At Financial Canadian, we understand the challenges of securing small personal loans with poor credit. Many Canadians face this hurdle when unexpected expenses arise or they need quick cash.

In this guide, we’ll explore your options for obtaining small personal loans, even if your credit score isn’t ideal. We’ll also provide practical tips to improve your chances of approval and highlight responsible borrowing practices.

What Are Small Personal Loans for Poor Credit?

Definition and Purpose

Small personal loans for poor credit are financial products designed for individuals with low credit scores. These loans typically range from $300 to $5,000 and serve short-term financial needs. Most of these loans are unsecured, which means they don’t require collateral.

Credit Scores and Loan Eligibility

Your credit score significantly influences your loan eligibility. Experian classifies a FICO score below 580 as poor. With such a score, traditional banks often reject loan applications. However, this doesn’t eliminate all your options.

Many alternative lenders focus on providing loans to those with less-than-stellar credit. These lenders often assess creditworthiness differently, looking beyond just the credit score. They might evaluate factors like income, employment history, and overall financial situation.

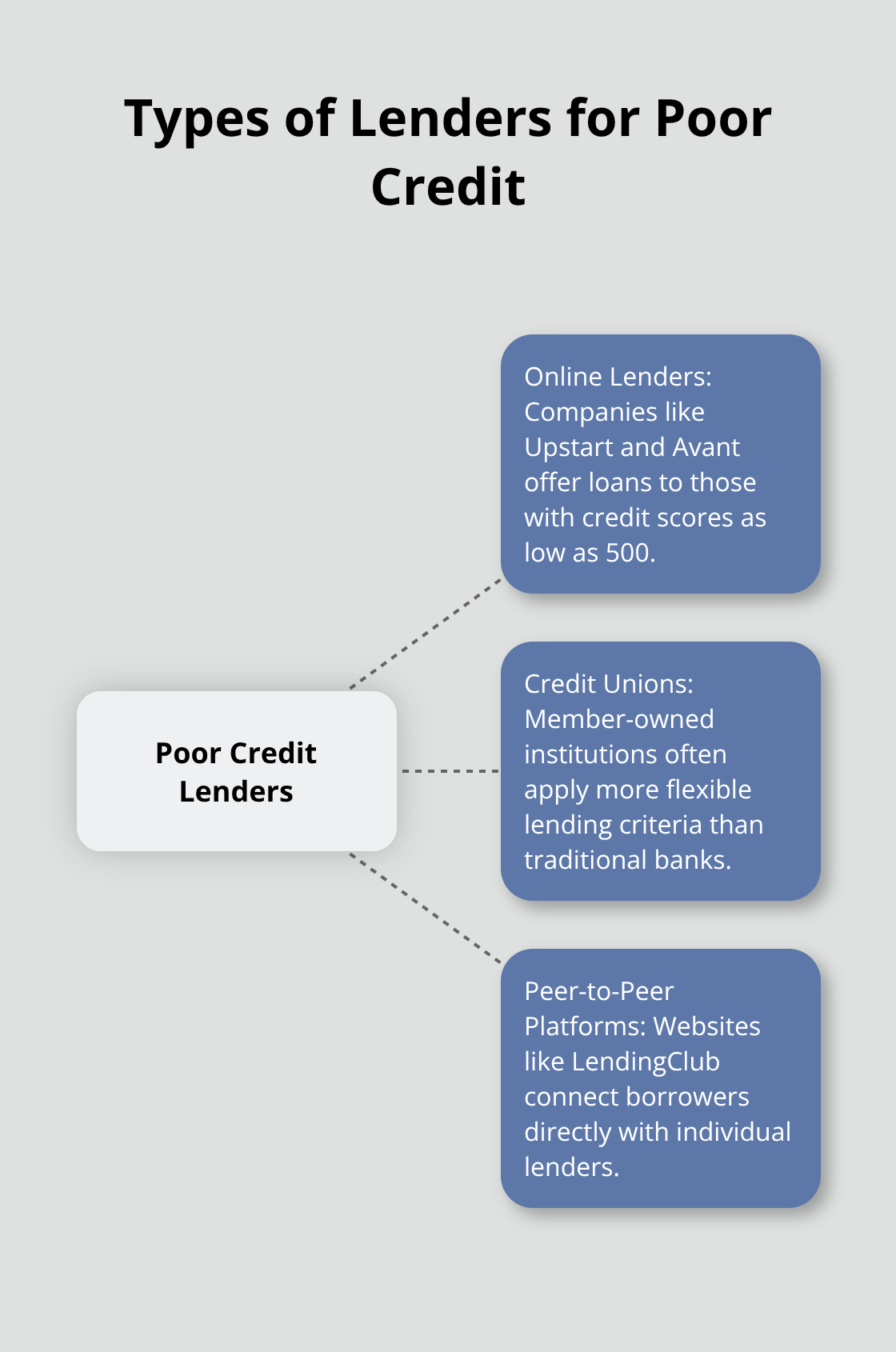

Types of Lenders for Poor Credit

Several lenders offer small personal loans to those with poor credit:

- Online Lenders: Companies like Upstart and Avant have carved out a niche by offering loans to those with credit scores as low as 500. These lenders often use alternative data to assess creditworthiness, making them more accessible to those with poor credit.

- Credit Unions: These member-owned financial institutions often apply more flexible lending criteria than traditional banks. Some credit unions specialize in loans for those with fair to poor credit.

- Peer-to-Peer Platforms: Websites such as LendingClub connect borrowers directly with individual lenders. This direct connection can sometimes result in more favorable terms for those with poor credit.

