At Financial Canadian, we understand that navigating personal loans with okay credit can be challenging. Many Canadians find themselves in this situation, wondering how to secure the financing they need.

We’ve put together a comprehensive guide to help you understand your options and improve your chances of approval. From understanding credit scores to exploring lender options, we’ll cover everything you need to know about personal loans for those with fair credit.

What Is Okay Credit and How Does It Affect Personal Loans?

Defining Okay Credit in Canada

In Canada, credit scores range from 300 to 900. A score between 600 and 660 falls into the “okay” or “fair” credit category. This range sits between poor credit (below 600) and good credit (above 660).

The Impact on Personal Loan Terms

Okay credit influences your personal loan options significantly:

- Interest rates ranging from 6%-24% for personal loans from Canada’s Big Six banks and major financial institutions

- Loan amounts: You might qualify for lower amounts

- Repayment terms: Lenders often offer shorter terms

- Income requirements: Prepare for more stringent income checks

Available Personal Loan Types

Even with okay credit, several loan options exist:

- Unsecured personal loans: No collateral required (but higher interest rates apply)

- Secured personal loans: Using an asset as collateral can improve rates

- Debt consolidation loans: Combine multiple debts into one payment

- Line of credit: Offers flexible borrowing and repayment options

Credit Scores and Approval Factors

While credit scores play a significant role in loan approval, lenders consider other factors:

- Income stability

- Debt-to-income ratio

- Employment history

- Assets and savings

Strategies to Improve Approval Chances

To boost your approval odds with okay credit:

- Try to lower your credit utilization ratio to under 30%

- Make all payments on time for at least six months before applying

- Consider a co-signer with stronger credit

- Prepare explanations for any negative marks on your credit report

While okay credit might limit some options, it doesn’t close all doors. Understanding your position and taking steps to improve can help you access personal loans that meet your needs. In the next section, we’ll explore specific strategies to enhance your credit profile and increase your chances of loan approval.

