Personal loan credit score requirements vary dramatically across Canadian lenders, with some accepting scores as low as 580 while others demand 700 or higher.

Your credit score directly impacts not just approval odds but also interest rates, loan amounts, and repayment terms. We at Financial Canadian have analyzed lending standards across banks, credit unions, and online platforms to help you understand exactly what score you need and how to improve your chances of approval.

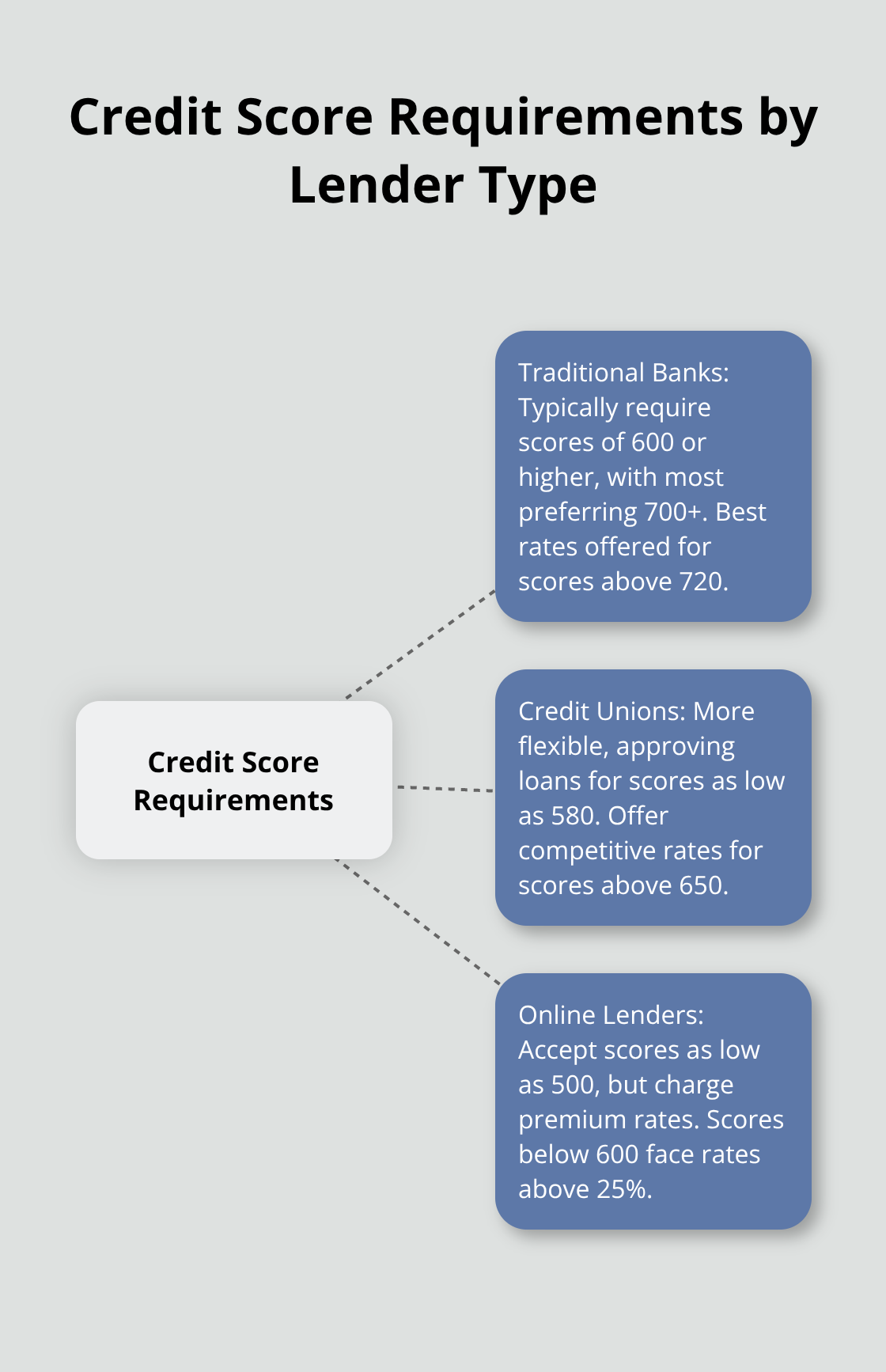

What Score Do Different Lenders Actually Require?

