Are you struggling with poor credit but need a credit card? Secured credit cards might be the solution you’re looking for.

At Financial Canadian, we understand the challenges of rebuilding credit. That’s why we’ve put together this guide on how to get secured credit cards with poor credit.

Learn about the best options available in Canada and how to apply for them effectively.

What Are Secured Credit Cards?

Definition and Key Features

Secured credit cards work similarly to debit cards in that you’re using your own money as insurance for transactions, rather than borrowing funds from a lender. These financial tools are designed for individuals with poor or no credit history. Unlike traditional credit cards, these cards require a security deposit, which typically becomes your credit limit. This deposit acts as collateral, reducing the risk for credit card issuers and making it easier for people with less-than-stellar credit to qualify.

How Secured Credit Cards Work

When you apply for a secured credit card, you need to provide a cash deposit. This amount usually ranges from $200 to $2,000 (depending on the card issuer and your financial situation). Once approved, you can use the card like any other credit card, making purchases up to your credit limit.

It’s important to make timely payments each month. Your payment history is reported to the major credit bureaus – Equifax and TransUnion in Canada. This reporting is key to building or rebuilding your credit score.

Benefits for Those with Poor Credit

Secured credit cards offer several advantages for individuals struggling with poor credit:

- Easier Approval: The security deposit on a secured credit card is generally equal to your credit limit and acts as collateral, making card issuers more willing to extend you credit.

- Credit Building: Regular, on-time payments can help improve your credit score over time. A study by the Federal Reserve Bank of Philadelphia found that secured cardholders saw an average increase of 24 points in their credit scores after two years of responsible use.

- Transition to Unsecured Cards: Many issuers allow you to graduate to an unsecured card after you demonstrate responsible use (typically after 12-18 months of on-time payments).

- Financial Discipline: The lower credit limits of secured cards can help you practice responsible spending and budgeting.