How to Boost Your Loan Approval Odds

Scrutinize Your Credit Report

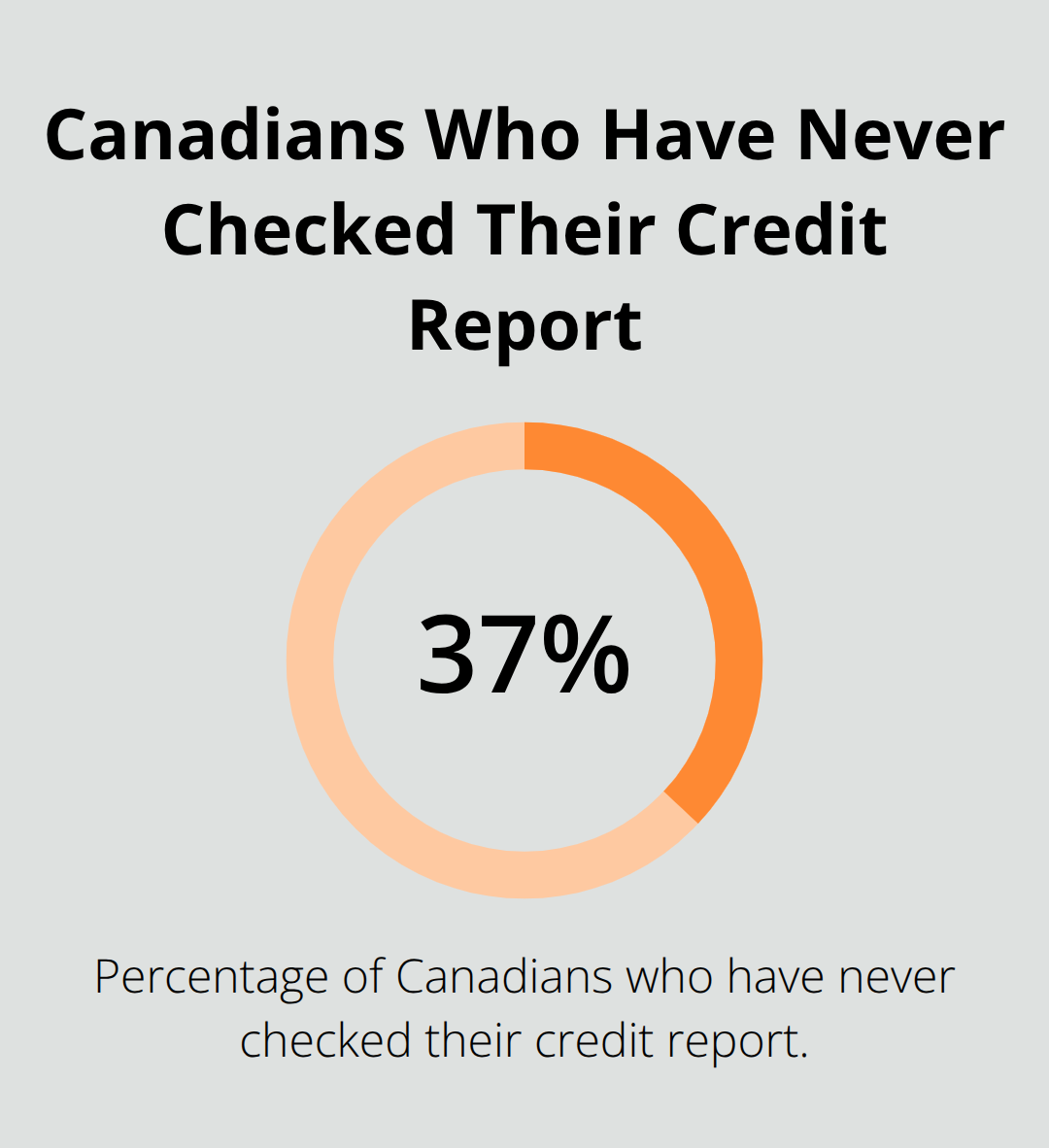

Obtain your free credit report from Equifax Canada or TransUnion Canada. Review it for errors. The Financial Consumer Agency of Canada reports that 37% of Canadians have never checked their credit report. Don’t fall into this category.

If you spot inaccuracies, dispute them immediately. Each credit bureau has a specific process for corrections. Addressing these issues can give your credit score a quick boost.

Focus on your credit utilization ratio. Credit utilization refers to the percentage of your total available revolving credit, such as credit cards and personal lines of credit. Try to keep it below 30%. If you’re over this threshold, prioritize paying down your credit card balances. This action can significantly impact your credit score within a few billing cycles.

Tackle Your Debt-to-Income Ratio

Lenders examine your debt-to-income (DTI) ratio when assessing loan applications. To improve your DTI:

- Increase your income: Consider a side hustle or negotiate a raise at work.

- Pay off existing debts: Focus on high-interest debts first.

- Avoid new debt: Put a temporary freeze on credit card usage.

Explore Alternative Loan Options

If your credit remains a concern, consider these alternatives:

- Secured loans: Offering collateral can lower the lender’s risk, potentially resulting in better terms. Common forms of collateral include vehicles or savings accounts.

- Co-signer: A co-signer with strong credit can significantly boost your approval odds. However, both parties must understand the responsibilities involved.

- Credit union membership: Credit unions often have more flexible lending criteria than traditional banks. For instance, some credit unions offer personal loans starting at competitive rates (as low as 8.75% APR in some cases), which can be attractive for those with okay credit.

Improving your loan approval chances takes time and effort. It may take a few months to see significant changes in your credit profile. However, each positive step brings you closer to securing the personal loan you need. Now that we’ve covered strategies to enhance your financial profile, let’s explore specific lenders that specialize in personal loans for individuals with okay credit.

Where Can You Find Personal Loans with Okay Credit?

Online Lenders for Fair Credit

Fairstone Financial stands out as a prominent online lender in Canada. They work with borrowers who have credit scores as low as 600. Fairstone offers unsecured personal loans with interest rates ranging from 19.99% to 25.99%, and loan terms between 36 and 120 months. While these rates are higher than options for excellent credit, they remain competitive in the fair credit market.

Loans Canada presents another option. This platform connects borrowers with multiple lenders. They accommodate individuals with credit scores as low as 550. Loan amounts range from $500 to $50,000, with APRs starting at 10%. However, borrowers with okay credit should expect rates closer to 20-30%.

Credit Unions with Flexible Terms

Credit unions often provide more personalized service and flexible terms for those with okay credit. Meridian Credit Union, for example, offers personal loans with rates starting at 8.99% for their members. They consider factors beyond just credit scores, which can benefit those with fair credit.

Alterna Bank (a digital subsidiary of Alterna Savings Credit Union) provides unsecured personal loans up to $50,000. Their rates start at 10.99%, which competes well for borrowers with okay credit.

Comparing Interest Rates and Fees

When you evaluate lenders, look beyond just the interest rate. Consider these factors:

- Annual Percentage Rate (APR): This includes both the interest rate and fees, providing a more accurate picture of the loan’s cost.

- Origination fees: Some lenders charge an upfront fee, typically 1-5% of the loan amount. (For a $10,000 loan, this could mean an additional $100-$500.)

- Prepayment penalties: Check if fees apply for paying off your loan early. Many online lenders don’t charge these, but always confirm.

- Late payment fees: These can add up quickly. Most lenders charge around 5% of the missed payment amount.