Traditional Banks Set the Highest Standards

Major Canadian banks typically require credit scores of 600 or higher for personal loan approval, with most banks preferring scores above 700. Royal Bank of Canada and TD Bank reject applications below 620, while Scotiabank occasionally approves borrowers with scores as low as 600 if they maintain strong relationships with the bank. These institutions offer their best rates around 6-12% to borrowers with scores above 720, but anyone below 650 faces rejection or referral to alternative divisions with significantly higher rates.

Credit Unions Offer More Flexible Approval Standards

Credit unions approve personal loans for members with scores as low as 580, which makes them the most accessible option for fair credit borrowers. Vancity Credit Union and Meridian Credit Union evaluate applications through a comprehensive approach, considering employment history and member relationships alongside credit scores. These institutions cap personal loan rates at 18% (as required by law), providing substantially better terms than online lenders for borrowers with scores between 580-650. Credit union members with scores above 650 typically secure rates between 8-14%, competing directly with traditional banks while maintaining more lenient approval criteria.

Online Lenders Target Higher-Risk Borrowers

Online platforms like Paymi and Fairstone Financial accept credit scores as low as 500, but charge premium rates from 19.99% to 46.96% annually. These lenders use alternative data including income verification and employment stability to approve applications that banks automatically reject. Borrowers with scores below 600 should expect rates above 25%, while those between 600-650 face rates around 15-22% depending on income levels and debt-to-income ratios.

Understanding these requirements helps you target the right lenders, but your credit score also determines the specific terms you’ll receive once approved.