Choosing the Right Secured Credit Card

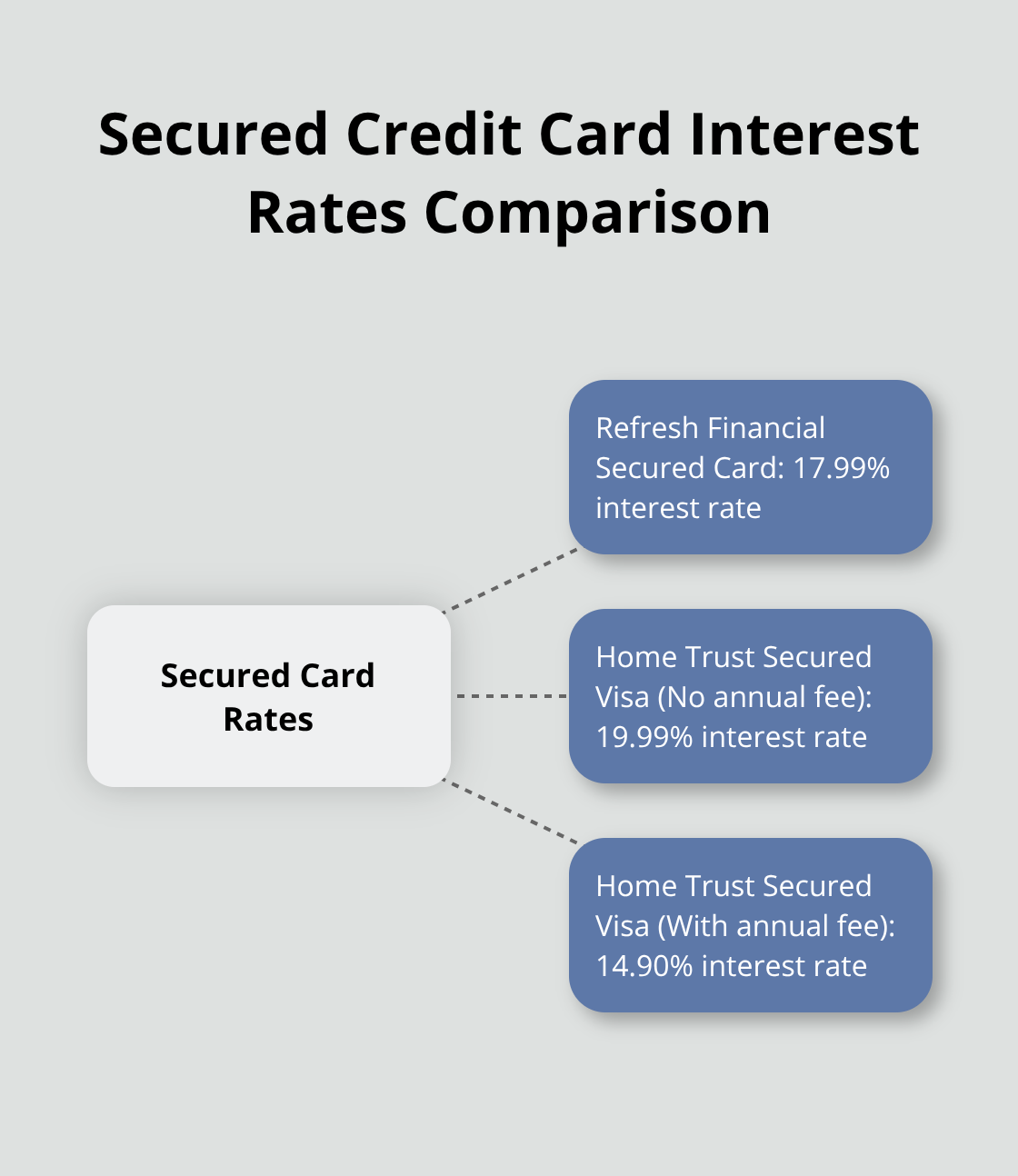

When selecting a secured credit card, pay attention to fees and interest rates. Some cards charge annual fees, while others don’t. Interest rates can vary widely, with some Canadian secured cards offering rates as low as 14.9% and others as high as 22.9%.

The goal is to use the secured card as a stepping stone to better credit and more favorable financial products in the future. Understanding how these cards work and using them responsibly can take you a significant step towards improving your financial health.

Now that we’ve covered the basics of secured credit cards, let’s explore some of the top options available in Canada for those with poor credit.

Best Secured Credit Cards in Canada for Poor Credit

When you need to rebuild your credit in Canada, the right secured credit card can make a significant difference. We have analyzed the top options available, focusing on their fees, interest rates, and credit limits to help you make an informed decision.

Refresh Financial Secured Card

The Refresh Financial Secured Card offers accessibility for those with very poor credit or no credit history. This card requires no credit check, has a low annual fee, and an interest rate of 17.99%. The minimum security deposit is $200, which also serves as your initial credit limit.

A unique feature of this card allows you to increase your credit limit by adding more to your security deposit (up to a maximum of $10,000). This flexibility enables you to grow your credit limit as your financial situation improves.

Home Trust Secured Visa Card

The Home Trust Secured Visa Card comes in two versions:

- No-annual-fee option with a 19.99% interest rate

- Annual fee version ($59/year) with a 14.90% interest rate

Both versions require a minimum security deposit of $500, which becomes your credit limit.

The annual fee version’s relatively low interest rate makes it a good choice if you occasionally carry a balance. However, you should try to pay your balance in full each month to avoid interest charges and maximize credit score improvement.

Capital One Guaranteed Secured Mastercard

The Capital One Guaranteed Secured Mastercard requires a security deposit. Your credit limit will be determined based on your credit assessment. The card has an annual fee and an interest rate.

This card’s standout feature is the potential to get a credit limit with a deposit. However, the annual fee and interest rate should be considered when comparing it to other options.

Factors to Consider When Choosing a Secured Credit Card

When selecting a secured credit card, consider these key factors:

- Annual fees

- Interest rates

- Minimum deposit requirements

- Reporting to credit bureaus (Equifax and TransUnion)

Your specific financial situation and credit-building goals should guide your decision. Check if the card reports to both major credit bureaus in Canada to ensure your credit-building efforts are recognized.

Using Your Secured Credit Card Responsibly

To improve your credit score and eventually qualify for better financial products, use your secured credit card responsibly. Make small purchases and pay the balance in full each month. This strategy will help you build a positive credit history without incurring interest charges.

Now that you understand the top secured credit card options in Canada, let’s explore the steps you need to take to apply for one successfully.

How to Apply for a Secured Credit Card

Check Your Credit Score

Before you apply, you need to know your financial standing. You can access your credit report online for free with Equifax and TransUnion. If your score falls below 600, you likely have poor credit and should consider a secured credit card.

Research Card Options

Take the time to explore different secured credit cards. Focus on factors such as annual fees, interest rates, and minimum deposit requirements.

Prepare Your Application

Collect the necessary documents before you apply. You will typically need:

- Proof of identity (government-issued ID)

- Proof of address (utility bill or bank statement)

- Proof of income (pay stubs or tax returns)

- Social Insurance Number (SIN)

Some issuers may require additional documentation, so check their specific requirements.