Interest Rates and Considerations

It’s important to note that while these options exist, they often come with higher interest rates to offset the risk of lending to individuals with poor credit.

We at Financial Canadian always recommend comparing multiple lenders before making a decision. Each lender has its own criteria and offerings, and shopping around can help you find the best possible terms for your situation.

These loans can provide quick access to funds, but you should approach them with caution. Borrow only what you need and can afford to repay to avoid falling into a debt trap.

Now that we’ve covered what small personal loans for poor credit are and where to find them, let’s explore your options in more detail.

Where Can You Get Small Personal Loans with Poor Credit?

Online Lenders for Bad Credit

Online lenders have become a popular choice for individuals with less-than-stellar credit. Loan companies like OppLoans, RiseCredit, NetCredit, and FigLoans offer lower APRs than payday lenders, and some don’t check your credit score. These lenders often assess creditworthiness using alternative data, looking beyond just your credit score.

OppLoans provides loans ranging from $500 to $4,000. While these rates are high, they often beat payday loans. NetCredit offers loans up to $10,000.

When you apply with these lenders, you’ll need to provide proof of income, employment details, and bank account information. The application process is typically quick, with many lenders offering same-day or next-day funding.

Credit Unions: A More Flexible Option

Credit unions often apply more flexible lending criteria than traditional banks. Navy Federal Credit Union offers some of the lowest personal loan amounts, starting at $250.

To apply for a credit union loan, you must become a member. This usually involves opening a savings account and paying a small fee. You’ll need to bring proof of identity, address, and income when you apply. Credit unions may also consider your overall financial picture, including your relationship with the institution, when they make lending decisions.

Secured Loans: Leveraging Collateral

If you struggle to get approved for an unsecured loan, a secured loan might be an option. These loans require collateral, which reduces the lender’s risk and may result in more favorable terms.

For example, you could use your car as collateral for an auto title loan. However, exercise caution with these loans as they often come with high interest rates and the risk of losing your vehicle if you default.

Another option is a secured credit card, which requires a cash deposit. While not a loan per se, it can help you build credit for future borrowing. Capital One’s Secured Mastercard offers credit limits of $200 to $1,000 with a matching security deposit.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual lenders. This direct connection can sometimes result in more favorable terms for those with poor credit. Platforms like LendingClub allow you to create a loan listing, which investors can then choose to fund.

P2P loans often have more flexible requirements than traditional bank loans. However, interest rates can still be high for borrowers with poor credit.

Now that we’ve explored various options for small personal loans with poor credit, let’s look at how you can improve your chances of approval.

How to Boost Your Loan Approval Odds

Scrutinize Your Credit Report

Before you apply for a loan, obtain a free copy of your credit report from Equifax or TransUnion. These credit bureaus allow Canadians to access their reports once a year at no cost. Review your report carefully for errors or outdated information. A study by the Federal Trade Commission found that one in five consumers has an error on their credit report that could affect their score.

If you spot inaccuracies, dispute them immediately with the credit bureau. To do so, you’ll need to provide your full name, date of birth, current address, and previous address (if you’ve been at your current address for less than two years). You may also need to provide your Social Insurance Number, though this is optional.

Leverage a Co-Signer’s Good Credit

Ask a family member or close friend with good credit to co-sign your loan. A co-signer with a strong credit history can significantly improve your chances of approval and potentially secure better interest rates. Experian reports that having a co-signer can increase your chances of approval by up to 50% and could lower your interest rate by several percentage points.

However, co-signing is a serious responsibility. Your co-signer becomes equally responsible for the loan, and any missed payments will affect their credit score as well as yours.

Showcase Financial Stability

Lenders want assurance that you can repay the loan. Demonstrate stable income and employment to convince them of your ability to make payments. Prepare recent pay stubs, tax returns, and bank statements to show consistent income. If you’ve worked at your current job for at least six months to a year, it can strengthen your application.

Some lenders also consider alternative income sources. If you have a side gig or freelance work, include this information in your application. A survey by Bankrate found that 45% of Americans have a side hustle, which can provide additional income stability.

Tackle Existing Debt

Reduce your existing debt before you apply for a new loan to improve your debt-to-income ratio (DTI), a key factor lenders consider. Try to get your DTI below 43%, as this is often the highest ratio lenders will accept for a qualified mortgage.

Start by paying off small debts or negotiating with creditors to lower your balances. Even a small reduction in your overall debt can make a difference. For instance, paying off a $500 credit card balance could lower your credit utilization ratio, potentially boosting your score by 20 to 30 points.

Consider Secured Loan Options

If you struggle to qualify for an unsecured loan, consider secured loan options. These loans require collateral to back the loan, which may make them more accessible to higher-risk borrowers with poor credit scores or little to no credit history. While secured loans can offer better rates, be cautious of the potential risks involved (like losing your collateral if you default on the loan).

Final Thoughts

Small personal loans with poor credit offer financial relief, but borrowers must exercise caution. High interest rates often accompany these loans, so you should only borrow what you need and can repay. You can improve your creditworthiness by demonstrating financial stability, reducing debt, and making timely payments on current obligations.

We at Financial Canadian understand the challenges of securing loans with less-than-ideal credit. Our expertise extends beyond financial advice to web design services that can elevate your business’s digital presence. A well-designed website can significantly impact your business success (much like responsible financial management affects personal finances).

Your financial journey is unique, and small personal loans can provide temporary relief. Focus on building a solid financial foundation for long-term success. With smart financial decisions, you can overcome credit challenges and work towards a more secure financial future.

Leave a comment