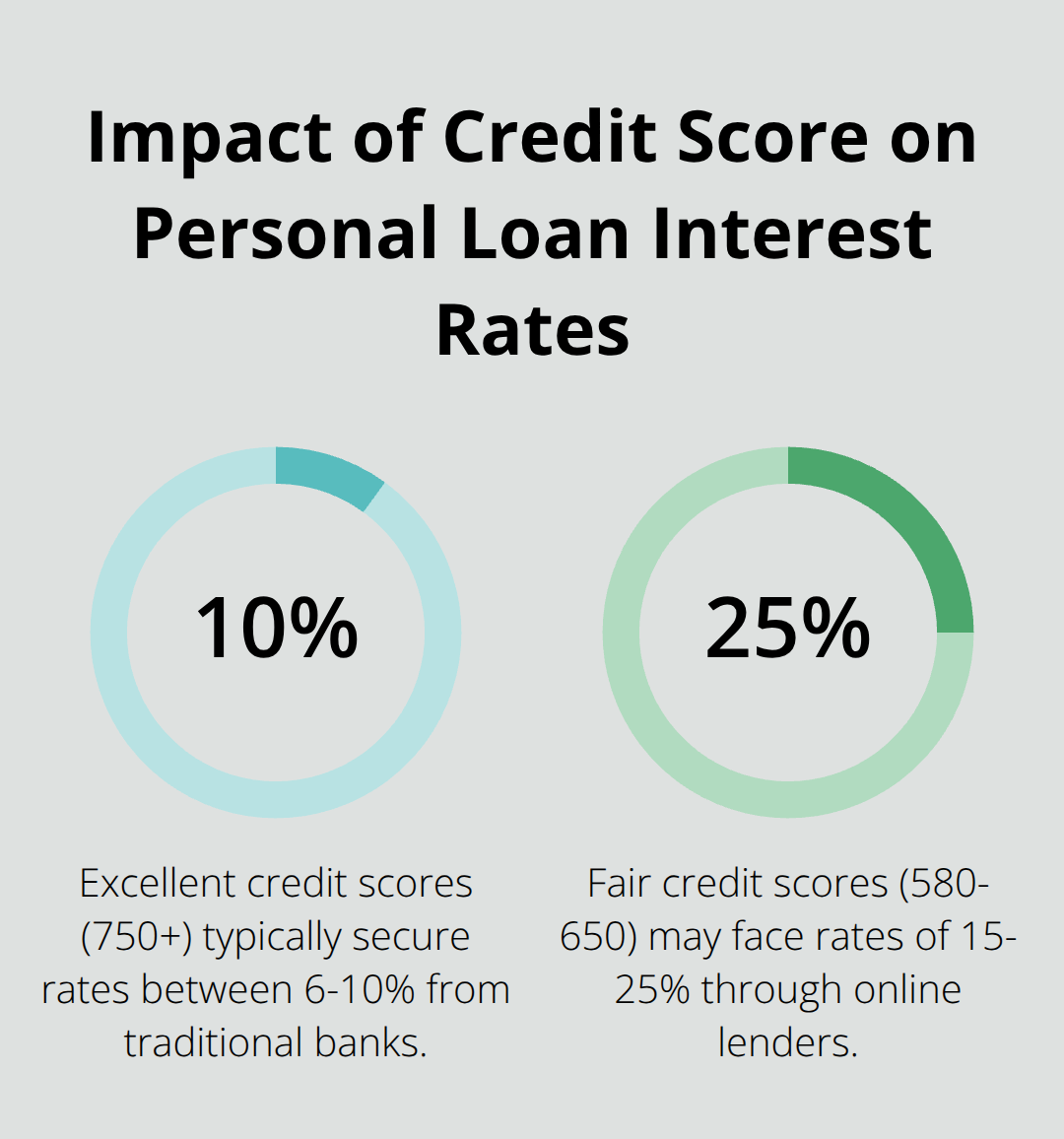

How Much Does Your Credit Score Actually Cost You?

Your credit score creates a pricing tier system that costs you thousands of dollars over the life of a personal loan. Borrowers with excellent credit scores above 750 typically secure rates between 6-10% from traditional banks, while those with fair credit between 580-650 pay 15-25% through online lenders. This rate difference means a $20,000 five-year loan costs an excellent credit borrower around $2,200 in total interest, compared to $8,400 for a fair credit borrower at 22% APR. The rate gap widens further for borrowers below 580, who face rates up to 46.96% and may only qualify for smaller loan amounts of $5,000-$10,000 instead of the larger maximums available to high-score applicants.

Credit Score Brackets Determine Your Loan Ceiling

Banks and credit unions impose strict loan amount limits based on credit score ranges, with most institutions offering maximum amounts of up to $100,000 to borrowers above 700 but cap loans at $15,000-$25,000 for scores between 600-699. Borrowers with scores below 600 face the harshest restrictions, typically they qualify for only $5,000-$15,000 through online lenders or alternative finance platforms. These limitations force lower-credit borrowers into multiple smaller loans with higher combined interest costs rather than single consolidated finance options.

Fees and Terms Penalize Lower Credit Scores

Origination fees range from 0% for excellent credit borrowers at credit unions to 12% for subprime applicants through online lenders, which adds hundreds or thousands to loan costs upfront. Repayment terms also shrink as credit scores drop, with prime borrowers who access seven-year terms while fair credit applicants face maximum three-year periods that inflate monthly payments. Late payment penalties increase from $25-$40 for good credit borrowers to $50-$75 for subprime loans, which creates additional financial stress for those already who struggle with higher base rates.

These cost differences highlight why credit score improvement becomes essential before you apply for personal loans, but specific strategies can help you boost your score effectively.

How Can You Boost Your Score for Better Rates?

