A secured credit card requires a cash deposit that becomes your credit limit. This deposit acts as collateral for the card issuer, making it easier to get approved even with poor or no credit history.

Understanding the secured credit card meaning helps you see why these cards serve as stepping stones to better credit. We at Financial Canadian believe secured cards offer the most practical path for Canadians looking to build or rebuild their credit scores.

How Secured Credit Cards Work

The Deposit Mechanism

Your security deposit determines everything about your secured credit card experience. Most Canadian banks require deposits between $200 and $10,000, with your deposit amount becoming your exact credit limit. Royal Bank of Canada sets their minimum at $500, while TD Canada Trust accepts deposits as low as $200.

The deposit sits in a separate savings account and earns minimal interest (typically 0.05% to 0.25% annually). Card issuers cannot touch this money unless you default on payments or close the account. This arrangement protects both you and the lender throughout your credit-building journey.

Credit Reporting and Score Impact

Secured cards report to Equifax and TransUnion monthly and treat your account identically to unsecured cards on your credit report. Payment history accounts for 35% of your credit score calculation, which makes on-time payments your biggest opportunity for improvement.

Credit utilization should stay below 10% of your limit for maximum score benefits. A $500 secured card used responsibly can improve your credit score significantly over time. This improvement opens doors to better financial products faster than most people expect.

Key Differences from Unsecured Cards

Unsecured cards offer credit limits based on income and credit history without deposits. Secured cards charge higher annual fees, typically $29 to $59 compared to $0 to $120 for premium unsecured cards. Interest rates on secured cards range from 19.99% to 28.99%, while unsecured cards start around 12.99% for good credit applicants.

Most secured cards offer no rewards programs and focus purely on credit development rather than earning benefits on purchases. These limitations become less important when you consider the long-term credit score improvements that lead to better financial opportunities.

Required Security Deposit and Credit Limits

Canadian secured cards typically require minimum deposits of $200 to $500, though some issuers accept lower amounts for specific programs. Your credit limit equals your deposit amount in most cases, creating a direct relationship between your upfront investment and available credit.

Higher deposits provide more flexibility for purchases while maintaining low utilization ratios. The deposit requirement varies significantly between issuers, so comparing options helps you find the best fit for your budget and credit goals.