Submit Your Application

Most card issuers accept online applications, which makes the process quick and convenient. Fill out the application honestly and accurately. Any inconsistencies could result in rejection.

After you submit your application, you will need to provide your security deposit. You can usually do this via bank transfer or certified cheque. The amount you deposit typically becomes your credit limit.

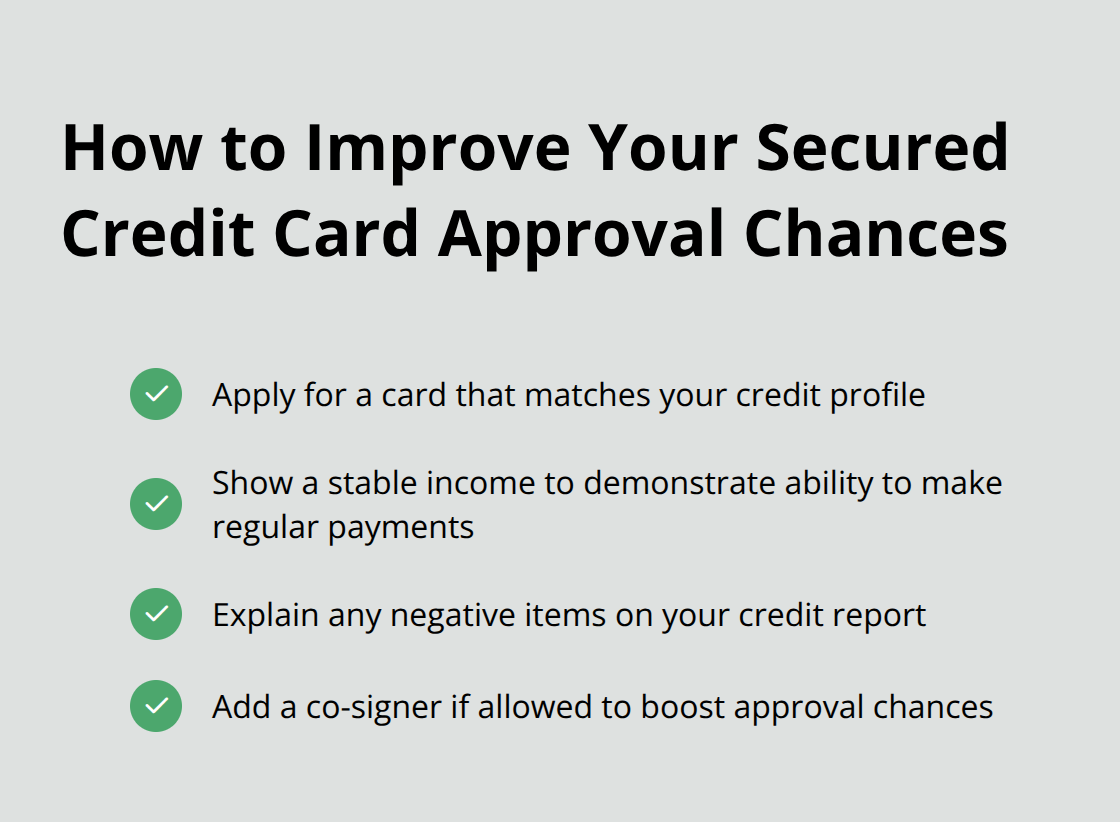

Improve Your Approval Chances

To increase your likelihood of approval:

Secured credit cards can help to build or rebuild your credit by showing you can use credit responsibly. While approval isn’t guaranteed, your chances are generally higher than with traditional credit cards. If an issuer denies your application, ask for the reason and work on improving those areas before you reapply.

Final Thoughts

Secured credit cards offer a valuable opportunity for individuals with poor credit to rebuild their financial standing. These cards provide a path to credit improvement and allow you to show responsible financial behavior over time. You can enhance your credit score and access better financial products in the future if you make timely payments and manage your credit utilization wisely.

The key to success with secured credit cards lies in responsible use. You should treat your secured card as a tool for financial growth rather than a means to accumulate debt. Small, manageable purchases and full balance payments each month will help you avoid interest charges while steadily improving your credit profile.

At Financial Canadian, we want to help you navigate the world of personal finance and credit improvement. Our expert web design services can establish a strong online presence for your business, which complements your financial growth journey. Secured credit cards for poor credit can be your first step towards financial recovery and stability.

Leave a comment