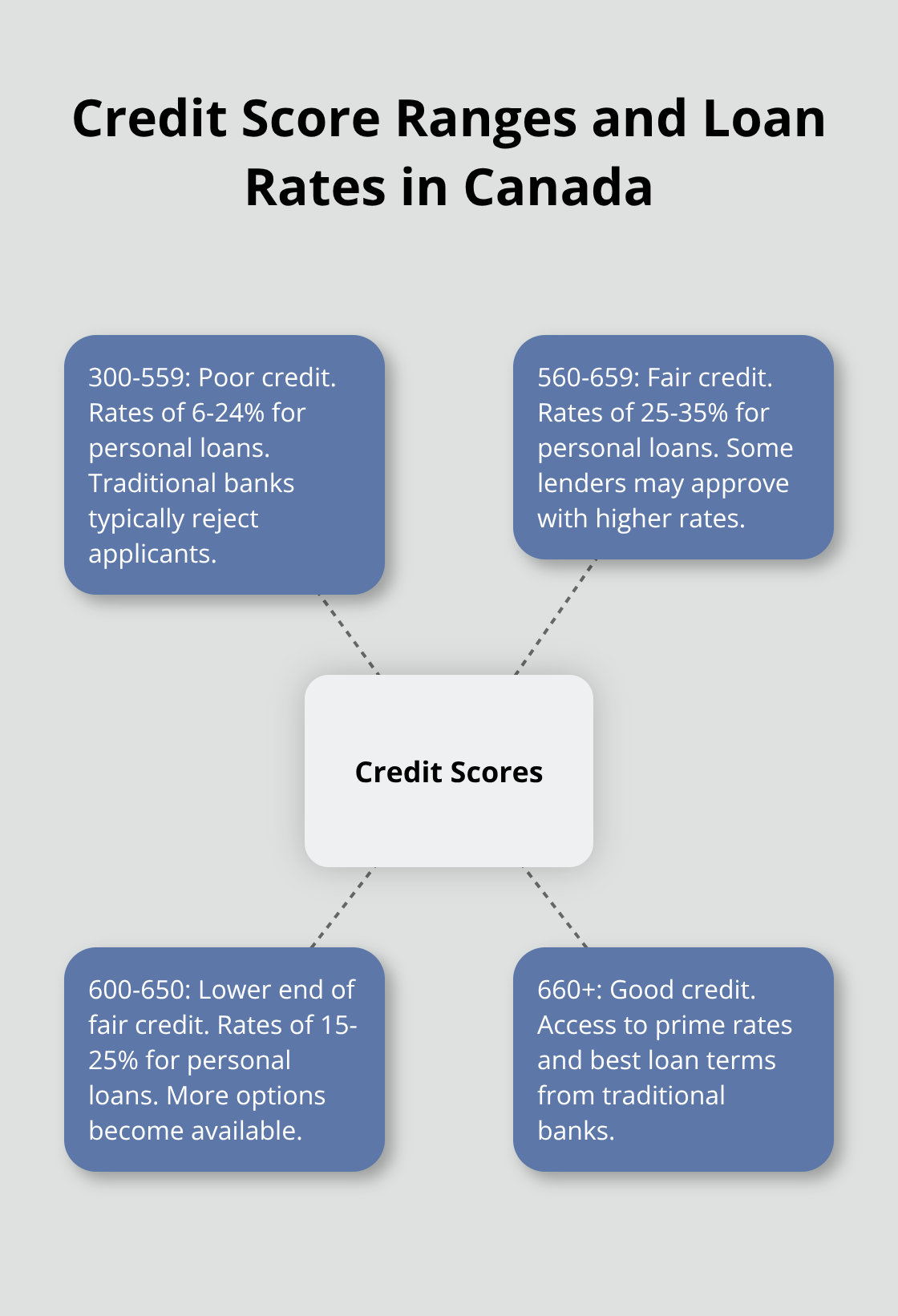

In Canada, scores below 660 mark you as a bad credit borrower, though the impact varies significantly across different ranges. Equifax and TransUnion, Canada’s major credit bureaus, classify scores from 300-559 as poor credit, while 560-659 falls into fair credit territory.

Most traditional banks reject applicants with scores under 600, but specialized lenders actively serve borrowers with scores as low as 300. The average Canadian credit score sits at 650, meaning roughly half the population faces challenges when they access prime rates.

Types of Personal Loans Available for Bad Credit Borrowers

Secured personal loans represent your strongest option for competitive rates. These loans typically offer APRs 5-10% lower than unsecured alternatives and require collateral like vehicles, savings accounts, or investment portfolios. Loan amounts reach up to 80% of your asset’s value.