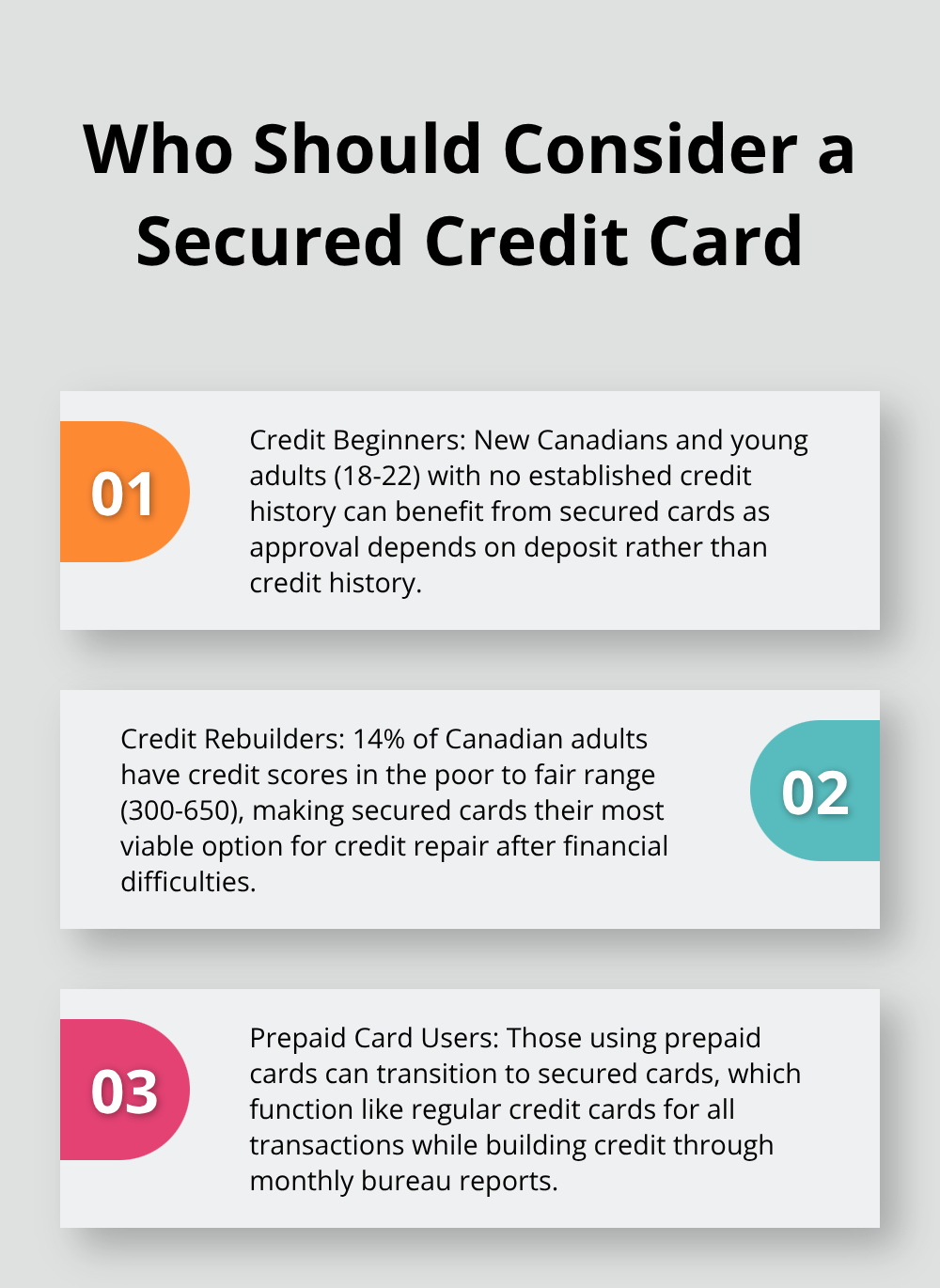

Who Should Consider a Secured Credit Card

Building Credit History from Scratch

New Canadians and young adults face identical challenges when banks review their credit applications with no payment history on file. Many newcomers to Canada have no established credit history within their first years of residency. Secured cards solve this problem immediately because approval depends on your deposit amount rather than credit history.

Students aged 18-22 represent another major group that benefits from secured cards. Traditional credit cards require established income or credit history that most students lack. Your first secured card should have a $500 minimum deposit to provide enough credit limit for meaningful purchases while you keep utilization below 10%.

Capital One and Home Trust both offer secured cards specifically for credit beginners, with monthly reports to both major credit bureaus from your first statement.

Rebuilding Credit After Financial Difficulties

Bankruptcy, consumer proposals, or multiple missed payments create credit scores below 600 that disqualify applicants from most unsecured credit products. Equifax data shows that 14% of Canadian adults have credit scores in the poor to fair range (300-650). This makes secured cards their most viable option for credit repair.

These cards work regardless of past financial difficulties because your deposit eliminates the lender’s risk. The credit repair timeline with secured cards typically spans 12-18 months of consistent on-time payments before you qualify for better products.

Your payment history updates monthly on your credit report. Responsible use of a secured card can increase your score by 50-100 points within the first year of proper management.

Transitioning from Prepaid Cards

Prepaid cards provide control but offer zero credit benefits because they never report to credit bureaus. Hotel reservations, car rentals, and online purchases often reject prepaid cards due to security concerns and inability to place authorization holds (particularly for rental car deposits and hotel incidentals).

Secured cards function identically to regular credit cards for all merchant transactions while they simultaneously build your credit profile through monthly bureau reports. This dual benefit makes them superior to prepaid options for anyone who wants to establish credit history.

The next step involves choosing the right secured card from Canada’s available options, which vary significantly in fees, terms, and graduation policies.

