Choosing between personal vs business credit cards affects your finances, credit score, and tax situation. The wrong choice can cost you money and complicate your financial management.

We at Financial Canadian break down the key differences to help you make the right decision. This guide covers eligibility requirements, benefits, and tax implications for both card types.

What Makes Personal and Business Credit Cards Different?

Personal and business credit cards serve distinct purposes with specific features that impact your financial strategy. Personal cards focus on individual expenses and offer longer introductory 0% APR periods that often exceed 15 months. Business cards prioritize company expenses with higher credit limits based on both personal income and business revenue, plus targeted rewards for office supplies and online advertising.

Application Requirements Create Clear Distinctions

Personal credit cards require only your Social Security number and personal income verification. Approval becomes straightforward for individuals with FICO scores above 670. Business cards demand additional documentation including your Employer Identification Number or business registration details, even though many small business owners still use personal cards for business expenses. Most business applications trigger hard credit checks on your personal credit, but corporate cards from companies like Ramp and Brex skip personal credit checks entirely for incorporated businesses.

Consumer Protection Laws Favor Personal Cards

The Credit Card Act shields personal cardholders from sudden rate increases and fee changes. Business cardholders lack these protections entirely. Personal cards also provide stronger dispute resolution processes and clearer terms disclosure requirements that business cards don’t match.

Credit Report Impact Varies Significantly

Personal cards report only to consumer credit bureaus like Experian and Equifax. Business cards can report to both business bureaus like Dun & Bradstreet and personal bureaus when payments are missed. This dual approach creates opportunities to build separate business credit histories that banks use for future loan approvals, though personal guarantees mean you remain liable for business card debts regardless of your company structure.

These fundamental differences shape which card type works best for your specific situation and spending patterns.