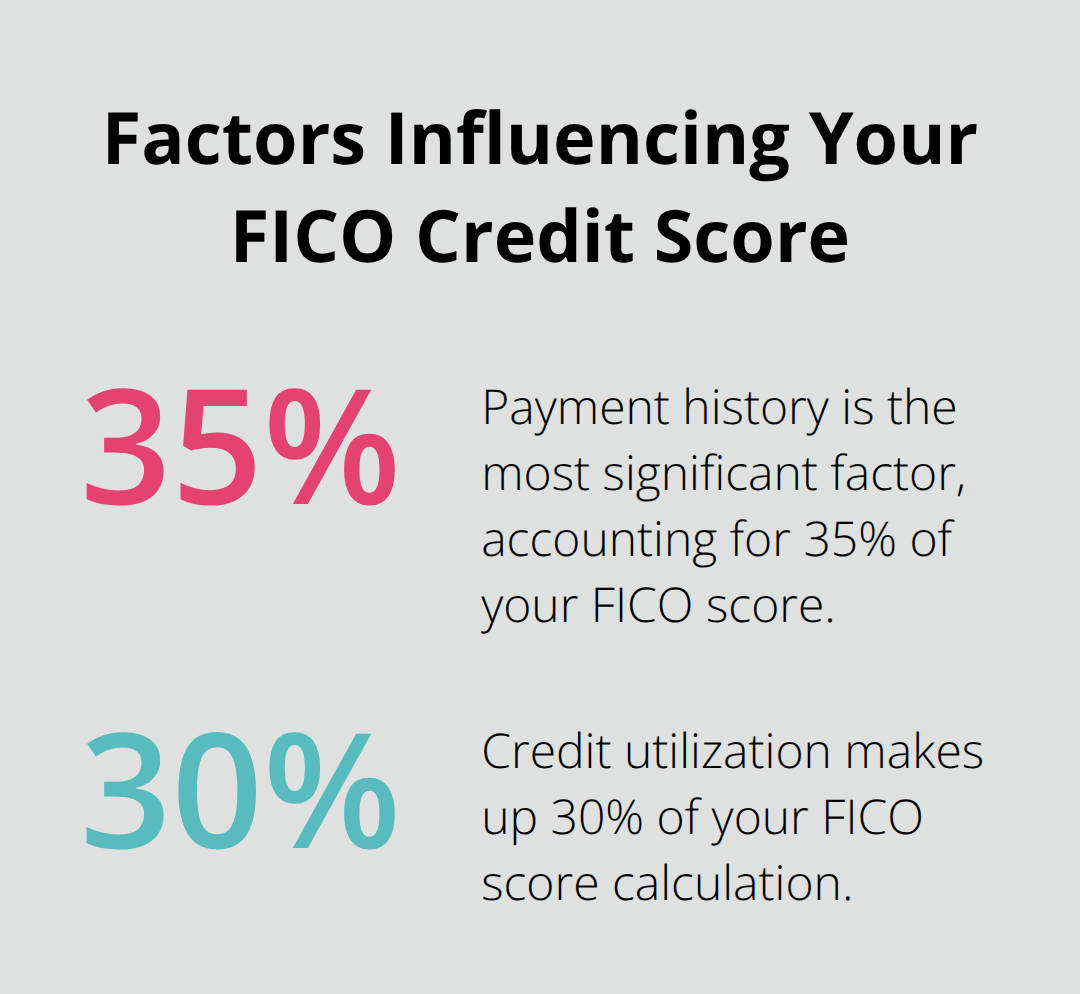

Target 30% Credit Utilization to See Immediate Score Gains

Credit utilization accounts for 30% of your FICO score calculation, which makes debt paydown the fastest way to improve your position. Experian data shows that borrowers who reduce their credit card balances below 30% of available limits see score increases of 10-40 points within 30 days. Pay down your highest-balance cards first, then spread balances across multiple cards to keep individual utilization rates low. Request credit limit increases on cards without additional spending, which automatically improves your utilization ratio without extra payments.

Payment History Drives 35% of Your Score

Payment history carries more weight than any other factor in credit score calculations, which means consistent on-time payments create the foundation for loan approval. Set up automatic minimum payments on all accounts to avoid late fees that damage your score for up to seven years. Pay down statement balances before the report date (typically 3-5 days before your due date) to show lower utilization on your credit report. Add utility and phone bills to your credit report through Experian Boost, which can increase scores by an average of 13 points for thin credit files.

Monitor Reports Monthly and Challenge Every Error

Credit report errors appear on 34% of consumer reports, which makes regular checks essential for score optimization. Check your reports monthly through free services rather than wait for annual reviews, since disputed items can take 30-45 days to resolve. Challenge any incorrect late payments, closed accounts that show as open, or debt amounts that exceed actual balances. Focus disputes on high-impact errors like missed payments or accounts that don’t belong to you, which can boost scores by 50+ points once removed from your file.

Final Thoughts

Personal loan credit score requirements span from 500 at online lenders to 700+ at major banks, but your score determines far more than approval odds. The difference between excellent and fair credit costs borrowers thousands in extra interest, with rate spreads that reach 20-30 percentage points across lender types. Credit unions provide the sweet spot for most Canadian borrowers, as they accept scores as low as 580 while they cap rates at 18%.

Traditional banks offer the lowest rates but maintain strict 600+ requirements, while online lenders accept higher-risk applicants at premium rates. You should reduce credit utilization below 30% and maintain perfect payment history to see score improvements within 30 days. Monthly credit report checks catch errors that affect 34% of consumers (according to Consumer Reports), while strategic debt paydown creates immediate rate benefits.

Start with credit unions if your score falls between 580-650, then consider traditional banks once you reach 700+. We at Financial Canadian support your financial journey through expert guidance and resources. Visit our comprehensive web design service to establish the professional online presence that supports your business growth goals.

Leave a comment