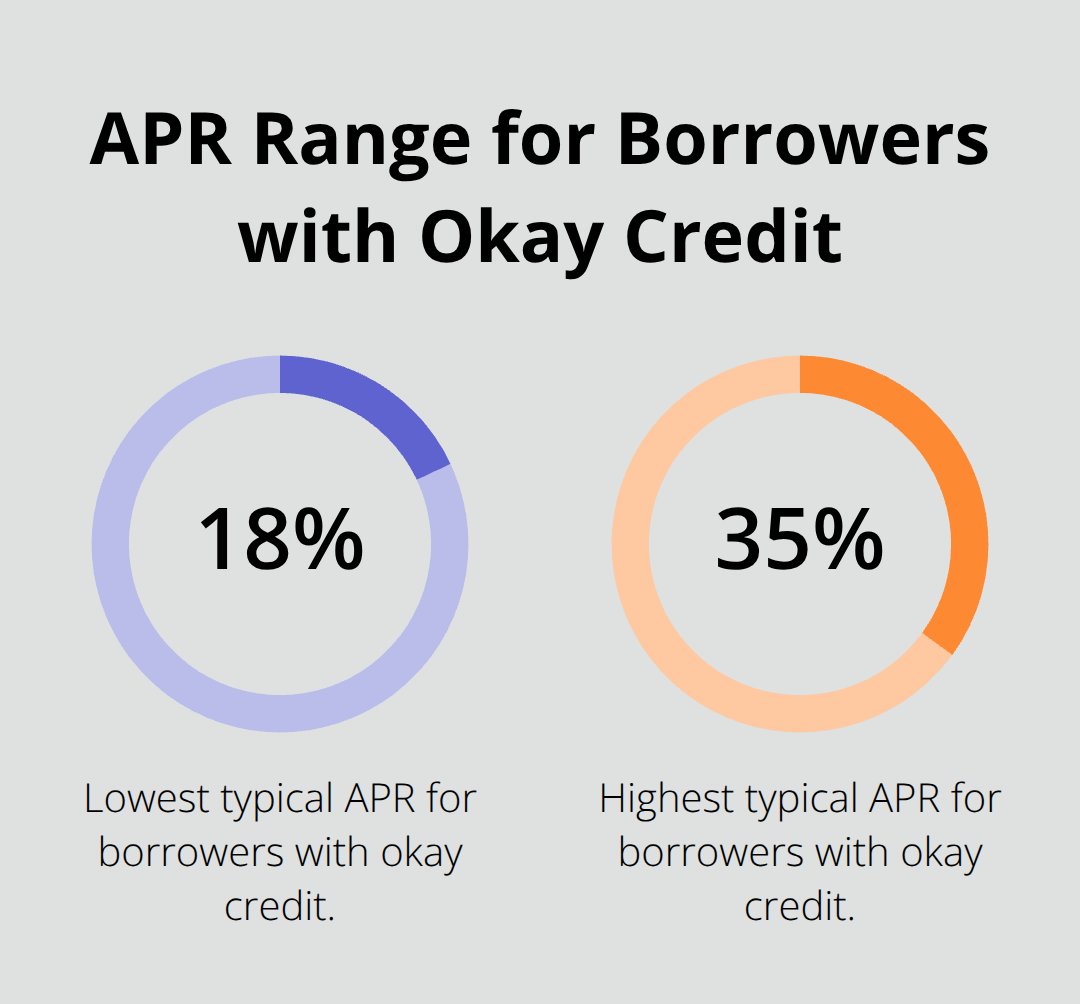

Our analysis shows that for borrowers with okay credit, APRs typically range from 18% to 35%. However, some credit unions may offer lower rates to members with strong relationships.

Choosing the Right Loan Term

A lower interest rate generally benefits borrowers, but also consider the loan term. A longer term might result in lower monthly payments but more interest paid overall. Use loan calculators to compare different scenarios and find the best balance for your financial situation.

The Importance of Shopping Around

Don’t settle for the first offer you receive. Compare offers from multiple lenders (including online lenders, credit unions, and traditional banks). This approach helps you find the most favorable terms for your specific financial situation.

Final Thoughts

Personal loans with okay credit are within reach if you take the right steps. You can improve your chances of approval by reviewing your credit report, reducing your debt-to-income ratio, and exploring alternative loan options. Lenders consider more than just your credit score when evaluating your application, so focus on improving your overall financial health.

Responsible borrowing practices will serve you well in your quest for a personal loan. Compare offers from multiple lenders, including online platforms and credit unions, to find the most favorable terms for your situation. Don’t rush into a decision; take the time to understand the full cost of each loan offer, including interest rates and any associated fees.

At Financial Canadian, we understand the importance of presenting yourself well, both financially and online. Just as a strong credit profile opens doors to better loan options, a well-designed website can boost your business’s credibility and growth. Our comprehensive web design service can help you establish a powerful online presence, setting you apart in today’s digital landscape.

Leave a comment