When Should You Choose Personal Credit Cards

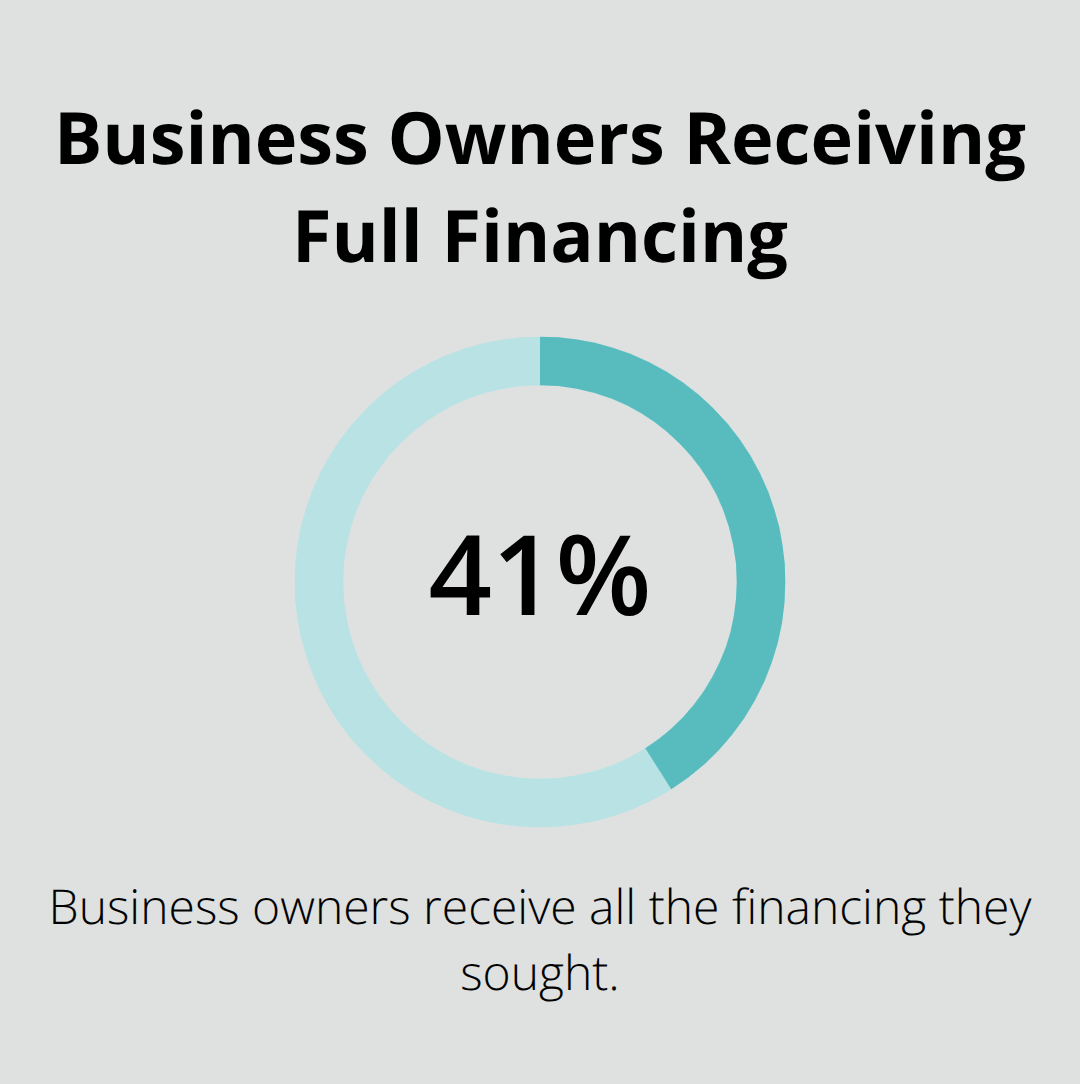

Personal credit cards work best when you prioritize individual credit development over business needs. Your personal credit score directly affects mortgage rates, auto loans, and future credit card approvals. According to Nav research, business owners face financing challenges, with only 41% receiving all the financing they sought, but this approach benefits sole proprietors with minimal business expenses who want to maximize personal credit opportunities.

Personal Credit Development Offers Long-Term Value

Personal cards report exclusively to consumer credit bureaus and strengthen your individual credit profile without business complications. Cards like the Chase Freedom Unlimited provide 1.5% cash back on all purchases while they build your credit history through consistent reports. Personal cards typically offer introductory 0% APR periods that exceed 15 months (compared to shorter terms on business cards). This extended period helps you manage large purchases while you establish positive payment history that boosts your FICO score above the 661 threshold for favorable loan rates.

Simple Management Reduces Administrative Tasks

Personal card applications require only your Social Security number and income verification, which eliminates business documentation requirements. You avoid the complexity of separate business expense tracking or employee card management with custom limits. Personal cards integrate seamlessly with apps and provide straightforward monthly statements without business-specific categories that complicate simple expense tracking for individual users.

Targeted Rewards Match Personal Expenses

Personal cards excel at rewards for everyday purchases like groceries, gas, and restaurants that business cards often ignore. The Chase Freedom Flex offers 5% cash back on rotating quarterly categories, while the Citi Double Cash provides 2% on everything. These reward structures typically outperform business card rates on personal expenses and make them superior choices when your expenses focus on individual rather than business categories.

However, business owners with significant company expenses face different considerations that personal cards cannot address effectively.

When Should You Choose Business Credit Cards

Business credit cards become the smart choice when you run any type of company operation, even side hustles or freelance work that generate minimal revenue. Many small business owners mix personal and business expenses on personal cards, which creates unnecessary tax complications and missed deduction opportunities.