Unsecured personal loans remain available through alternative lenders, though rates climb to 19.99-46.96% (rates depend on your score and income stability). Installment loans provide fixed monthly payments over 12-60 months, while lines of credit offer access to funds with variable rates that start around 12.99% for secured options.

How Bad Credit Affects Interest Rates and Terms

Your credit score directly determines your costs, with dramatic differences between score ranges. Borrowers with scores of 300-500 face rates of 6-24%, while those in the 500-600 range typically secure rates of 25-35%. The 600-650 bracket opens access to rates between 15-25%, which represents substantial monthly payment savings.

A $10,000 loan at 35% costs $436 monthly over three years, compared to $318 monthly at 15% – a difference of $4,248 in total interest. Income verification and employment stability can reduce rates by 2-5% even with poor credit scores.

These rate differences highlight why strategic preparation becomes essential before you apply for loans with bad credit.

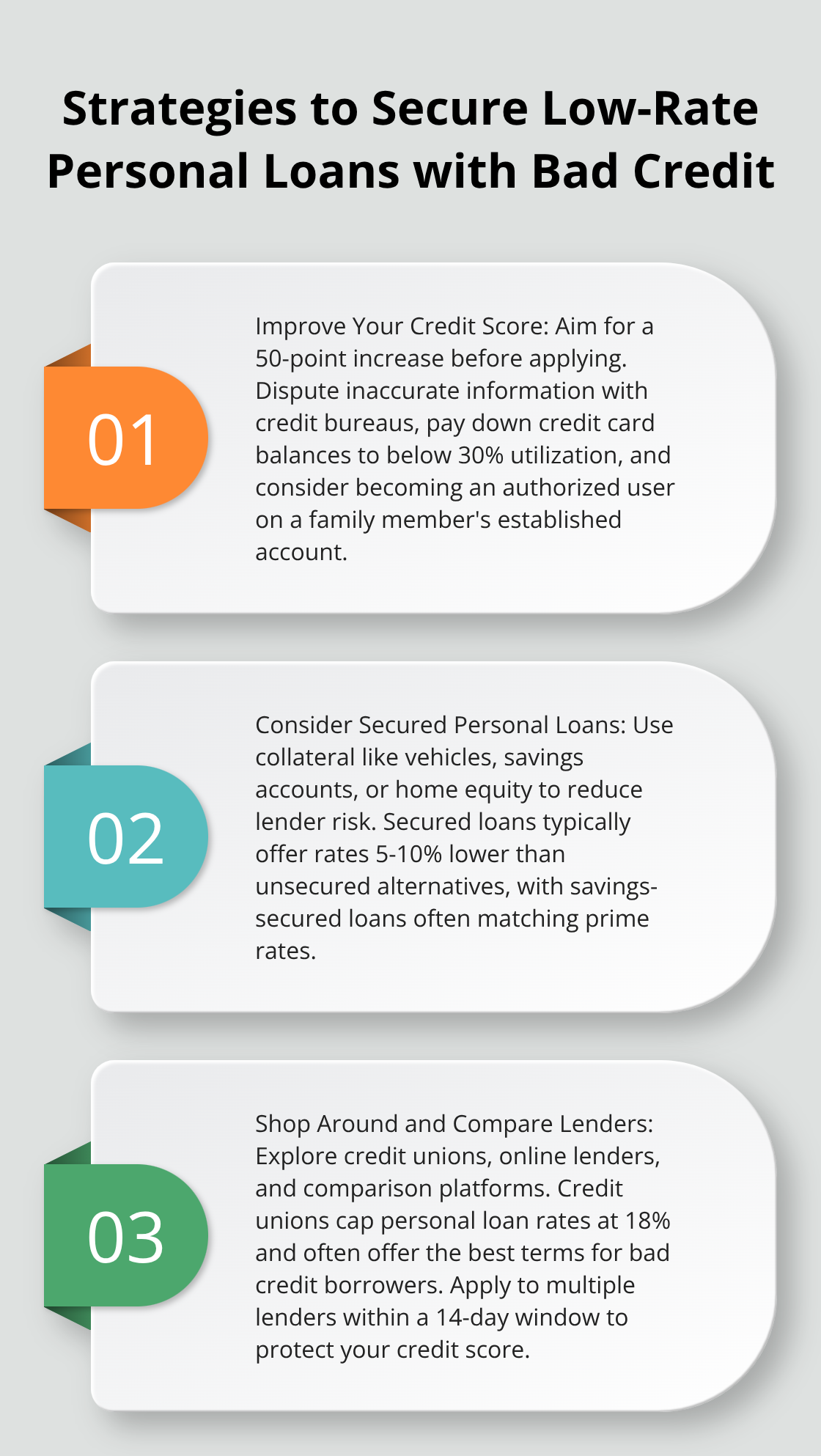

Strategies to Secure Low Rate Personal Loans with Bad Credit

The most effective approach to reduce your costs involves a 50-point credit score increase before you submit applications. Credit repair companies report that disputes of inaccurate information with Equifax and TransUnion boost scores within 60-90 days. Pay down credit card balances below 30% utilization, as this single action increases scores within one cycle.

Credit monitoring services like Credit Karma show that authorized user status on a family member’s established account adds points to your score within 30 days. This strategy works particularly well when the primary cardholder maintains low balances and perfect payment history.

Consider Secured Personal Loans and Collateral Options

Secured loans transform your power through collateral that reduces lender risk. Vehicle-secured loans typically offer lower rates than unsecured options, with many lenders accepting cars worth $5,000 or more. The vehicle remains in your possession while the lender holds the title as security.

Savings-secured loans provide the lowest rates available to bad credit borrowers, often matching prime rates when you pledge GICs or savings accounts as collateral. Home equity loans represent the ultimate secured option, with competitive rates even for borrowers with scores below 600 (though qualification requires substantial home equity).

Shop Around and Compare Multiple Lenders

Credit unions consistently offer the best rates for bad credit borrowers, with federally regulated institutions that cap personal loan rates at 18%. These member-owned institutions focus on community service rather than profit maximization, which translates to better terms for higher-risk borrowers.

Online lenders approve borrowers with scores as low as 500, though they may face higher interest rates through advanced risk assessment algorithms. These platforms analyze employment history, education, and cash flow patterns beyond simple credit scores.

Comparison platforms reveal rate differences between lenders for identical borrower profiles. Multiple applications within a 14-day window count as a single credit inquiry, which protects your score while you explore options. These preparation strategies set the foundation for exploring alternative sources that specialize in bad credit loans.