Best Secured Credit Cards in Canada

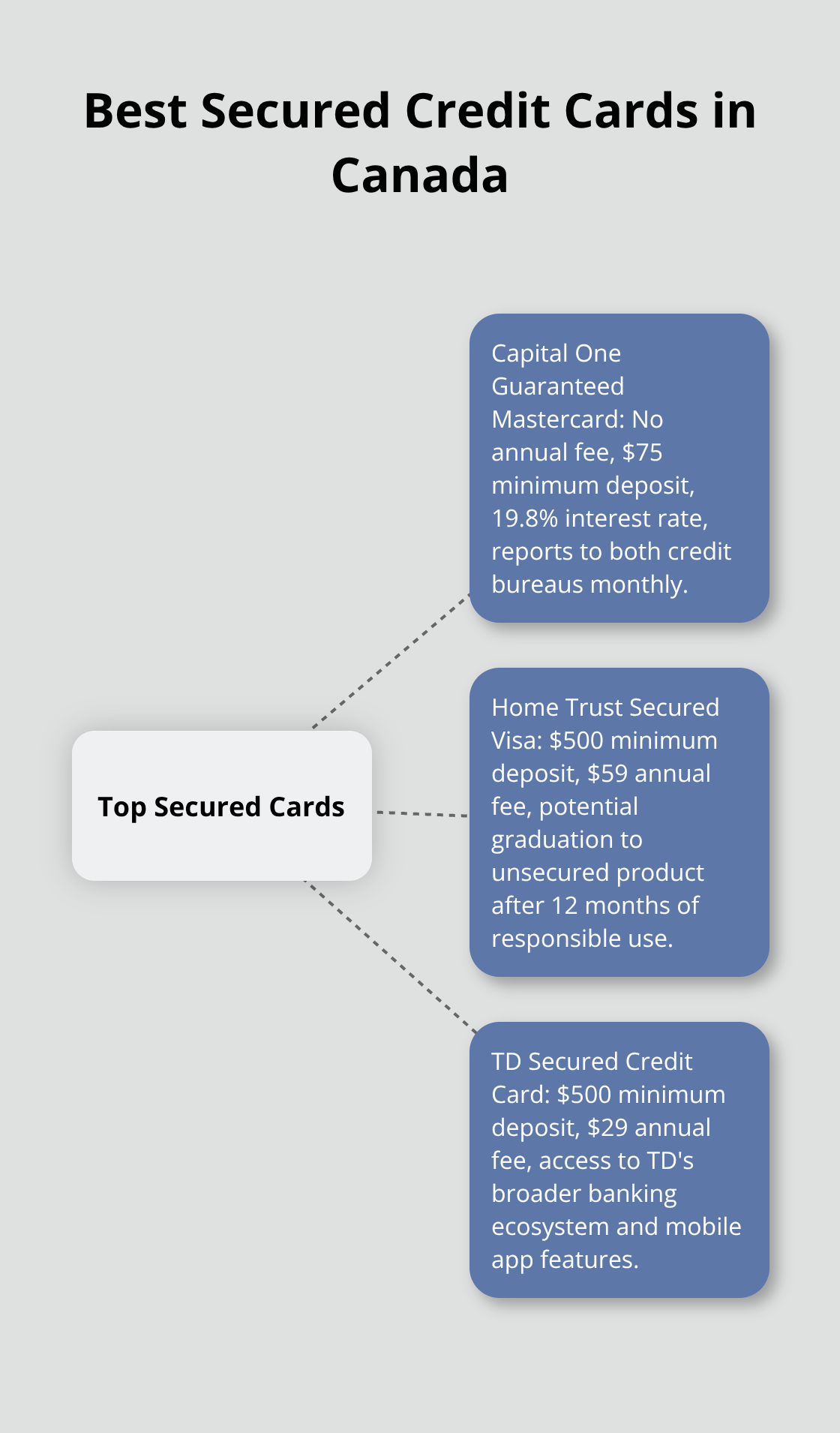

Cards with Lowest Costs and Best Terms

Capital One Guaranteed Mastercard charges no annual fee and requires a minimum $75 deposit, which makes it the most accessible option for Canadians with limited budgets. This card reports to both credit bureaus monthly and offers automatic credit line increases after five months of on-time payments. The 19.8% interest rate remains competitive within the secured card market.

Home Trust Secured Visa demands a $500 minimum deposit but provides better long-term value with its $59 annual fee structure. This card stands out because it offers potential graduation to an unsecured product after 12 months of responsible use. TD Secured Credit Card requires a higher $500 minimum deposit and charges a $29 annual fee, but provides access to TD’s broader banking ecosystem and mobile app features.

Graduation Policies and Unsecured Transitions

Most Canadian banks keep secured cardholders indefinitely without automatic graduation policies. Capital One reviews accounts every six months for potential upgrades to their unsecured Platinum Mastercard after users demonstrate consistent payment history and improved credit scores above 650. Home Trust offers the most transparent graduation path and automatically reviews accounts at 12 months, then converts qualified users to their unsecured Preferred Visa.

RBC Secured Visa lacks any graduation program and requires cardholders to apply separately for unsecured products. This policy makes RBC less attractive for customers who focus on credit development rather than long-term secured card use.

Interest Rates and Credit Bureau Reports

Secured card interest rates range from 19.8% at Capital One to 28.8% at some credit union options (though these rates matter less than credit reports since responsible users pay their full balance monthly to avoid interest charges entirely). All major Canadian secured cards report to both credit bureaus monthly, but some smaller issuers only report to one bureau.

Capital One and Home Trust provide the most comprehensive reports, which include credit limit increases and account age information that helps build stronger credit profiles. Credit unions often delay reports by 30-60 days compared to major banks, which can slow your credit improvement timeline significantly. For those with bad credit, secured cards offer the most reliable path to rebuilding your financial standing.

Final Thoughts

Secured credit cards provide the most reliable path for Canadians to build or rebuild their credit history. The secured credit card meaning becomes clear when you see how these products transform financial opportunities through consistent credit bureau reports and responsible use. Capital One Guaranteed Mastercard offers the best entry point with no annual fee and a $75 minimum deposit, while Home Trust Secured Visa provides superior graduation policies for users who focus on transitions to unsecured products.

Success with secured cards requires you to maintain utilization below 10% and make every payment on time. These habits typically improve credit scores by 50-100 points within 12 months (though individual results vary based on starting credit profiles). Most cardholders qualify for better financial products after they demonstrate 18 months of responsible payment history.

We at Financial Canadian understand that credit development takes patience and the right tools. Our comprehensive web design service helps financial professionals establish strong digital footprints to better serve clients who navigate credit challenges. The right secured card combined with disciplined financial habits creates the foundation for long-term credit success.

Leave a comment