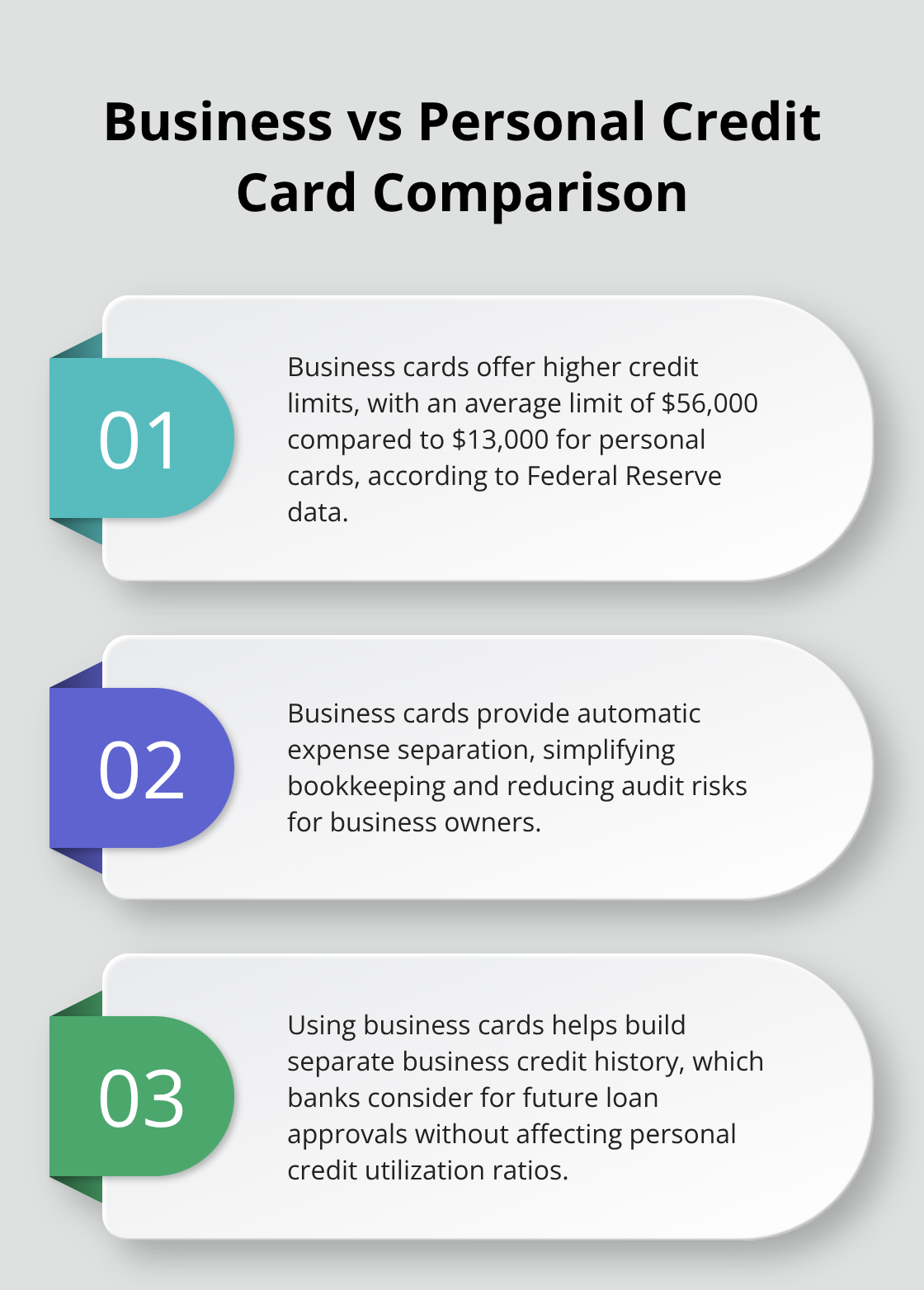

Business cards solve this problem through automatic expense separation that simplifies bookkeeping and reduces audit risks. Capital One Spark Cash Plus offers 2% cash back on all purchases with no annual fee, while the Chase Ink Business Preferred provides 3x points on travel and select business categories up to $150,000 annually. These cards typically approve applicants with FICO scores above 690 and require either an EIN or Social Security number for sole proprietorships.

Credit Limits That Support Growth

Business cards consistently offer higher credit limits than personal cards because issuers evaluate both personal income and business revenue when they set limits. The average business card limit exceeds $56,000 compared to $13,000 for personal cards (according to Federal Reserve data). Cards like the American Express Business Gold provide spending power that scales with your business needs.

Employee cards with customizable limits help you control team expenses effectively. The U.S. Bank Triple Cash Rewards Visa Business Card reports to Dun & Bradstreet and builds separate business credit that banks use for loan approvals without affecting your personal credit utilization ratios.

Tax Advantages and Expense Management

Business cards generate clean expense records that maximize tax deductions and integrate with accounting software like QuickBooks. The IRS allows business expense deductions when you maintain proper separation between personal and business spending, which becomes automatic with dedicated business cards.

Many cards provide detailed category tracking for office supplies, advertising, and travel expenses that personal cards cannot match. This separation protects you during audits and creates the financial documentation needed for business loans, investor presentations, and partnership agreements.

Final Thoughts

Your choice between personal vs business credit cards depends on your specific financial situation and spending patterns. Personal cards work best for individuals who focus on personal credit development with simpler management and better rewards for everyday expenses like groceries and gas. Business cards become the right choice when you operate any company, even freelance work, because they provide expense separation, higher credit limits, and tax advantages that personal cards cannot match.

Consider your primary goals when you make this decision. Personal cards offer stronger consumer protections and longer introductory periods if you need to improve your personal credit score for future loans or mortgages. Business cards provide the specialized features you need if you run a business and want to maximize tax deductions while you build business credit (separate from your personal credit profile).

Start with an evaluation of your spending patterns and credit goals. Apply for cards that match your situation and maintain good payment habits regardless of your choice. We at Financial Canadian help businesses establish strong digital presence through our comprehensive web design service that creates visually stunning, responsive websites tailored to your specific needs.

Leave a comment