Alternative Lending Solutions for Bad Credit Borrowers

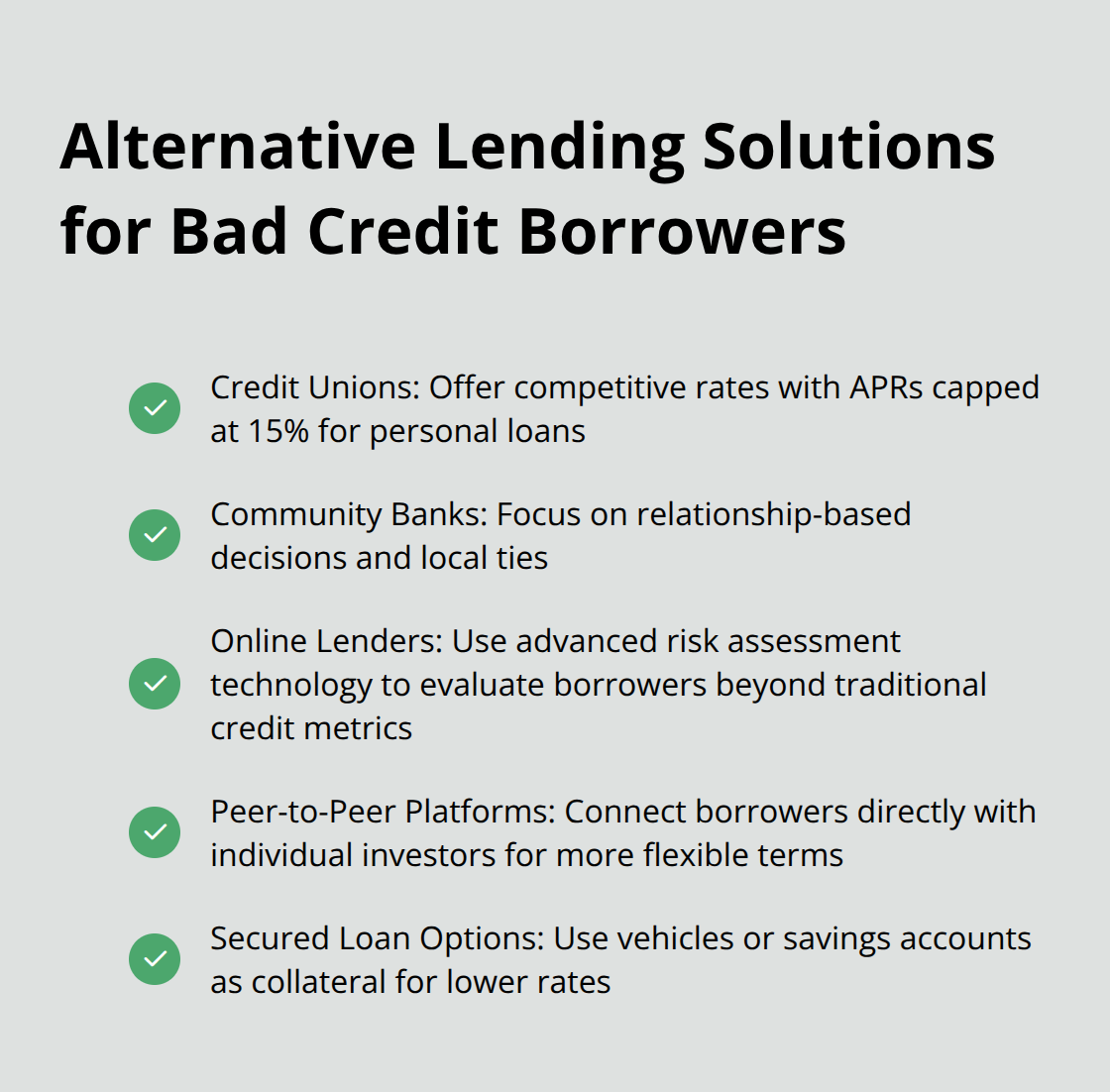

Credit Unions Deliver the Lowest Rates for Bad Credit

Credit unions consistently offer the most competitive rates for bad credit borrowers, with federally regulated institutions that cap personal loan APRs at 15% compared to traditional bank rates of 25-35%. Servus Credit Union and Vancity approve members with scores as low as 550, while Coast Capital Savings provides secured loans at prime plus 2% for borrowers who pledge savings accounts.

Membership requirements vary by institution, but most accept residents within their service areas for a $5-25 fee. Community banks like ATB Financial focus on relationship-based decisions and consider employment history plus local ties over pure credit scores. These institutions prioritize member service over profit maximization, which translates to better terms for higher-risk borrowers.

Online Lenders Use Advanced Risk Assessment Technology

Online platforms employ machine learning algorithms to evaluate borrowers beyond traditional credit metrics, which creates opportunities for scores between 500-650. Paymi approves 73% of applications with rates that start at 19.99% for bad credit borrowers, while Fairstone Financial approves borrowers with bankruptcy history after two years at rates from 26.99% for secured loans.

These lenders analyze bank statements, employment stability, and education levels to price risk more accurately than traditional credit scoring models. The application process takes 24-48 hours with same-day funding available (making them faster alternatives to traditional banks). Most online lenders require minimum annual incomes of $20,000-$30,000 but accept various employment types including contract work.

Peer-to-Peer Platforms Connect Borrowers with Individual Investors

Peer-to-peer platforms like Paymi connect borrowers directly with individual investors, which often results in more flexible terms and personalized loan structures. These platforms accommodate unique financial situations that traditional lenders reject, with investors who evaluate complete borrower profiles rather than just credit scores.

Individual investors on these platforms often accept lower returns in exchange for helping borrowers rebuild credit (creating win-win scenarios). Application approval rates reach 65-75% for borrowers with scores between 500-650, with loan amounts up to $35,000 available. Interest rates typically range from 15-28% depending on investor appetite and borrower risk profile.

Final Thoughts

Bad credit borrowers can access low rate personal loans through strategic preparation and targeted lender selection. Credit unions deliver the most competitive rates with 15% APR caps, while secured loans reduce costs by 5-10% through collateral backing. Online lenders and peer-to-peer platforms provide viable alternatives when traditional banks reject applications.

The most effective approach combines credit score improvement with comprehensive lender comparison. A 50-point score increase dramatically reduces borrowing costs, while multiple lender applications within 14 days protect your credit profile. Secured options that use vehicles or savings accounts consistently deliver the lowest rates available to bad credit borrowers.

Responsible borrowing means you select loan amounts you can comfortably repay and avoid predatory lenders with rates that exceed 35%. Focus on positive payment history to improve future borrowing power and access better terms over time. We at Financial Canadian help businesses establish strong digital foundations through our comprehensive web design service, and you can start your credit rebuilding journey today with these proven strategies (positioning yourself for better financial opportunities ahead).

Leave a comment